23+ Accounting Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

The accounting industry is on the brink of a profound transformation, driven by rapid advances in AI, automation, and cloud technology. Future trends indicate a data-driven, tech-enabled landscape where accountants evolve from traditional number crunchers to strategic advisors.

Tracking these evolving accounting industry trends and statistics is crucial for professionals aiming to leverage technology, enhance accuracy, and stay competitive in an increasingly digital world. This article examines the pivotal shifts that are shaping the modern accounting landscape.

Historical Growth and Market Dynamics of the Accounting Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Global Revenue Growth and Market Size Over the Years

- The global accounting services market grew from $544.06 billion in 2020 to an estimated $735.94 billion in 2025, representing a 35.3% increase over the five years.

- In 2024, the market size was $636.03 billion, projected to rise to $660.65 billion in 2025, reflecting a 3.9% CAGR between 2024 and 2025.

- Forecasts anticipate the market reaching $800.68 billion by 2029, with a 4.9% CAGR from 2025 to 2029, driven by regulatory reforms and technological advancements.

- The accounting and auditing segment is specifically expected to grow from $222.35 billion in 2024 to $238.06 billion in 2025, representing a 7.1% annual growth rate, and is projected to reach $308.63 billion by 2029.

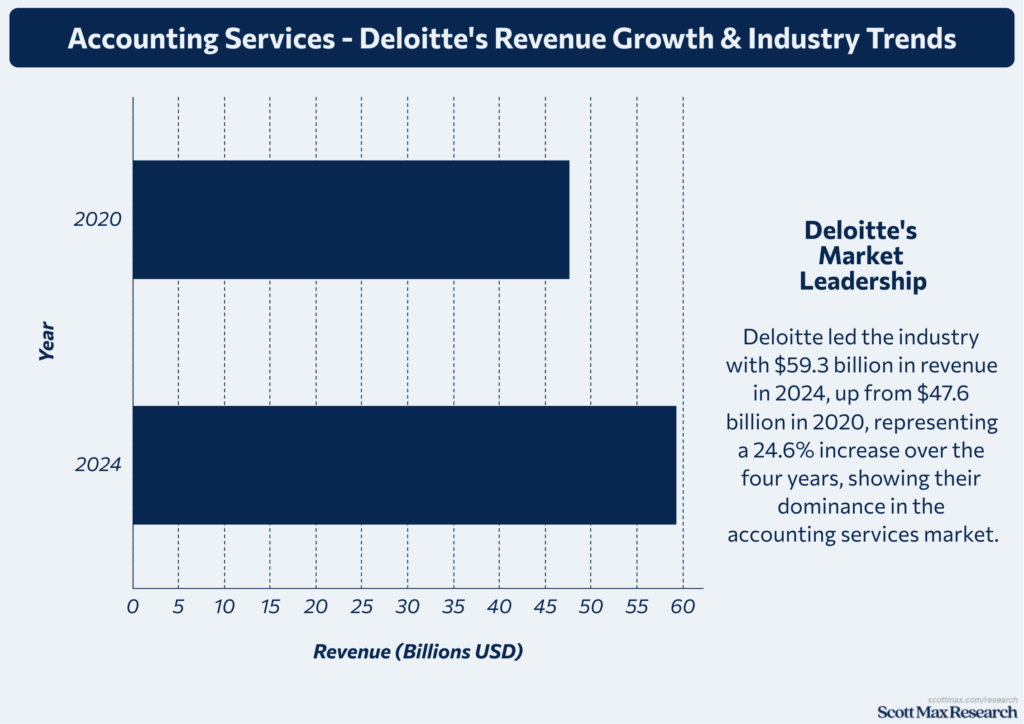

Key Players: The Dominance of the Big Four Accounting Firms

- The Big Four accounting firms (Deloitte, PwC, EY, KPMG) continue to dominate, collectively generating revenues exceeding $200 billion annually as of 2024, accounting for nearly 30% of the global market.

- Deloitte led the industry with $59.3 billion in revenue in 2024, up from $47.6 billion in 2020, representing a 24.6% increase over the four years. PwC followed closely with $50.3 billion in revenue for 2024.

- Smaller firms and mid-tier players have seen slower growth rates, averaging 2-4% annually, compared to the Big Four’s 6-8% CAGR, highlighting market concentration.

Expansion of Accounting Services: From Bookkeeping to Strategic Advisory

- Traditional bookkeeping and tax preparation services accounted for 40% of total revenues in 2015, declining to 25% by 2024 as firms expand into advisory and consulting.

- Client Advisory Services (CAS) now represent 35% of revenue streams for leading firms, up from 20% in 2018, driven by demand for financial planning, business strategy, and technology consulting.

- Automation and AI integration have reduced manual bookkeeping tasks by 30% since 2020, reallocating resources toward high-value advisory roles.

- Cloud accounting adoption surged from 15% of firms in 2017 to 65% in 2025, enabling real-time data access and strategic insights for clients.

Impact of Economic Cycles on Accounting Industry Performance

- The accounting industry showed resilience during economic downturns, with revenue growth slowing to 1.5% in 2020 amid the COVID-19 pandemic but rebounding to 5.2% in 2021 and 6.3% in 2024.

- Economic uncertainty increased demand for risk management and compliance services, contributing to a 12% rise in auditing and forensic accounting revenues between 2021 and 2024.

- The rise in financial fraud, with authorized fraud losses increasing by 6% to $616 million in 2022 (UK data), has driven growth in auditing services, supporting a 7.1% CAGR in the auditing market through 2025.

Technological Advancements Shaping the Accounting Landscape

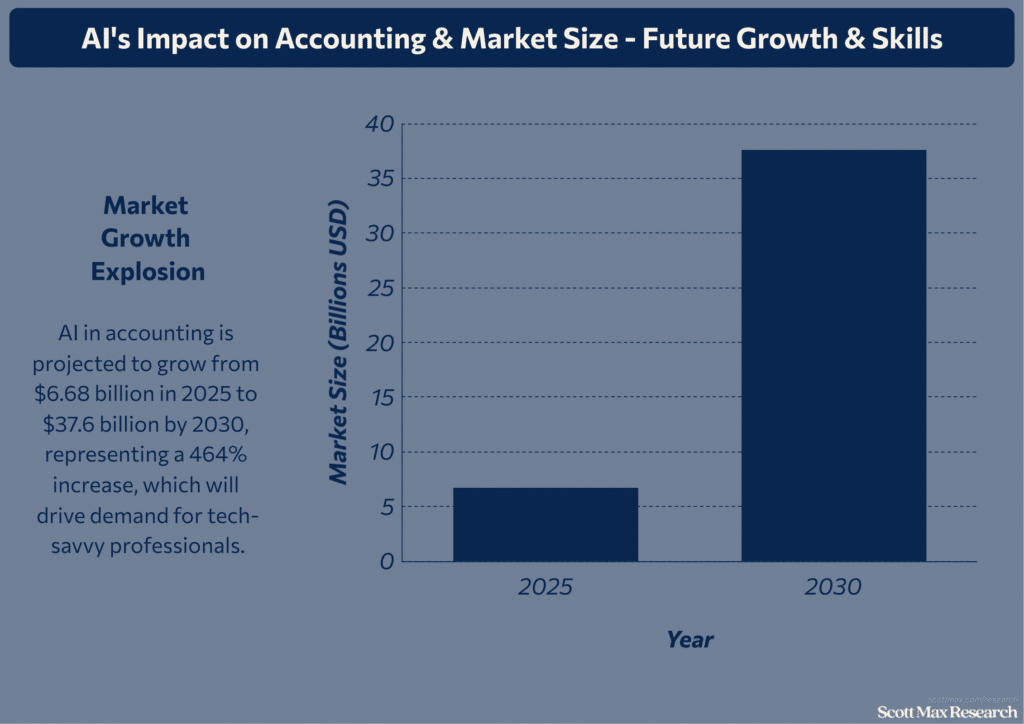

Rise of Artificial Intelligence and Machine Learning in Accounting

- The AI market in accounting is projected to grow from $6.68 billion in 2025 to $37.6 billion by 2030, representing a 464% increase over five years.

- AI investment by accounting firms is expected to increase at a 42.5% CAGR through 2027, up from modest adoption rates in 2020.

- By 2024, over 30% of accounting firms are expected to have integrated AI tools into their operations, with an additional 23% planning to adopt them in 2025, resulting in a total market penetration of over 50% within two years.

- Generative AI tools, such as ChatGPT, have accelerated adoption, with 45% of executives increasing their AI investments after being exposed to such technologies in 2023.

Adoption of Cloud Accounting Software and Automation Tools

- Cloud accounting adoption rose from 15% in 2017 to 62% of firms using cloud-based systems in 2025, a 313% increase over eight years.

- In 2025, 57% of firms report the meaningful integration of technology into their core operations, compared to 35% in 2020, signaling a deeper level of digital transformation.

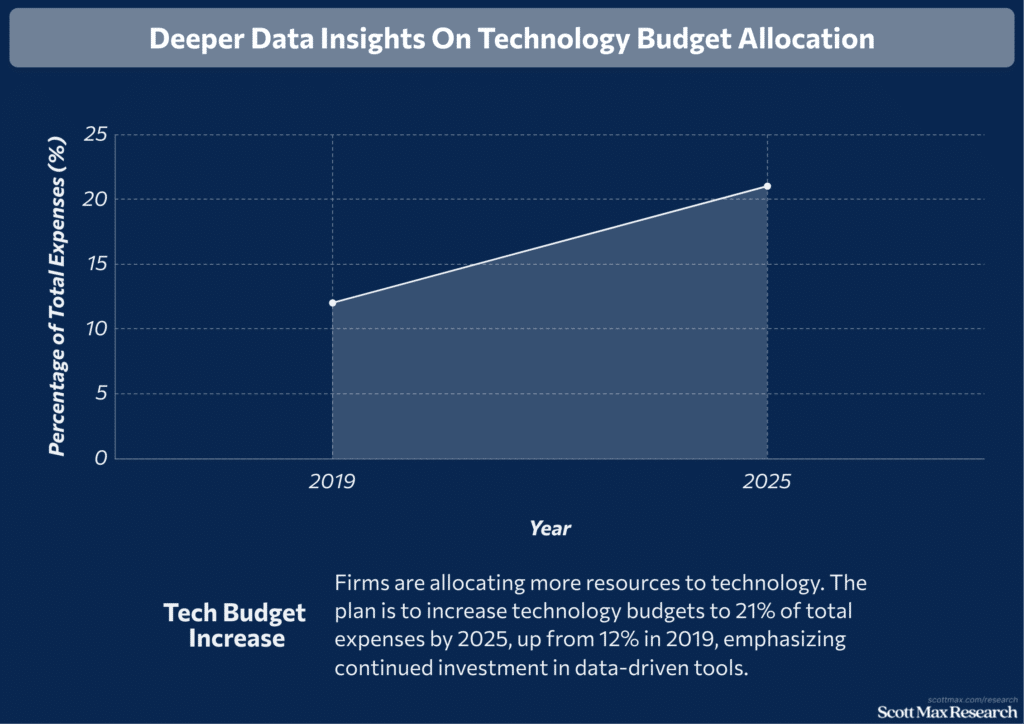

- Average IT budgets for accounting firms increased to 21% of total budgets in 2025, up from 12% in 2019, with larger firms allocating over 30%.

Data Analytics and Predictive Accounting for Enhanced Decision-Making

- The use of data analytics in accounting firms increased from 22% adoption in 2018 to 68% in 2025, a threefold rise in just seven years.

- Firms utilizing advanced analytics reported a 17% median revenue growth in 2023, compared to 10% for firms without analytics capabilities.

- Forecasting accuracy improved by 25% in firms that used AI-powered predictive models compared to traditional methods in 2024.

Blockchain and Cryptocurrency Accounting: Emerging Standards and Challenges

- The accounting blockchain market is projected to reach $868 million by 2025, up from $350 million in 2021, representing a 148% increase over four years.

- The adoption of blockchain in auditing processes increased by 35% between 2022 and 2025, driven by the Big Four and other large firms.

- Cryptocurrency accounting demand surged, with crypto tax filings increasing by 50% from 2022 to 2024, reflecting a regulatory focus and market growth.

- Blockchain’s immutable ledger technology has reduced fraud detection time by 30% in firms using smart contracts and distributed ledgers since 2023.

- Despite growth, only 18% of firms have fully integrated blockchain solutions as of 2025, with another 40% exploring pilot programs.

Workforce Trends and Talent Development in Accounting

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Growth in Accounting Employment and Job Market Projections

- The U.S. accounting and auditing workforce consisted of approximately 1.56 million professionals in 2024, with 130,800 annual job openings projected through 2033 to replace retiring professionals and meet demand.

- Employment for accountants and auditors is expected to grow by 6% from 2023 to 2033, which is faster than the average growth rate for all occupations.

- The accounting workforce has shrunk by over 17% since 2020, with more than 300,000 professionals leaving the field in the past three years, intensifying talent shortages.

Increasing Demand for Digital Literacy and Data-Driven Skills

- In 2025, 61% of accountants view AI as an opportunity to improve accuracy and reduce mundane tasks, reflecting the growing adoption of digital technologies.

- AI in accounting is projected to grow from $6.68 billion in 2025 to $37.6 billion by 2030, representing a 464% increase, which will drive demand for tech-savvy professionals.

- Firms plan to dedicate 21% of their budgets to technology in 2025, up from 12% in 2019, with larger firms allocating over 30%.

- Approximately 23% of accounting firms currently utilize AI tools, with another 33% actively exploring adoption, indicating a rapid demand for digital skills.

- Data analytics adoption grew from 22% in 2018 to 68% in 2025, tripling in seven years, with predictive accounting improving forecasting accuracy by 25%.

Shifts in Roles: From Traditional Accountants to Strategic Business Partners

- Client Advisory Services (CAS) revenue increased 17% in 2023 compared to 2022, with projections of a 99% rise by 2025, reflecting a shift toward strategic advisory roles.

- Approximately 83% of accounting firms offer advisory services, with an additional 20% planning expansions, indicating a broad move beyond traditional bookkeeping.

- Automation has reduced routine tasks by 30-40% since 2020, enabling accountants to focus on higher-value activities such as financial analysis and strategic planning.

Regulatory Changes and Accounting Standards Evolution

Key Updates in Financial Reporting Standards (FASB, IFRS)

- The Financial Accounting Standards Board (FASB) issued over 20 major updates between 2021 and 2024, including amendments to lease accounting and revenue recognition rules, impacting over 1.5 million U.S. companies.

- The International Financial Reporting Standards (IFRS) Foundation reported that, as of 2025, over 140 countries have adopted IFRS standards, up from 130 countries in 2020, representing a 7.7% increase in global adoption.

- The SEC's 2024 climate-related disclosure rules require companies to report greenhouse gas emissions and related financial risks, affecting over 4,000 publicly traded companies in the U.S. and significantly expanding ESG-related financial reporting.

Impact of ESG (Environmental, Social, Governance) Reporting Requirements

- ESG reporting adoption rose from 35% of public companies in 2020 to 78% in 2025, driven by regulatory mandates and investor demand.

- The SEC's new ESG disclosure rules, effective in 2024, require detailed reporting on carbon emissions, water usage, and social impact metrics, impacting firms with combined revenues exceeding $50 trillion globally.

- Firms reported that ESG compliance costs have increased by 18% annually since 2022, with average annual spending rising from $1.2 million in 2020 to $2.1 million in 2025.

- ESG-related audit services revenue grew by 22% in 2024 compared to 2023, reflecting increasing demand for third-party verification and assurance.

Compliance Challenges in a Rapidly Changing Regulatory Environment

- In India, 87% of companies reported increased compliance costs in 2024, with technology investments rising by 25% to meet evolving regulations (EY, 2025).

- Globally, 19% of organizations faced legal or regulatory actions in the past three years due to compliance failures.

- Data breaches cost companies an average of $220,000 more when non-compliance was a factor, emphasizing the financial risk of inadequate controls.

- 77% of organizations plan to transition to updated compliance frameworks within the required periods, but 21% delay action until audits or external findings.

Preparing for Future Audits: Transparency and Granularity in Reporting

- The PCAOB's QC 1000 standard, effective December 2025, requires firms to establish clear quality objectives and enhance risk assessments, affecting all registered audit firms that collectively audit over 10,000 public companies.

- Audit documentation timelines have shortened by 20% since 2023 due to stricter standards, requiring faster and more detailed reporting.

- Firms using AI-driven audit tools increased from 15% in 2020 to 48% by 2025, resulting in a 30% reduction in average audit cycle times.

- Transparency requirements now include granular disclosures on financial assumptions and ESG metrics, with over 70% of large firms enhancing internal controls to comply by 2025.

- The average time to identify and contain data breaches in accounting firms is 292 days, underscoring the need for improved audit and compliance controls.

Data-Driven Strategies and Their Impact on Accounting Efficiency

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Integration of Business Intelligence and Analytics in Financial Processes

- The global data analytics market is projected to reach $132.9 billion by 2026, growing at a CAGR of 30.08% from 2016 to 2026, with accounting firms contributing significantly to this growth.

- In 2025, nearly 65% of organizations have adopted or are actively exploring AI technologies for data and analytics, with finance and accounting departments among the most data-driven.

- Accounting firms using advanced analytics tools increased from 22% in 2018 to 68% in 2025, tripling adoption in seven years, enabling predictive modeling and scenario analysis that improved forecasting accuracy by 25%.

- Firms integrating business intelligence report a 63% increase in operational productivity, with data-driven decision-making boosting profitability by at least 50%.

- The adoption of cloud accounting software, which facilitates real-time data access and collaboration, increased from 15% in 2017 to 62% by 2025, thereby enhancing data security and compliance.

Automation of Routine Tasks: Payroll, Invoicing, and Transaction Processing

- AI-powered automation in accounting grew from a market size of $4.74 billion in 2024 to an expected $6.98 billion in 2025, with a CAGR of 47.3%, streamlining data entry, reconciliation, and transaction processing.

- Firms report spending an average of $15,800 on technology upgrades in 2025, a 25% increase from 2023, reflecting investment in automation and cloud solutions.

- Payroll automation adoption increased by 40% between 2021 and 2025, resulting in a reduction of processing errors and a faster acceleration of payroll cycles.

Case Studies: Real-World Examples of Data-Driven Accounting Success

- Xerox’s 2023 report found that 66% of accounting businesses improved staff retention, revenue, and profits by adopting cloud accounting and data analytics.

- Firms offering Client Advisory Services (CAS) reported a 17% median revenue growth in 2023 over 2022, with projections of a 99% increase by 2025, driven by data-driven insights and automation.

- AI integration helped a mid-sized firm reduce monthly close cycles from 10 days to 6 days, improving reporting speed by 40%.

- A Big Four firm reported that deploying predictive analytics reduced client risk exposure by 22% and increased audit accuracy by 18% in 2024.

Future Outlook: How Data Will Continue to Transform Accounting Practices

- The AI market in accounting is expected to grow from $6.68 billion in 2025 to $37.6 billion by 2030, representing a 464% increase, driven by the integration of advanced analytics, NLP, and blockchain.

- Firms plan to increase technology budgets to 21% of total expenses by 2025, up from 12% in 2019, emphasizing continued investment in data-driven tools.

- Emerging technologies, such as generative AI, are already being used at the enterprise level by 21% of tax and accounting firms in 2025, up from 8% in 2024, thereby accelerating data analysis and client communication.

Conclusion

The accounting industry has witnessed remarkable growth fueled by technological innovation, automation, and evolving client demands. Key trends, such as AI adoption, cloud-based solutions, and data analytics, are reshaping accounting practices, driving efficiency, and providing strategic insights.

As regulatory landscapes evolve, accounting professionals must develop digital skills and adopt data-driven strategies to remain competitive. Preparing for these future trends is essential for sustaining growth and innovation, ensuring the industry continues to deliver accurate, timely, and value-added financial services in an increasingly complex business environment.

Insights On Accounting Industry Trends and Statistics

What are the key trends shaping the accounting industry in 2025?

AI integration, cloud accounting, automation, and ESG reporting are the main drivers transforming accounting practices in 2025, enhancing efficiency and strategic decision-making.

How is AI impacting accounting workflows?

AI reduces manual tasks such as data entry and transaction reconciliation, enabling faster financial analysis, fraud detection, and predictive forecasting. AI investment is expected to grow by over 40% annually.

What does the talent landscape look like in accounting?

There is a significant talent shortage, with 75% of CPAs expected to retire within 10 years and unemployment rates for accountants nearing 2%, resulting in increased demand for skilled professionals.

How big is the global accounting market today?

The global accounting services market is projected to reach approximately $735 billion by 2025, up from $544 billion in 2020, driven by the growth of digital transformation and e-commerce.

Why is ESG reporting becoming essential in accounting?

Sustainability and governance reporting are increasingly mandated by investors and regulators, making ESG compliance a critical service for accountants to ensure transparency and accuracy.

References & Citations:

- Accounting Industry Statistics 2025 (Trends & New Data)

Simonida Jovanovic (Apr 2025), Accounting Industry Statistics 2025 (Trends & New Data) - 92 Top Accounting Statistics & Facts for 2025

Julie Watson (Jun 2025), 92 Top Accounting Statistics & Facts for 2025 - Accounting Services Global Market Report 2025 – By Type (Payroll Services, Tax Preparation Services, Bookkeeping, Financial Auditing And Other Accounting Services), By Service Provider (Large Enterprise, Small And Medium Enterprise), By End Use Industry (IT Services, Manufacturing, Financial Services, Construction, Others) – Market Size, Trends, And Global Forecast 2025-2034

The Business Research Company (Jan 2025), Accounting Services Global Market Report 2025 – By Type (Payroll Services, Tax Preparation Services, Bookkeeping, Financial Auditing And Other Accounting Services), By Service Provider (Large Enterprise, Small And Medium Enterprise), By End Use Industry (IT Services, Manufacturing, Financial Services, Construction, Others) – Market Size, Trends, And Global Forecast 2025-2034 - 2025 Accounting Trends Shaping the Industry

INAA Group (Nov 2024), 2025 Accounting Trends Shaping the Industry - Global Accounting Services Report 2025, Forecast To 2034

The Business Research Company (Mar 2025), Global Accounting Services Report 2025, Forecast To 2034 - Accounting technology trends: Wrapping up 2024 and looking ahead to 2025

Ana Ansell (Dec 2024), Accounting technology trends: Wrapping up 2024 and looking ahead to 2025 - The future of accounting: Top trends of 2025

Emily Zhang (Jun 2025), The future of accounting: Top trends of 2025 - Emerging Accounting Technology Trends to Look Out For in 2025

Financial Cents (2025), Emerging Accounting Technology Trends to Look Out For in 2025 - Future of the Accounting Industry: 7 Important Trends in 2025

Arjobi Gautam (Jun 2024), Future of the Accounting Industry: 7 Important Trends in 2025 - 2025 In-Demand Finance and Accounting Roles and Hiring Trends

Robert Half (Jun 2025), 2025 In-Demand Finance and Accounting Roles and Hiring Trends - Accountants and Auditors

Bureau of Labor Statistics (Apr 2025), Accountants and Auditors - The 2025 Accountant Shortage: Why It’s Happening, What Skills Are Lacking, and Whether AI Is Friend or Foe

Marcela Green (May 2025), The 2025 Accountant Shortage: Why It’s Happening, What Skills Are Lacking, and Whether AI Is Friend or Foe - 2025 Workforce Transformation Report: Preparing Firms for a New Era

MassCPAs (May 2025), 2025 Workforce Transformation Report: Preparing Firms for a New Era - Top regulatory compliance challenges facing India Inc in 2025

Arpinder Singh (Jan 2025), Top regulatory compliance challenges facing India Inc in 2025 - 110 Compliance Statistics to Know for 2025

Anna Fitzgerald, Emily Bonnie (Oct 2024), 110 Compliance Statistics to Know for 2025 - Key Compliance Statistics & Insights For 2025

Sharavanan (May2024), Key Compliance Statistics & Insights For 2025 - Understanding Compliance Requirements for Accountants in 2025

DiamondIT (2025), Understanding Compliance Requirements for Accountants in 2025 - The CPA and accounting industry is facing new challenges and regulatory requirements in 2025

Bill Sorenson (Feb 2025), The CPA and accounting industry is facing new challenges and regulatory requirements in 2025 - 18 Accounting Trends to Pay Attention to in 2025

Scott Beaver (Jun 2025), 18 Accounting Trends to Pay Attention to in 2025 - 115 Compliance Statistics You Need To Know in 2025

Rick Stevenson (Jan 2025), 115 Compliance Statistics You Need To Know in 2025 - The Future and Current Trends in Data Analytics Across Industries

Coherent Solutions, Inc. (Jun 2025), The Future and Current Trends in Data Analytics Across Industries - Artificial Intelligence in Accounting Market Report 2025

Research and Markets (Feb 2025), Artificial Intelligence in Accounting Market Report 2025 - 2025 Generative AI in Professional Services report: Executive summary for tax professionals

Thomson Reuters (Apr 2025), 2025 Generative AI in Professional Services report: Executive summary for tax professionals