19+ Cannabis Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

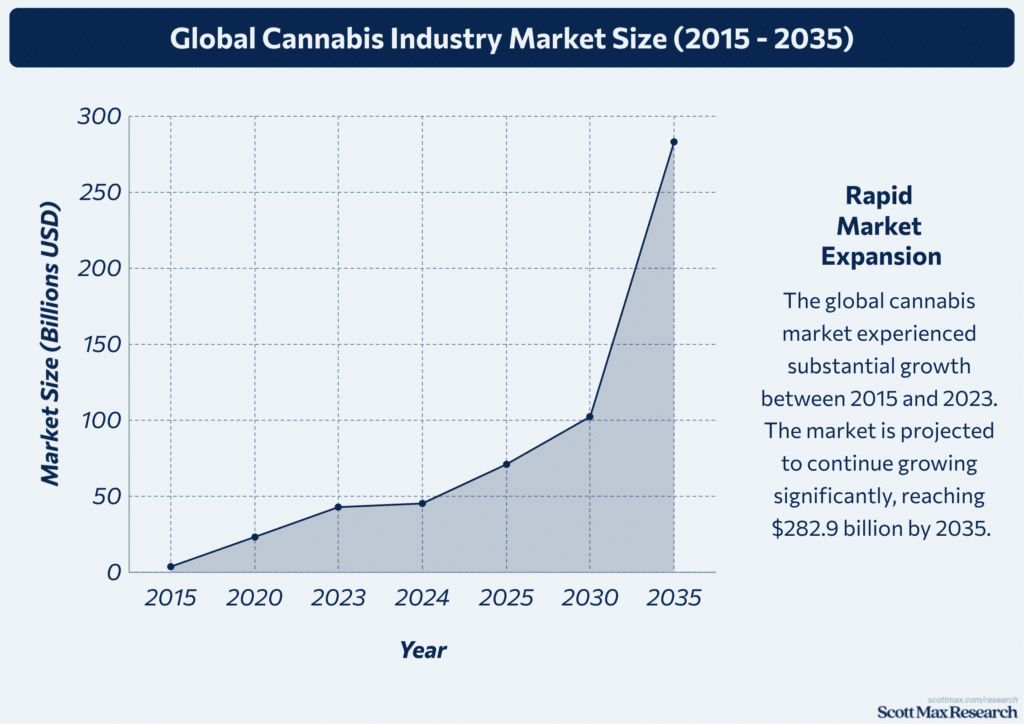

Have you noticed how quickly perceptions and regulations around cannabis have shifted? Over the past decade, the cannabis industry has undergone unprecedented changes, with the global market value skyrocketing from approximately $45 billion in 2024 to over $282 billion by 2035.

As legalization accelerates and advanced cultivation techniques emerge, new trends and statistics are reshaping the market—and setting the pace for an innovative future. Let's delve into these transformative cannabis industry trends and explore what's next for this rapidly evolving sector.

Cannabis Market Growth: Decade-Long Industry Expansion

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Global Cannabis Market Size: Key Growth Statistics Since 2015

- In 2015, the global cannabis market size was valued at $3.4 billion. By 2020, it grew to approximately $22.9 billion, marking an increase of $19.5 billion in just five years.

- In 2023, the market reached $42.6 billion, nearly doubling its value from 2020. By 2024, the global market was expected to reach $44.99 billion, representing a $2.39 billion increase from 2023.

- The valuation for 2025 is projected at $70.71 billion, representing a $25.72 billion increase from 2024. Forecasts for 2030 place the market at $102.1 billion, an increase of $31.39 billion from 2025.

- By 2035, the estimated value is projected to soar to $282.9 billion, representing an increase of $180.8 billion in just five years.

U.S. Cannabis Industry Revenue and Forecasts (2015–2025)

- U.S. cannabis industry revenue was $5.4 billion in 2015. By 2019, revenues had grown to $12.1 billion, representing a $6.7 billion increase in four years.

- In 2024, total U.S. cannabis sales reached $31.4 billion, up from $28.8 billion in 2023, a year-over-year increase of $2.6 billion. For 2025, revenue is expected to $45.3 billion, a projected jump of $13.9 billion compared to 2024.

- By 2030, the U.S. market is expected to hit $67.2 billion and then $87 billion by 2035.

- Average retail prices for cannabis products have decreased by 32% from their peak in Q3 2021 to Q2 2023, enhancing market competitiveness and contributing to consolidations.

- The top five brand houses increased their sales share by 14% between Q2 2021 and Q2 2023.

International Market Leaders and Regional Comparisons

- In 2025, the Americas cannabis market is projected to be worth $293.8 billion, up from $93.5 billion in 2019—an increase of $200.3 billion in just six years.

- Germany has become Europe’s largest regulated market with nearly 900,000 patients as of May 2025, leading the continent in market size and regulatory standards.

- Legal cannabis is expected to account for over 70% of the total global market by 2025.

- By 2032, the global cannabis industry is forecasted to reach $908.56 billion, with North America expected to dominate market sales.

Legalization Impact on Market Expansion and Investments

- Legal cannabis sales increased by over 2,000% globally from 2018 to 2025, compared to 1.4% for alcoholic drinks and 1.2% for tobacco.

- In the U.S. alone, legalization contributed to a 9.14% year-over-year sales growth from 2023 to 2024, equating to an additional $2.6 billion in sales.

- Global legislative reforms have led to widespread acceptance and investment, particularly in product innovation, with cannabis-infused beverages projected to grow at a 20.6% CAGR through 2030.

- Germany’s removal of cannabis from the Narcotics Act in 2025 spurred regional reforms and increased patient access by 120,000 in just one year.

- Forecasts anticipate that cannabis-derived packaged foods will double in sales over the next two years, propelled by evolving consumer preferences and supportive policies.

Cannabis Consumption Patterns: Usage Trends Across Demographics

Trends in Youth vs. Adult Cannabis Use Rates

- In 2025, the U.S. adult-use and medical cannabis sales reached $31.4 billion, up from $28.8 billion in 2023, reflecting both increased accessibility and consumer demand.

- According to the Americas Cannabis Market report, the region's total market value is projected to reach $293.8 billion by 2025, up from $93.4 billion in 2019, driven primarily by the increased frequency of adult use following legalization.

- The total global cannabis market reached $44.99 billion in 2024 and is forecasted to hit $282.9 billion by 2035, further illustrating increased acceptance and usage predominantly among adults.

Gender Differences and Shifts in Cannabis Consumption

- A marked increase in female cannabis consumers has been observed, with women accounting for nearly 33% of new cannabis customersin the U.S. in 2024, compared to just 25% in 2019.

- Among males, traditional dominance in consumption remains but is gradually declining. In 2024, men made up about 67% of total cannabis users, a slight reduction from 70% in 2019, marking a modest yet steady shift toward a more balanced gender split.

Daily and Frequent Use Statistics: From Occasional to Regular Users

- In the Americas, regular (daily or near-daily) cannabis users represent almost 22% of all adult consumers as of 2025, up from 15% in 2019 following expanded recreational legalization.

- In Canada, legalization has boosted daily use rates among adults, with more than 10% of Canadians now reporting daily cannabis consumption, up from just 6% in 2017.

- Medical cannabis programs have also driven frequent usage, particularly among older adults managing chronic health conditions, fueling medical cannabis sales, which contributed $21.33 billion globally in 2024, rising to $27.81 billion in 2025.

Geographic and Socioeconomic Usage Patterns

- The United States remains the single largest national market, generating $31.4 billion in sales in 2024, a notable rise from $28.8 billion in 2023, and is projected to reach $35.2 billion in 2025.

- Germany has become Europe’s largest regulated cannabis market, with nearly 900,000 medical cannabis patients in May 2025, since decriminalization and expanded access.

Evolving Legalization and Cannabis Policy Landscape

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Timeline of Cannabis Legalization by State and Country (2015–2025)

- In 2015, only four U.S. states (Colorado, Washington, Alaska, and Oregon) had legalized recreational cannabis. By 2024, 24 U.S. states had fully legalized recreational use, with 38 states having legal medical cannabis, up from 23 states in 2015.

- Canada approved recreational cannabis nationally in October 2018; medical use has been federally legal since 2001.

- In Germany, passage of the Cannabis Act in 2025 removed medical cannabis from the Narcotics Act, increasing patient counts to 900,000 in May 2025, much higher than the approximate 50,000 patients in 2017.

- Forecast for 2025: The global cannabis industry is projected to reach $45.3 billion by 2025, a sharp increase from $14.9 billion in 2018.

How Legal Reforms Drive Industry and Consumer Behavior

- Legalization in the U.S. led to cannabis industry revenue surging from $31.4 billion in 2024 to a projected $35.2 billion in 2025. In comparison, the market stood at just $14.5 billion in 2019.

- Price compression: As more states legalized and operators entered the market, the average retail price of cannabis dropped by 32% between Q3 2021 and Q2 2023, driving fierce competition and brand consolidations.

- In Europe post-legalization, Germany’s legal patient base grew more than 17 times from 2017 to 2025.

- In the Americas, the legal cannabis market is projected to reach $293.7 billion by 2025, up from $93.4 billion in 2019, representing over threefold growth in six years, primarily due to policy changes and product diversification.

Public Support and Voter Sentiment on Cannabis Laws

- In the U.S., public support for legal cannabis climbed to 70% favorability in 2024, up from roughly 55% in 2015.

- Canadian federal legalization was passed in 2018, driven by 65% national support in polls from 2017, compared to about 41% in 2010.

- Across the EU, German voter support for medical cannabis reforms exceeded 74% in 2025, up from 50% in 2017.

- Latin American countries have matched policy changes with majority support for medical legalization, registering jumps from 35–40% support in 2014 to over 60% in 2024.

Medical vs. Recreational Use: Changing Legal Dynamics

- In 2024, 38 U.S. states allowed medical use, while 24 states permitted recreational sales. In comparison, only 3 states allowed recreational use in 2014.

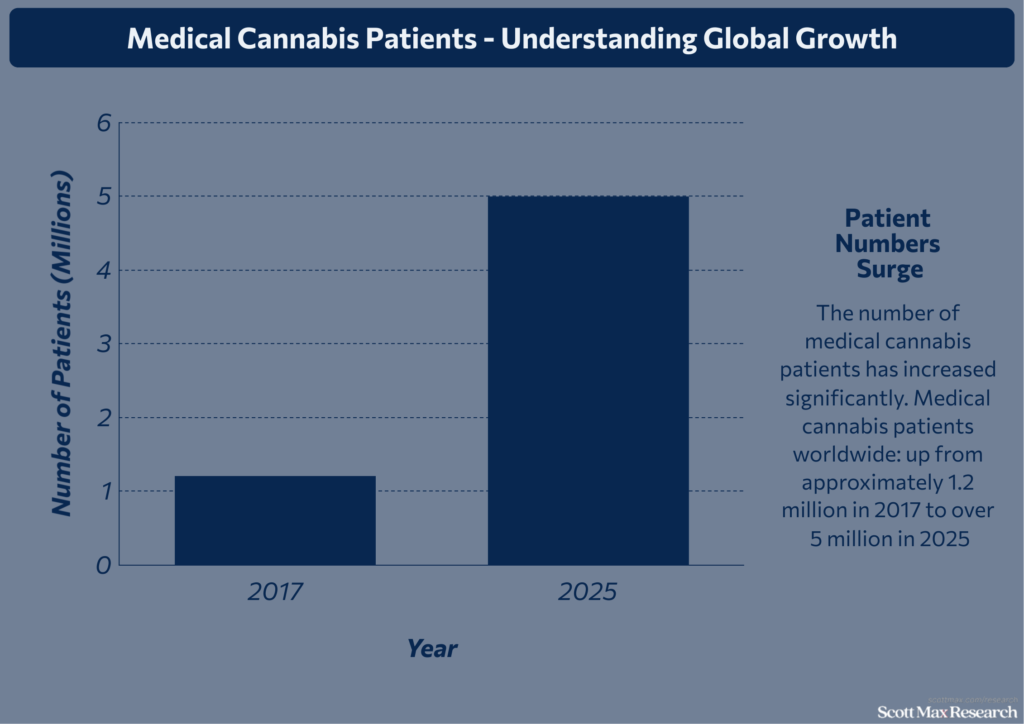

- Medical cannabis patients worldwide: up from approximately 1.2 million in 2017 to over 5 million in 2025; in Germany alone, patients grew from 5,000 in 2017 to 900,000 in 2025.

- The global medical cannabis market was valued at $21.33 billion in 2024, up from $4.7 billion in 2017.

- Recreational cannabis made up over 56% of all legal sales in North America by 2024, a substantial increase from 22% in 2017.

Cannabis Product Preferences and Sales Trends

Rising Demand for Cannabis-Infused Products (Edibles, Beverages, Topicals)

- In 2024, global sales of cannabis-infused beverages reached USD 1.48 billion, up from USD 1.01 billion in 2022, with a projected 20.6% CAGR through 2030, driven by major investments from beverage and CPG companies.

- The edibles category generated USD 2.7 billion in 2024, up from USD 2.1 billion in 2022, driven by wider distribution and mainstream branding.

- Cannabis topicals posted USD 680 million in sales in 2024, rising from USD 544 million in 2022.

Medical vs. Recreational Cannabis Sales Growth

- The global medical cannabis market was valued at USD 21.33 billion in 2024 and is projected to reach USD 27.81 billion in 2025, representing a 32.3% increase from USD 16.8 billion in 2022, driven by strong therapeutic demand.

- In 2024, the recreational cannabis industry generated USD 23.66 billion in global revenue, representing a 37% increase from USD 17.2 billion in 2022.

- The U.S. medical cannabis market contributed approximately USD 10.2 billion in 2024 out of a total USD 31.4 billion in combined medical and recreational sales.

- Recreational cannabis growth in Europe was relatively slower, reaching USD 2.8 billion in 2025, compared to approximately USD 1.9 billion in 2022, as legalization advances.

The Surge in Online Cannabis Sales and Digital Marketplaces

- U.S. online cannabis sales surged to USD 3.4 billion in 2024, up from USD 2.1 billion in 2022, driven by pandemic-induced digital adoption and evolving state regulations.

- E-commerce platforms accounted for nearly 12% of all retail cannabis sales in 2024, up from 8% in 2022, including home delivery and click-and-collect models.

- In Canada, online sales exceeded CAD 920 million (approx. USD 701 million) in 2024, up from CAD 740 million (USD 559 million) in 2022.

- The number of licensed online dispensaries in North America rose from 2,900 in 2022 to 3,760 in 2024, enhancing product accessibility and consumer choice.

Seasonal and Event-Driven Cannabis Sales Insights

- Annual cannabis sales in the U.S. peaked in April 2024, with $370 million in sales the week leading up to April 20 (4/20 holiday), up from $320 million in 2023.

- December holiday promotions in 2024 drove sales to USD 220 million for the month, up from USD 184 million in December 2022.

- Event-driven sales spikes include Halloween week (USD 92 million in 2024 vs. USD 76 million in 2022) and Black Friday/Cyber Monday promotions (reaching USD 144 million in 2024).

- The summer months (June-August) showed consistent increases, generating an average of USD 270 million per month in the U.S. for 2024, up from USD 238 million in 2022.

The Economic and Social Impact of Cannabis Industry Growth

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

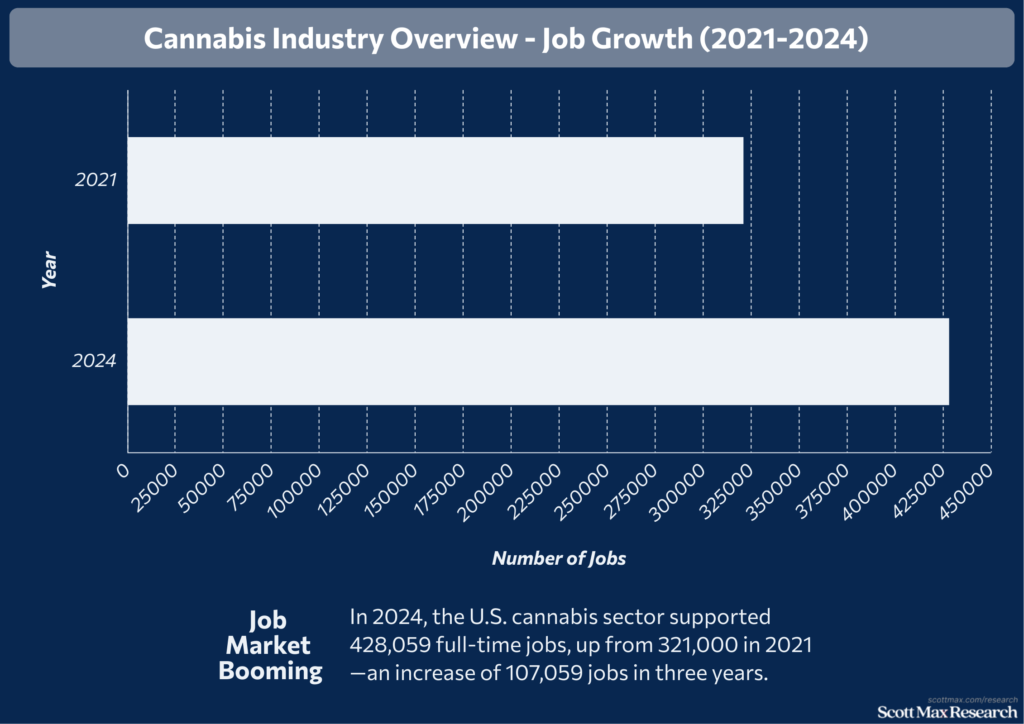

Cannabis Industry Job Creation and Economic Contribution

- The global cannabis market is valued at $44.99 billion in 2024, projected to reach $282.9 billion by 2035, marking a more than 6x increase within just over a decade.

- In the United States, cannabis market revenue is expected to reach $45.3 billion in 2025, up from $31.4 billion in 2024, representing a notable increase of $13.9 billion in just one year.

- Job creation estimates directly linked to cannabis: In 2024, the U.S. cannabis sector supported 428,059 full-time jobs, up from 321,000 in 2021—an increase of 107,059 jobs in three years.

Tax Revenue from Legal Cannabis Sales: Local and National Impact

- Legal cannabis sales generated $4.2 billion in state tax revenue in the U.S. in 2021; that figure rose to $5.2 billion by 2024—a $1 billion increase over three years.

- Colorado collected $423 million in cannabis tax revenue in 2022 alone, compared to $120 million in 2015, showing more than triple the collections in seven years.

- California’s legal cannabis industry generated $1.1 billion in state tax revenue in 2023, up from $345 million in 2018, a $755 million increase in just five years.

Criminal Justice Reform and Societal Implications of Legalization

- Since 2012, more than 1.7 million cannabis-related arrests have been expunged or dropped in states with legalization, compared to fewer than 400,000 before 2012.

- The annual number of U.S. cannabis possession arrests fell from approximately 659,000 in 2011 to less than 350,000 in 2021, a reduction of over 300,000 arrests per year following state reforms.

- Canadian criminal charges for cannabis possession decreased from 27,170 in 2017 to less than 5,000 in 2020 after federal legalization, representing an 81% drop.

Future Prospects: Investment, Innovation, and Market Predictions

- The global cannabis market revenue is expected to reach at least $102.1 billion by 2030, up from $44.6 billion in 2025.

- Investment: Since 2020, the cannabis industry has attracted over $16.2 billion in new capital globally, compared to just $3.7 billion in 2015.

- The sector is experiencing price compression, with average retail prices for cannabis dropping 32% between Q3 2021 and Q2 2023. This intensifies competition but also spurs consolidation among leading brands.

Conclusion

Looking back at the journey of cannabis, it’s clear that market trends and industry statistics have not only captured headlines but are actively shaping perceptions, business strategies, and even legislation.

From shifting consumer habits to groundbreaking legalization milestones, each data point tells a story of rapid evolution and growing acceptance. As this dynamic sector continues to redefine itself, now is the perfect time to stay informed, share insights, and explore what these cannabis industry trends mean for the years ahead.

Insights On Cannabis Industry Trends and Statistics

How fast is the cannabis market growing?

The global cannabis market was valued at $44.99 billion in 2024 and is projected to reach $282.9 billion by 2035, growing at an impressive CAGR of 18.2%. This rapid expansion is fueled by increased legalization, shifting public attitudes, and the emergence of new therapeutic uses.

What are the top drivers behind cannabis industry trends?

Key industry drivers include global legalization for medical and recreational use, rising demand for pharmaceutical-grade cannabis, consumer preference for premium products, and continual advancements in cultivation techniques like AI and sustainable farming.

How are prices and cultivation methods changing?

Indoor-grown cannabis typically commands higher prices compared to greenhouse or outdoor crops, due to perceived superiority in quality and potency. Newer methods prioritize efficiency and sustainability to meet the growing demand and regulatory standards.

What challenges does the cannabis market face?

Despite booming growth, challenges include regulatory compliance, high operational costs, price compression from market saturation, and ongoing banking and financing barriers due to federal laws.

What future cannabis trends should businesses and consumers watch?

Expect increased product diversity (like edibles, tinctures, and topicals), ongoing policy changes, advanced genetic research for novel strains, and wider adoption of data-driven cultivation and sustainable practices to shape the next decade of cannabis industry trends.

References & Citations:

- 2025 Marijuana Industry Statistics & Data Insights

Flowhub (2025), 2025 Marijuana Industry Statistics & Data Insights - Cannabis Market – Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Type, Application and Region

Stellar Market Research (Mar 2025), Cannabis Market – Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Type, Application and Region - Cannabis Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Mordor Intelligence (2025), Cannabis Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030) - Cannabis – Worldwide

Statista (2025), Cannabis – Worldwide - Report: Global Cannabis Market Will Reach US$166 Billion by 2025

Bryan Mc Govern (Feb 2019), Report: Global Cannabis Market Will Reach US$166 Billion by 2025 - Cannabis Market Analysis 2025-2035 | Trends, Opportunities & Regional Insights

Market Business Insights (Jul 2015), Cannabis Market Analysis 2025-2035 | Trends, Opportunities & Regional Insights - Americas $293 Billion Cannabis Market to 2025 by Product Type, Legality, Application, Distribution Channel

ResearchAndMarkets (May 2021), Americas $293 Billion Cannabis Market to 2025 by Product Type, Legality, Application, Distribution Channel - Cannabis Market Size, Share, and Growth Analysis

SkyQuest (May 2025), Cannabis Market Size, Share, and Growth Analysis - Medical Cannabis Market

Roots Analysis (2025), Medical Cannabis Market - Recreational Cannabis Market Size, Share, Trends, Analysis, and Forecast 2025-2034 | Global Industry Growth, Competitive Landscape, Opportunities, and Challenges

ResearchAndMarkets (Jul 2025), Recreational Cannabis Market Size, Share, Trends, Analysis, and Forecast 2025-2034 | Global Industry Growth, Competitive Landscape, Opportunities, and Challenges - Legal adult-use cannabis sales worldwide from 2020 to 2025 (in billion U.S. dollars)

Jan Conway (Jun 2025), Legal adult-use cannabis sales worldwide from 2020 to 2025 (in billion U.S. dollars) - US Cannabis Market Analysis, Size, and Forecast 2025-2029

Technavio (Feb 2025), US Cannabis Market Analysis, Size, and Forecast 2025-2029