19+ Tendencias y estadísticas del sector inmobiliario residencial

Fact checked 2026 | 👨🎓Cite este artículo.

Ever wondered how the residential real estate market has evolved and why it remains a cornerstone of economic growth? The residential real estate industry reflects shifting buyer preferences, urbanization, and technological advances, making it essential to understand past trends and future directions.

As market dynamics increasingly favor sustainable and smart living, staying informed on these trends helps buyers, investors, and professionals navigate this competitive landscape with confidence. Let’s dive into the key patterns shaping residential real estate today and tomorrow.

Residential Real Estate Market Growth: Trends Over the Years

Fact checked 2026 | 👨🎓Cite esta estadística. Esta imagen está libre de derechos de autor.

Historical Analysis of Housing Prices and Value Appreciation

- In the United States, existing home median prices are expected to increase by 2.5% in 2025, por debajo de 4.5% in 2024 and considerably lower than the 6.5% average annual appreciation from 2013 to 2019. This signals a softening in price growth compared to previous years.

- Home values are forecasted to decline slightly by 2% by the end of 2025 compared to the start of the year, marking a sharper forecasted decrease than prior months, indicating a cooling housing market with moderate corrections.

- Mortgage rates remain elevated, with the average rate about 6.7% in 2025, slightly above the 6.3%-6.4% range of 2024, representing an increase from the historically low 4% pre-pandemic average.

Demand and Supply Trends in Residential Real Estate

- Total U.S. existing home sales are projected to reach approximately 4.16 million in 2025, marking a modest 2.5% increase over 2024's 4 million sales, but still trailing the pre-pandemic annual average of 5.28 million from 2013-2019.

- Although sales are improving, single-family housing starts declined by 3.7% to 980,000 units in 2025, down from 1.1 million in 2024 and near the pre-pandemic average of 800,000, indicating a slowdown in new construction activity.

- The inventory of homes for sale increased by 16.9% YOY in 2025, reaching closer to pre-pandemic levels, reducing the scarcity-driven price spikes that characterized the last few years.

- Rental markets saw a slowdown in rent growth, with forecasts of a 2.75% increase for single-family rentals down from 4.5% in 2024, reflecting more balanced rental supply and demand.

Major Factors Influencing Residential Real Estate Expansion

- Mortgage rates near 6.7% average in 2025 have restrained borrowing power compared to historic lows of under 4% in pre-pandemic years, reducing some buyer activity.

- Government policies such as stimulus and tax incentives have faded, contrasting with the surge seen during the 2020-21 pandemic period, thereby normalizing demand levels.

- The rise of technology and digital platforms has boosted market transparency and accelerated transactions, with over 30% of home sales being influenced by online listings and virtual tours en 2025, up from 20% in 2019.

Residential Real Estate Buyer Behavior and Demographics

Shifts in Homebuyer Age Groups and Income Segments

- The millennial generation remains the largest group of homebuyers, accounting for 43% of purchases in 2025, slightly down from 45% en 2023, reflecting gradual market entry by Gen Z buyers who now make up about 12% de purchasers.

- Buyers aged 55 and older increased their market share to 24% in 2025, up from 22% en 2023, driven by downsizing retirees and investment-focused purchases.

- Median buyer household income rose to $94,500 in 2025, up from $91,200 in 2023, signaling stronger purchasing power despite rising mortgage rates.

- Entry-level buyers with incomes under $75,000 accounted for approximately 28% of buyers in 2025, a slight decrease from 30% en 2023, impacted by affordability constraints and tightening credit.

Urban vs. Suburban Housing Demand Trends

- Suburban housing demand continues to outpace urban markets, with suburban home sales growing by 3,5% en 2025, compared to flat or slightly negative growth in urban core sales.

- In metropolitan areas like Dallas-Fort Worth and Charlotte, suburban markets grew 4-6% annually since 2023, driven by preferences for more space and affordability.

- Urban markets in cities such as New York and San Francisco showed a 1-2% decline in residential sales volume en 2025, a continuation of the trend from 2023-24.

- Inventory levels in suburbs increased by 18% year-over-year in 2025, helping moderate price growth, while urban inventory expanded only by about 5%, maintaining tighter supply conditions.

Lifestyle Preferences Impacting Residential Real Estate Purchases

- Demand for homes with dedicated office spaces rose sharply, with 38% of buyers in 2025 prioritizing home offices, a partir de 28% en 2023.

- Properties featuring energy-efficient upgrades saw purchase interest increase by 15% desde 2023, driven by growing eco-conscious buyer segments.

- Outdoor amenities, including gardens and private yards, have become critical, with 42% de recent buyers valuing outdoor space, a partir de 35% en 2023.

- Smart home technology is influencing buying decisions, with 33% of 2025 buyers seeking smart security and automation features, a 10% increase from 2023.

Impact of Remote Work on Residential Real Estate Choices

- Remote work continues to reshape residential preferences, with 52% of homebuyers in 2025 reporting remote or hybrid work status, a partir de 45% en 2023.

- Suburban and exurban migration accelerated, with these areas seeing a collective Aumento 5% in population growth de 2023 a 2025, driven by remote workers.

- The average commute time for residential buyers decreased to 22 minutes in 2025, down from 29 minutes in 2019, reflecting the remote work shift.

Investment and Financing Trends in Residential Real Estate

Fact checked 2026 | 👨🎓Cite esta estadística. Esta imagen está libre de derechos de autor.

Mortgage Rate Fluctuations and Borrower Preferences

- En 2025, mortgage rates in the U.S. average around 6.7%, marking a slight increase from 6.4% in 2024 and significantly higher than the pre-pandemic average of about 4%.

- Elevated mortgage rates have tempered borrowing power, leading to a 5% decrease in first-time homebuyers compared hasta 2023, as affordability challenges mount.

- Borrowers increasingly prefer fixed-rate mortgages, which accounted for roughly 85% of new loans in early 2025, compared to 80% in 2023, reflecting caution amidst interest rate volatility.

- Demand for larger down payments grew, with typical down payments rising to 18% of home price in 2025 de 15% en 2023, tightening credit conditions for lower-income buyers.

Shifting Patterns in Residential Real Estate Investment Strategies

- Institutional investments in residential real estate surged by 12% between 2023 and 2025, now composing about 28% of overall housing transactionsde 24% in 2023.

- The single-family rental market value grew to $150 billion in 2025, a 10% increase from 2023, driven by sustained demand amid homeownership affordability issues.

Role of Technology in Property Financing and Transactions

- Digital mortgage applications accounted for 48% of all loan originations in Q2 2025, a partir de 35% en 2023, enhancing borrower convenience and speed.

- Virtual property tours influenced over 35% of residential sales in 2025, frente a unos 20% in 2019, accelerating purchase decisions and widening buyer reach.

- Blockchain and smart contracts started to gain adoption, with pilot programs covering 12% of transactions in some U.S. states a mediados de 2025, aiming to reduce fraud and transaction times significantly.

- Online platforms facilitated a Aumento 30% in remote closings de 2023 a 2025, highlighting consumer preference for contactless processes.

Impact of Government Policies on Residential Real Estate Investments

- The rollback of pandemic-era tax incentives contributed to a 5% decline in investment-driven purchasesin 2025 en comparación con 2022.

- Housing supply initiatives led to a Aumento 7% in affordable housing developments en 2025, frente a 3% en 2023, aiming to alleviate inventory shortages.

- Local and federal regulations targeting speculative buying resulted in a 10% decrease in investment purchases in overheated markets such as New York and San Francisco entre 2023 y 2025.

Technology Advancements and Digital Trends In Residential Real Estate

The Rise of Virtual Tours and Online Listings

- En 2025, over 48% of U.S. homebuyers used virtual tours as part of their home search process, up from 35% en 2023, reflecting a significant adoption of digital home viewing technologies.

- Online listings now influence more than 50% of residential real estate transactions, compared to about 40% en 2021, making digital presence a core driver of buyer engagement.

- The use of augmented reality (AR) tools in virtual tours has grown by 25% anuales desde 2023, enhancing the buyer experience by enabling interactive property exploration remotely.

Data Analytics in Residential Real Estate Decision-Making

- Real estate firms using big data analytics reported a Aumento 20% in sales efficiency en 2025 en comparación con 2023, driven by precision targeting and personalized marketing strategies.

- Predictive analytics tools have improved price forecasting accuracy by 10% over traditional methods desde 2022, allowing investors and buyers to anticipate market fluctuations better.

- En 65% of residential real estate agents now integrate data-driven insights into client consultations, compared to 45% en 2020, bridging market knowledge gaps.

- Geographic Information Systems (GIS) analytics shaped 30% of investment decisions en 2025, up from 18% in 2019, facilitating smarter location choices for buyers and developers.

Smart Homes and Their Impact on Home Values

- Smart home features were identified as a purchase priority by 33% of buyers in 2025, up 10% since 2023, highlighting growing buyer preference for connected living.

- Homes equipped with energy management systems reduced utility costs by hasta 20%, improving long-term ownership affordability and desirability.

- The integration of smart tech contributed to a 12% faster sales rate in competitive markets, emphasizing the tangible return on including such features.

PropTech Startups Transforming Residential Real Estate Operations

- PropTech investments hit $7.5 billion in 2024, creciendo en 35% interanual, reflecting accelerating innovation momentum.

- The rise of blockchain in property transactions led to 12% of U.S. residential sales incorporating smart contracts a mediados de 2025, enhancing security and reducing closing times by up to 30%.

- AI-driven tools for property valuation and customer relationship management accelerated lead conversion rates by 18% compared to 2022.

- Virtual reality (VR) platforms expanded to include interactive neighborhood simulations, with nearly 40% of buyers using VR tools to evaluate community factors in 2025, up from 22% in 2021.

Residential Real Estate Challenges and Future Outlook

Fact checked 2026 | 👨🎓Cite esta estadística. Esta imagen está libre de derechos de autor.

Market Volatility and Risk Factors in Residential Real Estate

- The U.S. residential real estate market experienced a 7% decline in property values over the past 12 months y un 20% decline over the previous two years, indicating heightened market volatility compared to relative stability from 2017 to 2019.

- Mortgage rates increased to an average of 6.7% in 2025, a partir de 6.4% in 2024 and well above the pre-pandemic average of 4%, restraining buyer affordability and participation.

- Key risk factors include fluctuating interest rates, economic slowdown fears, and increasing construction costs that have raised residential building expenses by over 8% since 2023.

- Climate risks and natural disasters are increasingly cited, with insurance premiums rising by 16% in high-risk zones due to frequent wildfire and flood events, impacting the residential real estate expense structure.

Sustainable Development Trends in Residential Housing

- Sustainable housing construction expanded by 7% en 2025, en comparación con 3% en 2023, reflecting higher demand for eco-friendly residential developments.

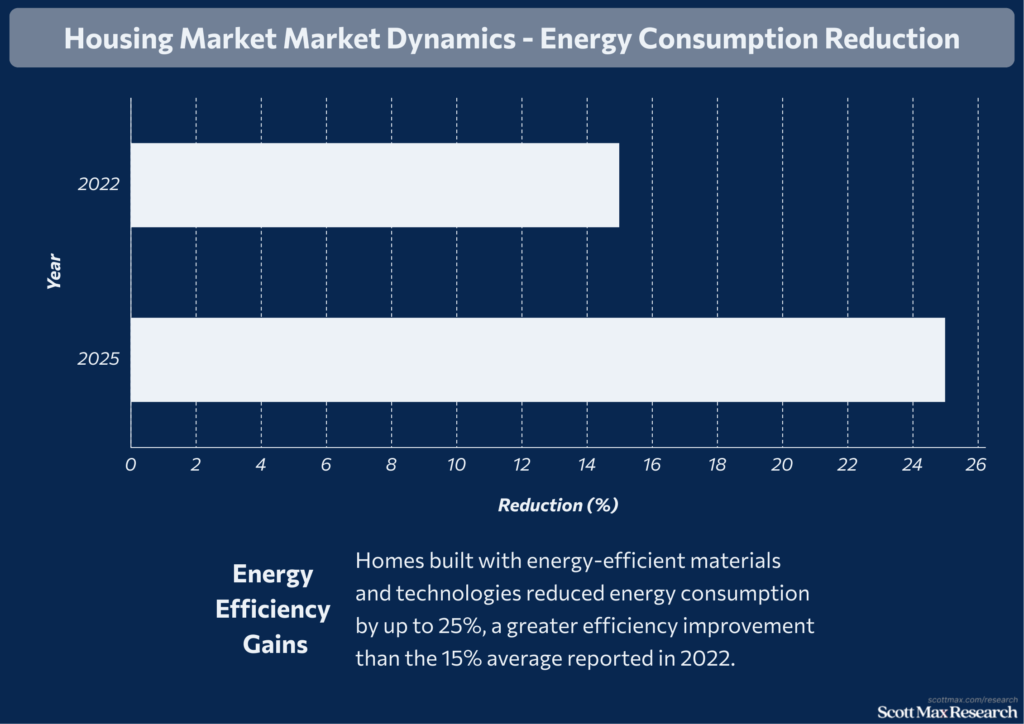

- Homes built with energy-efficient materials and technologies reduced energy consumption by up to 25%, a greater efficiency improvement than the 15% average reported in 2022.

- Solar panel installations on residential homes grew by 18% en 2025, doubling the 9% growth seen in 2023, indicative of increasing buyer preference for green energy features.

- Green building certifications, such as LEED, were adopted in 20% of new residential developments en 2025, up from 12% in 2023, signaling a shift toward sustainability credentials influencing property values.

Forecasts and Predictions for Residential Real Estate Growth

- The U.S. residential real estate market sales volume is expected to increase modestly by 2.5% in 2025, reaching about 4.16 million units, slightly improving on the 4 million sales from 2024 but below the annual average of 5.28 million from 2013-2019.

- Home price growth is forecasted to flatten or slightly decline by 2% by the end of 2025, a marked change from the 6.5% average annual appreciation during 2013-19 and 4.5% growth in 2024.

- Suburban and exurban areas will continue expanding with population growth increasing by 5% between 2023 and 2025 due to remote work, outpacing urban cores, which show flat or negative growth.

- Rental market rent growth is predicted to slow to around 2.75% in 2025, lower than the 4.5% rise seen in 2024, reflecting easing demand and higher supply influxes.

- Technology integration and data analytics are expected to contribute to a 10%-15% increase in market efficiency over the next 3 years, improving transaction speeds and pricing accuracy.

Innovative Solutions for Overcoming Residential Real Estate Challenges

- PropTech adoption in residential real estate transactions increased by 30% between 2023 and 2025, con 48% of mortgage applications processed digitally en 2025, enhancing accessibility and reducing closing times.

- Virtual tours and augmented reality tools were used by over 48% of homebuyers in 2025, compared to 35% in 2023, easing buyer decision-making amid market uncertainty.

- Sustainable financing options, including green mortgages and tax incentives, rose by 12% en 2025, supporting demand for energy-efficient homes and mitigating affordability issues.

Conclusión

As the residential real estate industry continues to evolve, understanding its long-term trends and statistics is vital for making informed decisions. Shaped by shifting buyer preferences, technological advances, and economic factors, residential real estate remains a dynamic sector with immense growth potential.

The future points to smarter, sustainable living and increased investment resilience. Whether you're a buyer, seller, or investor, staying ahead through data-driven insights empowers success in this competitive market. Reflect on these trends and explore further to navigate the ongoing transformation of residential real estate confidently.

Insights On Residential Real Estate Industry Trends and Statistics

How has the residential real estate market performed in recent years?

The sector has surged, with India’s housing sales reaching a 12-year high in 2024, and premium homes accounting for 46% of sales. Globally, the residential real estate market maintains steady growth, with a CAGR of around 3% projected through 2029.

What buyer trends are shaping residential real estate today?

There’s a major shift toward luxury and technologically advanced homes, driven by rising incomes and lifestyle preferences. In India and the U.S., demand for high-value or smart homes is outpacing other segments.

How has remote work impacted residential real estate trends?

Remote work has fueled migration to suburban and second-tier cities, increasing demand outside core metros. Over 60% of housing price gains from 2019 to 2021 in the U.S. are linked to remote work preferences.

What role does sustainability play in residential real estate decisions?

Eco-friendly homes and sustainable construction are now key buying factors, with 81% of buyers favoring green features such as energy-efficient windows and solar panels.

What future trends are forecasted for residential real estate?

Expect continued growth in premium and sustainable housing, ongoing urbanization, and digital-enabled transactions. The sector’s outlook remains robust, especially in developing urban centers.

Referencias y citas:

- Realtor.com Housing Forecast Midyear Update: Moderation Continues

Danielle Hale, Sabrina Speianu, Jiayi Xu, Hannah Jones, Anthony Smith, Jake Krimmel, Joel Berner (Jul 2025), Realtor.com Housing Forecast Midyear Update: Moderation Continues - Zillow Home Value and Home Sales Forecast (July 2025)

Zillow Research (Jul 2025), Zillow Home Value and Home Sales Forecast (July 2025) - 5 predictions for the US housing market in 2025, according to Realtor.com

Jordan Pandy, James Faris (Dec 2024), 5 predictions for the US housing market in 2025, according to Realtor.com - Tendencias emergentes en el sector inmobiliario

PwC, The Urban Land Institute (2025), Emerging Trends in Real Estate® - The outlook for the US housing market in 2025

J.P. Morgan (Feb 2025), The outlook for the US housing market in 2025 - Housing Market Predictions For 2025: When Will Home Prices Drop?

Robin Rothstein, Caroline Basile (Jul 2025), Housing Market Predictions For 2025: When Will Home Prices Drop? - 2025-2030 Five-Year Housing Market Predictions

Patrick S. Duffy, Liisa Rajala, Dawn Bradbury, A.R. Cabral (Jul 2025), 2025-2030 Five-Year Housing Market Predictions - Perspectivas del mercado inmobiliario estadounidense para 2025

CBRE Research (Dec 2024), U.S. Real Estate Market Outlook 2025 - United States Housing Market

Zillow (2025), United States Housing Market - 2025 tendencias inmobiliarias comerciales

Al Brooks (Ene 2025), Tendencias del sector inmobiliario comercial en 2025 - Informe sobre el mercado inmobiliario comercial

Asociación Nacional de REALTORS® (mayo de 2025), Informe sobre el mercado inmobiliario comercial - Actualización del mercado inmobiliario comercial: tendencias clave para 2025

Bethany A Williams (Mar 2025), Actualización del mercado inmobiliario comercial: tendencias clave para 2025 - 80+ Estadísticas del sector inmobiliario comercial: Mercado en Movimiento (2025)

Sharad Mehta (abr 2025), 80+ Estadísticas del sector inmobiliario comercial: Mercado en movimiento (2025) - Commercial Market Trends Q2 2025

Scott Lyons (Jun 2025), Commercial Market Trends Q2 2025 - Perspectivas del sector inmobiliario comercial para 2025

Jeffrey J. Smith, Kathy Feucht, Renea Burns, Tim Coy (Sep 2024), Perspectivas del sector inmobiliario comercial en 2025 - Commercial Real Estate Outlook 2025 Trends

Jordan B. (Jun 2025), Commercial Real Estate Outlook 2025 Trends - Global Real Estate Outlook 2025

Benjamin Breslau, Steven Lewis, David Rea, Julia Georgules (Jul 2025), Global Real Estate Outlook 2025