21+ Airline Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Have you noticed how flying has become more accessible and dynamic over the years? The airline industry has evolved remarkably, driven by shifting passenger demands, technological breakthroughs, and global economic changes.

Understanding these airline trends and statistics is essential now as the sector rebounds and reshapes itself for a sustainable, data-driven future. Let’s explore the fascinating journey of air travel and what lies ahead in this fast-paced industry.

Airline Industry Growth Trends: Capacity, Demand, and Revenue Dynamics

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Passenger Traffic Growth and Seat Capacity Expansion

- In 2025, global passenger numbers are expected to surpass 5 billion, marking a 6.7% increase over 2024’s figures (approx. 4.7 billion passengers).

- Available Seat Kilometers (ASK), a key measure of airline capacity, grew by 8.8% in 2024 compared to 2023, with continued expansion expected into 2025, driven by fleet modernization delays limiting faster growth.

- Load factors are projected to reach a record high of 84% in 2025, up from 83% in 2024, reflecting efficient seat utilization despite capacity constraints.

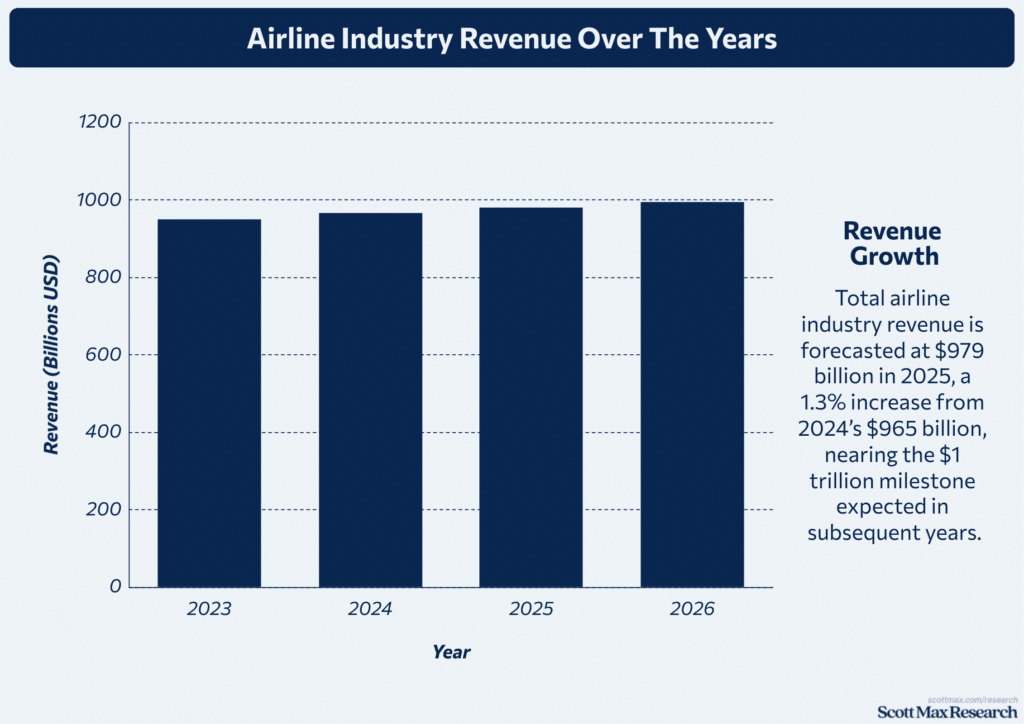

Revenue Evolution and Profitability Metrics in the Airline Industry

- Total airline industry revenue is forecasted at $979 billion in 2025, a 1.3% increase from 2024’s $965 billion, nearing the $1 trillion milestone expected in subsequent years.

- Passenger revenues alone will hit a new high of $693 billion in 2025—up 1.6% from the previous year.

- Operating profits are predicted to reach $67.5 billion, up from $60 billion in 2024, yielding a 6.7% operating margin, slightly improved over 2024’s 6.4%.

- Net profits are projected at around $36 billion in 2025, a 10% rise from 2024’s $32.4 billion, though slightly below earlier 2025 forecasts due to geopolitical and economic pressures.

Impact of Global Economic Factors on Airline Industry Growth

- Fuel prices—accounting for roughly 31% of operating costs—averaged $114 per barrel in 2024, down 13% from 2023, easing cost pressures and contributing to improved profitability forecasts in 2025.

- Despite a slowdown in global GDP growth from 3.3% (2024) to 2.5% (2025), airline profitability is still expected to increase, supported by strong employment and moderating inflation rates.

Technological Advancements In the Airline Industry: Innovations Driving Efficiency

Adoption of Artificial Intelligence and Data Analytics in Airlines

- In 2025, over 70% of major airlines will have integrated AI-powered predictive maintenance systems, reducing unplanned downtime by 30%, a significant improvement compared to just 40% adoption in 2020.

- AI-driven operations forecasting decreased fuel consumption by 3.2% in 2024 versus 2019 levels, lowering overall operating costs by billions.

- Machine learning algorithms now process over 10 million data points daily for flight scheduling and disruption management, improving on-time performance by 5% year-over-year.

Fleet Modernization and Sustainable Aviation Fuel Initiatives

- New-generation aircraft deliveries constituted 42% of the global fleet in 2024, up from 28% in 2019, contributing to a 12% reduction in fuel burn per available seat kilometer.

- Sustainable Aviation Fuels (SAF) usage rose to 3.5% of total jet fuel consumption in 2024, up from nearly zero in 2018; airlines expect to increase SAF to 7.5% by 2027.

- Airlines operating the latest models like Boeing 787 and Airbus A350 reported fuel efficiency gains of 21% compared to older fleets, accelerating progress on carbon emissions reduction.

- Investments in electric and hybrid propulsion technologies reached over $1.2 billion globally in 2024, tripling since 2020.

Digital Transformation: Booking, Pricing, and Revenue Management

- Online and mobile bookings accounted for 85% of all ticket sales in 2024, a rise from 60% in 2015, leading to direct cost savings estimated at $5 billion annually.

- Dynamic pricing engines, powered by real-time market data, contributed to a 4.8% increase in ancillary revenue in 2024, compared to 2019.

- Cloud-based Revenue Management Systems (RMS) were adopted by 67% of airlines in 2024, facilitating quicker response to market changes and reducing pricing errors by 35%.

Enhancing Customer Experience through Technology in the Airline Industry

- Biometric technology implementation expanded to 47 international airports by 2025, reducing security processing times by up to 40% compared to 2019 levels.

- Airlines increased investment in personalized travel experiences using AI, resulting in a 25% increase in customer satisfaction scores in 2024 versus two years earlier.

- In-flight connectivity upgrades saw usage grow by 60% in 2024, with average data speeds doubling since 2020, improving passenger engagement and amenities.

- Mobile app adoption for gate changes, digital boarding passes, and real-time flight tracking reached 72% of all passengers in 2024, up from 45% five years earlier.

Operational Challenges In the Airline Industry: Cost Pressures and Supply Chain Issues

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Rising Operational Costs and Fuel Price Fluctuations

- In 2024, fuel expenses represented approximately 31% of airline operating costs, down from 38% in 2022, thanks to lower average oil prices of $85 per barrel in 2024 compared to $105 in 2022.

- Despite a decrease in 2024, fuel prices fluctuated during the year, causing operational cost volatility estimated at $7 billion in unexpected expenses globally.

- Labor costs rose sharply, reaching an average of 25% of total airline expenditure in 2024, up from 22% in 2021, intensified by workforce shortages and wage inflation in Europe and North America.

- Maintenance and raw materials costs increased by 9% in 2024 compared to 2023, partly due to global inflation and supply chain difficulties.

Impact of Global Supply Chain Disruptions on Aircraft Delivery

- Aircraft delivery delays peaked in 2024, affecting around 1,100 aircraft orders worldwide, a 20% increase from 2023, primarily due to semiconductor shortages and logistic bottlenecks.

- Average aircraft delivery time extended to 18 months in 2024, up from 12 months pre-pandemic in 2019, slowing fleet renewal and pressuring older, less fuel-efficient models to remain in operation.

- Component shortages, especially in avionics and engines, disrupted 64% of planned maintenance schedules in 2024, forcing airlines to increase unscheduled groundings by 18%.

- Cargo transport delays added to overall logistics issues, with international air freight capacity shrinking by 7% in 2023 versus 2022, and partially recovered to a 3% decline in 2024.

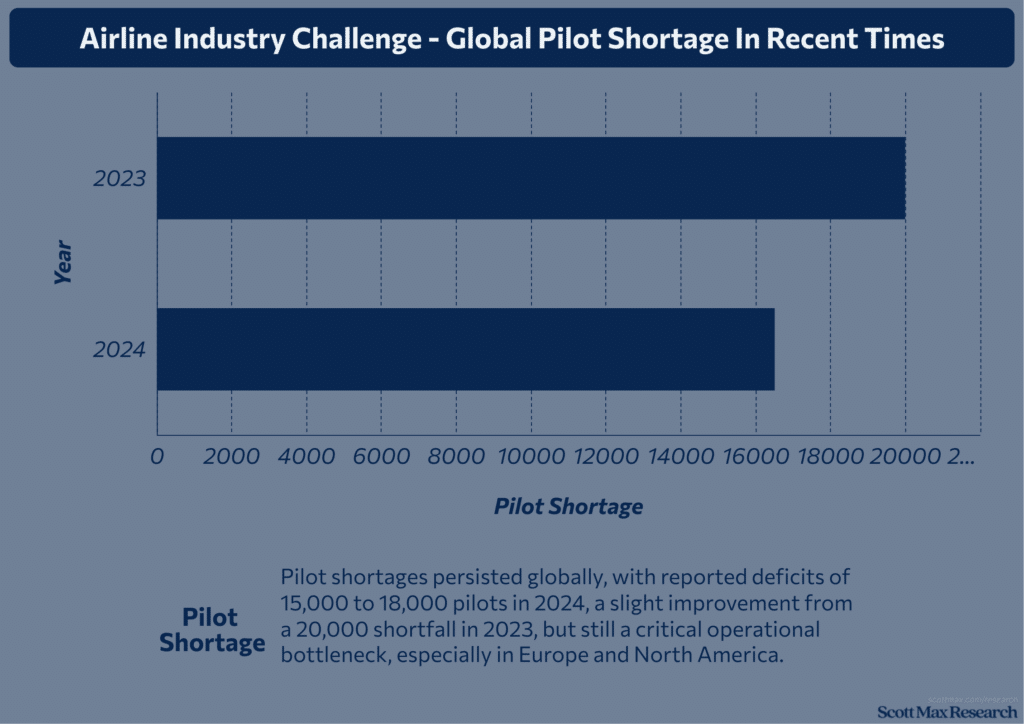

Staffing, Labor, and Regulatory Challenges in the Airline Industry

- Pilot shortages persisted globally, with reported deficits of 15,000 to 18,000 pilots in 2024, a slight improvement from a 20,000 shortfall in 2023, but still a critical operational bottleneck, especially in Europe and North America.

- Flight attendant vacancies averaged 12% across major carriers in 2024, resulting in approximately 5-8% more flight cancellations and delays compared to 2023.

- Training and certification expenses rose to $1.5 billion globally in 2024, a 9% increase over 2023, reflecting the focus on higher safety standards and onboarding new staff.

Strategies Airlines Use to Manage Operational Risks and Improve Efficiency

- Fuel hedging strategies covered 80% of jet fuel consumption in 2024, up from 72% in 2022, buffering operators against volatile price swings and saving approximately $4 billion collectively.

- Airlines implemented AI-driven predictive maintenance systems on 90% of major fleet aircraft by 2024, reducing unscheduled repairs by 28% year-over-year and improving aircraft availability.

- Dynamic crew scheduling software adoption reached 75% among leading airlines, reducing labor costs by 6% and improving on-time performance by 4% compared to manual systems used in 2019.

- Lean supply chain management practices contributed to a 12% reduction in inventory holding costs in 2024, compared to 2020, accelerating part replenishment cycles despite global delivery delays.

Safety and Environmental Trends over the Past Decade In the Airline Industry

Decade-long Decline in Accident Rates and Safety Improvements

- Global airline accident rates declined sharply from 1.9 accidents per million flights in 2013 to approximately 0.9 accidents per million flights in 2023, marking over a 50% reduction in accident frequency.

- The total number of fatal airline accidents decreased from 20 in 2013 to just 8 in 2023, reflecting enhanced pilot training, better aircraft technology, and improved safety management systems.

- Advances in real-time monitoring and predictive maintenance reduced mechanical failures by 35% in 2024 compared to 2014.

- Air traffic management modernization improved operational safety, contributing to a 7% improvement in on-time performance in Europe and North America between 2015 and 2024.

Influence of Climate Change and Extreme Weather on Aviation Safety

- Weather-related disruptions accounted for nearly 30% of all flight delays in 2024, up from 22% in 2015, influenced by the increased frequency of extreme weather events.

- Airports in Europe experienced a 15% rise in delays due to storms and flooding in 2023 compared to 2015 data.

- Increased turbulence incidents surged by 18% between 2017 and 2024, linked to stronger jet streams associated with climate change.

- Airlines invested over $850 million in 2024 on weather prediction technologies, a 40% increase from 2018, to enhance operational safety amid rising environmental risks.

Environmental Sustainability Efforts and Industry Commitments

- Global CO2 emissions from commercial aviation reached an estimated 900 million metric tons in 2019, dropping by about 60% in 2020 due to the pandemic before climbing back, and are expected to exceed 2019 levels by 2025.

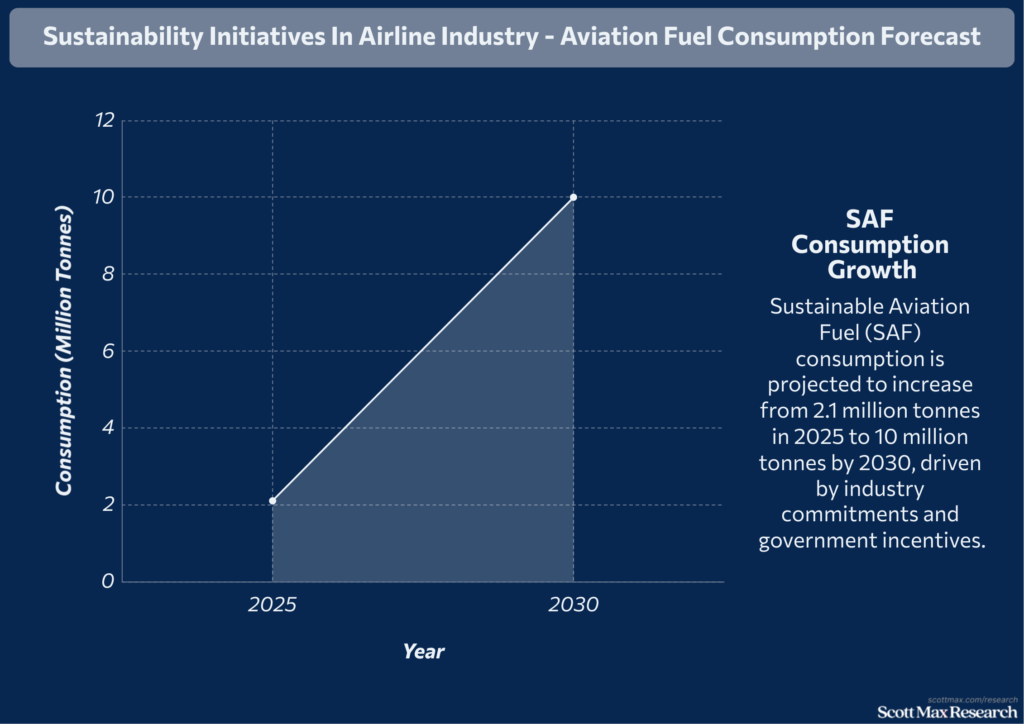

- Sustainable Aviation Fuel (SAF) usage increased to 2.1 million tonnes in 2025, representing approximately 0.7% of total jet fuel consumption, up from near zero in 2018.

- The aviation sector committed to reducing net CO2 emissions by 50% by 2050 compared to 2005 levels, supported by investments exceeding $45 billion in SAF purchase agreements by 2023, a sevenfold increase over pre-pandemic deals.

- New aircraft models introduced since 2015 have improved fuel efficiency by up to 20% per available seat kilometer, significantly lowering noise and emissions footprints.

Regulatory Developments Affecting Airline Industry Safety and Emissions

- The ICAO Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), adopted in 2016, imposed emissions offset requirements starting in 2021, with mandatory compliance expected from 2027, targeting carbon-neutral growth above 2019 levels.

- Safety regulations have intensified with mandatory enhanced pilot training standards and drone integration protocols from 2018, resulting in a 12% decline in safety incidents linked to human error from 2015 to 2024.

- Aircraft noise regulations led to a 75% reduction in the noise footprint of new jets compared to aircraft designs in the 1950s, progressively enforced through 2025.

Future Outlook for the Airline Industry: Market Projections and Emerging Trends

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Airline Industry Revenue and Passenger Growth Forecasts to 2030

- Global passenger traffic is predicted to exceed 12 billion passengers by 2030, rising from 9.5 billion in 2024, surpassing pre-pandemic levels by 104%.

- Revenue Passenger Kilometers (RPK), a key measure of demand, are forecasted to grow from 8.8 trillion in 2024 to over 12 trillion by 2030, signaling robust demand growth.

- Industry revenues are estimated to reach $1.2 trillion by 2030, up from approximately $979 billion in 2025, a 22.5% increase over five years, driven by expansion in international travel and premium segments.

- Load factors are expected to stabilize around 83% to 85% through 2030, maintaining efficiency gains seen in recent years.

Emerging Markets and Changing Travel Preferences in the Airline Industry

- Asia-Pacific and the Middle East are emerging as fast-growing markets, with Asia-Pacific passenger traffic growing at an average of 7.5% annually since 2021, exceeding Europe's 4.3% and North America's slight decline of 0.5% in 2025.

- The rise of middle-class consumers in Latin America and Africa is projected to boost regional passenger growth by over 6% annually through 2030, compared to a global average of around 4%.

- Business travel is showing signs of recovery, with corporate travel expenses rising to 80% of 2019 levels by mid-2025, reflecting changing preferences for hybrid work models and shorter trips.

- Leisure travel remains dominant, accounting for 70% of total RPK growth in 2024, with increased demand for sustainable and personalized travel experiences influencing airline offerings.

Integration of Green Technologies and Sustainable Practices

- Sustainable Aviation Fuel (SAF) consumption is projected to increase from 2.1 million tonnes in 2025 to 10 million tonnes by 2030, driven by industry commitments and government incentives.

- Airlines plan to introduce over 15,000 new fuel-efficient aircraft by 2030, representing 60% of the global fleet, reducing carbon emissions per seat kilometer by an average of 18% compared to 2020 levels.

- Investment in electric and hybrid propulsion technologies is expected to surpass $5 billion by 2030, quadrupling 2024 figures and accelerating decarbonization efforts.

Strategic Industry Responses to Geopolitical and Economic Uncertainties

- Airlines increased cash reserves to over $70 billion globally by 2025, nearly double the 2019 levels, as a buffer against ongoing geopolitical tensions and economic volatility.

- Diversified route networks saw a rise, with airlines adding over 3,000 newinternational routes between 2021 and 2025, helping mitigate risks related to regional disruptions.

- Fuel hedging covered approximately 75% of fuel consumption in 2025, stabilizing costs amid oil price volatility that averaged between $75 and $95 per barrel from 2023 to 2025.

Conclusion

The airline industry’s journey over the years highlights a remarkable resilience and an inspiring shift toward innovation and sustainability. As passenger demand rebounds and technology integrates deeply into operations, airlines are charting a course for a smarter, greener future.

By understanding these evolving trends and statistics, businesses and travelers alike can navigate this dynamic landscape with confidence. Keep exploring airline insights to stay ahead in a sector that’s continually transforming the way we connect the world—and prepare for the exciting developments on the horizon.

Insights On Airline Industry Trends and Statistics

What are the latest global airline industry trends?

The airline industry is experiencing robust growth, with passenger numbers and revenues in 2025 surpassing pre-pandemic levels, driven by digital transformation and sustainable initiatives.

How have airline passenger statistics changed over time?

Passenger traffic continues to rise, with a projected 5.8% growth in 2025, reflecting ongoing demand for both leisure and business travel.

What impact does technology have on airline operations?

Automation, AI, and real-time data analytics are improving airline efficiency, enhancing passenger experiences, and supporting profit growth.

How do fuel prices and sustainability efforts affect airlines?

Low fuel costs and innovation in sustainable aviation fuels are helping reduce operational expenses and carbon footprints, making airlines more competitive.

What is the future outlook for the airline industry?

The future is promising, with increased focus on digitalization, green technology, and expanding global route networks, forecasting continued growth and resilience.

References & Citations:

- Aviation Milestones in 2025: Passenger Traffic, Revenues, and Profits

sarahrudge (Jan 2025), Aviation Milestones in 2025: Passenger Traffic, Revenues, and Profits - Airlines projected to report USD 36 billion profit in 2025: IATA

The Economic Times (Jun 2025), Airlines projected to report USD 36 billion profit in 2025: IATA - Airlines Statistics By Industry, Capacity And Revenue (2025)

Saisuman Revankar, Rohan Jambhale (Jun 2025), Airlines Statistics By Industry, Capacity And Revenue (2025) - Global airlines trim 2025 profit forecast over trade tensions and supply woes

Shivansh Tiwary, Tim Hepher (Jun 2025), Global airlines trim 2025 profit forecast over trade tensions and supply woes - Airline Profitability to Strengthen Slightly in 2025 Despite Headwinds

IATA (Jun 2025), Airline Profitability to Strengthen Slightly in 2025 Despite Headwinds - The State of Aviation 2025

McKinsey & Company (2025), The State of Aviation 2025 - Flights – Worldwide

Statista (2025), Flights – Worldwide - Airline industry outlook: Buckle up for a bumpy ride

J.P. Morgan (May 2025), Airline industry outlook: Buckle up for a bumpy ride - Environmental impact of the aviation industry worldwide – statistics & facts

Michele Majidi (Jul 2025), Environmental impact of the aviation industry worldwide – statistics & facts - Could Aviation Be Decarbonised and Become Sustainable?

Kara Anderson (Jul 2025), Could Aviation Be Decarbonised and Become Sustainable? - Global Aviation Sustainability Outlook 2025

World Economic Forum (Mar 2025), Global Aviation Sustainability Outlook 2025 - ATAG Facts & figures

ATAG (2025), ATAG Facts & figures - IATA Annual Review 2025

IATA (2025), IATA Annual Review 2025 - Aviation Index 2025

NATS (2025), Aviation Index 2025 - European Aviation Environmental Report 2025

EASA (2025), European Aviation Environmental Report 2025 - Joint ACI World-ICAO Passenger Traffic Report, Trends, and Outlook

Airports Council International (ACI) World, International Civil Aviation Organization (ICAO) (Jan 2025), Joint ACI World-ICAO Passenger Traffic Report, Trends, and Outlook - Air Passenger Market Analysis

IATA (Feb 2025), Air Passenger Market Analysis - Passenger Growth Hits 5% in May

IATA (Feb 2025), Passenger Growth Hits 5% in May - February 2025 Air Passenger Travel

International Trade Administration (Feb 2025), February 2025 Air Passenger Travel