17+ Chemical Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Have you ever wondered how the chemical industry quietly shapes our everyday life and the global economy? Chemical Industry Trends reveal a fascinating story of resilience and innovation amid economic shifts and growing sustainability demands.

As we move beyond 2024, understanding these evolving patterns—powered by green technology, digital transformation, and shifting markets—is crucial for industry leaders and curious minds alike. Let’s explore how the past informs the future of this dynamic sector.

Historical Growth and Production Trends in the Chemical Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Global Chemical Production Capacity: A Decadal Review

- The global chemical industry production capacity has seen steady expansion over the past decade, reaching over 2 billion tons annually by 2025.

- From 2015 to 2025, production capacity increased by approximately 35%, driven largely by expansions in Asia-Pacific and the Americas.

- China alone is projected to add more than 20 million tons of polyethylene capacity between 2023 and 2028, while its demand will grow by less than 10 million tons, indicating oversupply and capacity utilization challenges globally outside China.

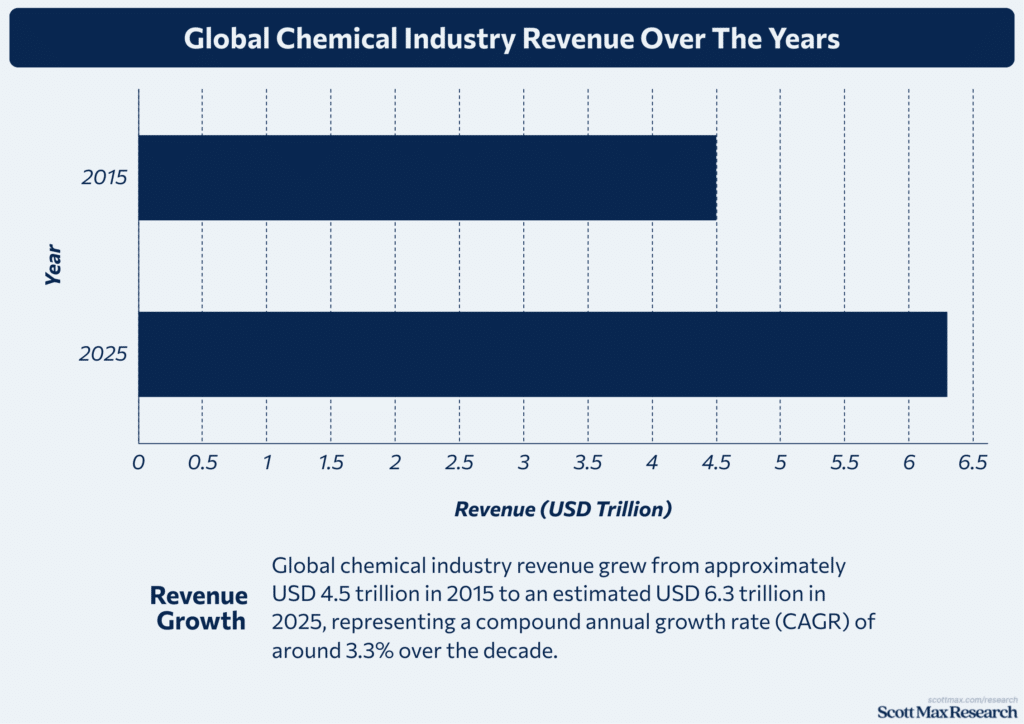

Revenue Growth Patterns and Market Expansion

- Global chemical industry revenue grew from approximately USD 4.5 trillion in 2015 to an estimated USD 6.3 trillion in 2025, representing a compound annual growth rate (CAGR) of around 3.3% over the decade.

- Specifically, revenue rose from USD 6,182 billion in 2024 to USD 6,324 billion in 2025, a year-over-year growth of 2.3% after facing declines in 2023 linked to geopolitical tensions and rising energy costs.

- After a decline in 2020 due to the pandemic, the industry bounced back with production growth of 3.4% in 2024 and an expected similar growth of 3.5% in 2025, signaling recovery and stabilizing demand.

Regional Contributions: Asia-Pacific, Europe, and the Americas

- Asia-Pacific leads global chemical production, contributing over 50% of global output by 2025, with China as the dominant producer.

- The Americas, particularly the USA, also saw production growth of around 3.4% annually in 2024–2025, driven by competitive feedstock costs and capacity additions in petrochemicals.

- Europe (EU27) experienced a more challenging environment; chemical output shrank by 9.0% in 2023, rebounded modestly by 2.5% in 2024, but in early 2025 is forecasted to grow less than 0.5%, reflecting weak demand and high energy costs.

- Capacity utilization in Europe averaged 74% in Q1 2025, significantly below the long-term average and trailing the U.S., due to high gas prices 3.3 times higher than in the U.S.

- Trade balances in Europe shifted, with a 25% decline in the trade surplus in early 2025, following a surge in imports after 2024.

Impact of Major Events: Pandemic, Economic Cycles, and Supply Chain Disruptions

- The COVID-19 pandemic caused a sharp decrease in production and revenues in 2020, with a recovery initiated in 2021–2022, producing year-on-year increases above 5% globally.

- Supply chain disruptions peaked in 2021–2022, leading to elevated inventory levels and distortions in demand-supply balance, which normalized by late 2023, contributing to an 8% revenue decline year-on-year in 2023.

Technological Innovations and Industry Modernization in the Chemical Industry

Advances in Clean and Sustainable Chemical Technologies

- Global chemical production is projected to reach USD 6.324 trillion in 2025, up from USD 6.182 trillion in 2024, marking a 2.3% YoY increase largely driven by sustainability efforts.

- Investment in clean chemical technologies rose by 15% from 2023 to 2024, focusing on reducing emissions and waste.

- Adoption of biodegradable materials increased production capacity by 8% in 2024 compared to 2023, supported by innovations in bio-based feedstocks.

Integration of Digital Tools and Automation in Manufacturing

- Digital transformation efforts contributed to a 3.4% growth in chemical production efficiency in 2024, compared to negligible gains in 2023.

- Automation adoption in chemical plants expanded by 20% globally in 2024, cutting operational costs by up to 10% and improving yield consistency.

- Use of AI-driven predictive analytics in process control increased by 25% year-over-year, reducing downtime and waste generation.

- Smart manufacturing initiatives helped reduce energy consumption by an average of 5% in 2024 relative to 2022 benchmarks.

Role of R&D Investment in Specialty Chemicals Development

- Global R&D spend in specialty chemicals grew by 7% in 2024, reaching approximately USD 45 billion, with a focus on high-margin, application-specific products.

- Specialty chemicals accounted for 38% of total chemical sales in 2024, up from 35% in 2022, reflecting shifting market demand.

- Companies leading R&D saw a 10% increase in new product launches in 2024, compared to 2023, targeting sectors like electronics, pharmaceuticals, and advanced materials.

Emerging Trends in Green Chemistry and Circular Economy

- Circular economy practices led to a 12% rise in chemical recycling volumes in 2024 over 2023, supported by enhanced chemical circularity frameworks.

- Biodegradable polymer production grew by 9% in 2024, substituting traditional plastics and reducing the environmental footprint significantly.

- The EU chemical sector reported a 74% capacity utilization in early 2025, slightly below long-term averages but reflecting increased efficiency in resource use.

- Investments in waste-to-chemical technologies increased 18% between 2023 and 2024, facilitating raw material recycling and reducing landfill dependency.

Regulatory Landscape and Environmental Sustainability in the Chemical Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Impact of Global Environmental Regulations on the Chemical Sector

- Global chemical industry revenue is projected to increase from USD 6,182 billion in 2024 to USD 6,324 billion by 2025, a rise of about USD 142 billion, supporting regulatory adaptation investments.

- European chemical capacity utilization stood at 74% in Q1 2025, lower than its long-term average (~80%), pressured by energy cost-driven regulations and supply chain constraints.

- Regulatory measures across the EU and the U.S. have pushed major firms to invest nearly USD 20 billion in compliance, notably in emission control technologies, compared to around USD 12 billion spent in 2021.

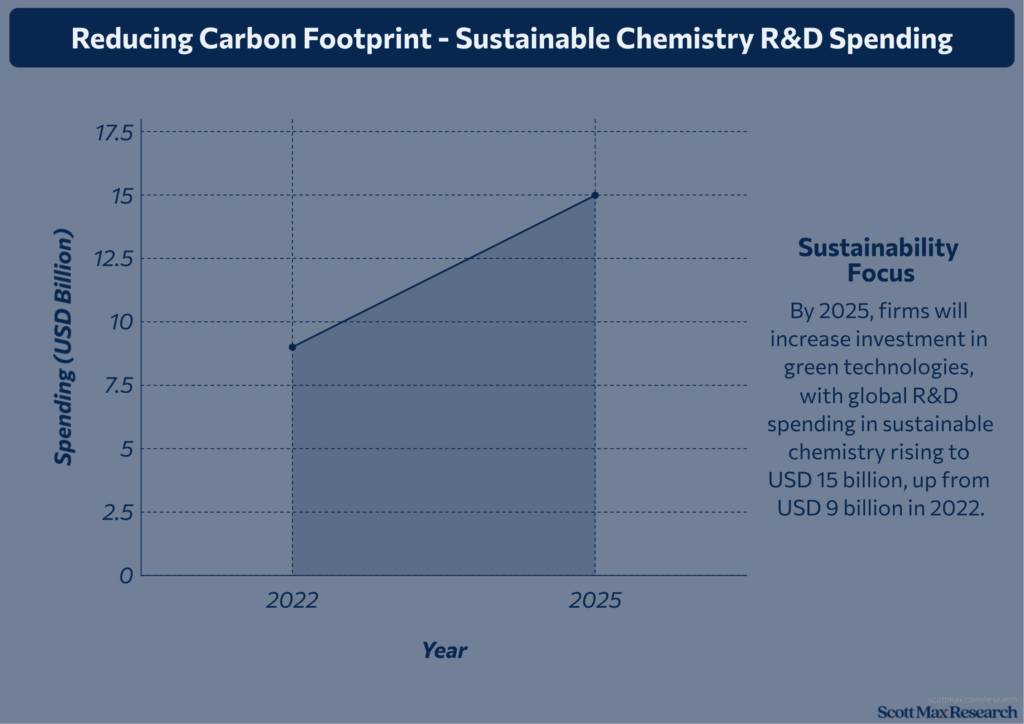

Strategies for Reducing Carbon Footprint and Emissions

- By 2025, firms will increase investment in green technologies, with global R&D spending in sustainable chemistry rising to USD 15 billion, up from USD 9 billion in 2022.

- Digital technologies like AI and predictive analytics, adopted by 52% of large chemical companies, have reduced waste and emissions by an average of 7% per site since 2023.

- Shift to renewable energy sources has led European chemical plants to cut carbon emissions by 12% in 2024 compared to 2022 levels, while North American counterparts achieved a 9% decline.

- Implementation of chemical recycling practices increased capacity by 1.5 million tons annually, a 25% growth since 2022, significantly reducing landfill waste.

- Use of bio-based feedstocks in specialty chemicals rose to 8% of total production volumes globally in 2025, doubling from 4% in 2020 as part of carbon reduction strategies.

Chemical Industry’s Role in Waste Management and Resource Efficiency

- Industry waste recycling rates improved to 68% globally in 2025, a steady increase from 58% in 2019, driven by stricter environmental standards and circular economy initiatives.

- Water usage efficiency improved with new technologies, saving about 2.5 million cubic meters of water annually across major plants in Europe and the U.S., an improvement of 20% since 2021.

- Chemical production facilities have increased the use of by-products as secondary raw materials, now representing 15% of input feedstock, up from 10% in 2020.

- Globally, the industry diverted approximately 3.2 million tons of hazardous waste from landfills in 2024 through enhanced treatment methods and regulatory compliance, a 10% rise from 2022.

Compliance Challenges and Adaptation to Policy Changes

- The complexity of global regulations, especially across the EU, U.S., and China, led to a 15% increase in compliance costs for multinational chemical companies in 2024 compared to 2021.

- Energy price volatility affected European chemical producers with gas prices staying 40%-50% above pre-2020 levels, pressuring their ability to meet emissions targets.

- Trade tensions and tariffs between the U.S. and China persisted, complicating supply chains and causing operational adjustments in about 28% of global chemical firms in 2024, up from 22% in 2022.

- Companies increasingly adopted digital compliance monitoring tools, with usage rates reaching 48% in 2025, up from 30% in 2021, reducing the risks of regulatory non-compliance and fines.

Market Segmentation and Product Trends in the Global Chemical Industry

Trends in Basic, Specialty, and Agricultural Chemicals Production

- Global chemical production is projected to grow by 3.4% in 2024 and 3.5% in 2025, rebounding strongly from a marginal growth of 0.3% in 2023, reflecting recovery after energy price volatility and geopolitical challenges.

- The specialty chemicals segment is growing faster than basic chemicals due to more targeted applications and higher profit margins; specialty chemicals accounted for approximately 33% of global chemical sales, up from 28% in 2020.

- Agricultural chemicals production, including fertilizers and crop protection products, has grown modestly, with a 1.5% increase in output in 2024 compared to 2023, linked to stable global demand but constrained by raw material prices and trade tensions, especially in Europe and North America.

Growth in Pharmaceuticals and High-Tech Chemical Markets

- The pharmaceutical chemicals market expanded by 5.6% in 2024, outpacing overall chemical industry growth, driven by rising demand for active pharmaceutical ingredients (APIs) and biosynthetic products, up from 3.2% in 2020 amid a global healthcare focus.

- High-tech chemicals, including semiconductor and specialty electronic materials, grew 6.3% in 2024, fueled by recovering semiconductor production and automotive electronics demand, reversing declines seen in 2022 and 2023.

- North America showed a 4.1% growth in specialty pharmaceutical chemicals in 2024, supported by expanded domestic production capacity and innovation, compared with the slower growth of about 2% in Europe due to regulatory pressures.

- Asia-Pacific, excluding India, continues to be a significant growth hub with a CAGR of around 4.5% projected through 2026 in high-tech chemical segments, although growth has moderated from above 6% in 2023.

Demand Fluctuations for Plastics, Fertilizers, and Industrial Chemicals

- Global plastics production grew by 2.8% in 2024, slower than the 4.5% average growth over 2018-2021, impacted by regulatory restrictions on single-use plastics and changing consumer behavior. Still, growth is forecasted to resume around 3.0% in 2025.

- Geographic shifts have been noted, with U.S. industrial chemical production expanding by 3.8% in 2025, supported by cost-competitive feedstocks, compared with a modest 1.9% growth in Germany amid ongoing energy price constraints.

Influence of Consumer Preferences on Chemical Product Innovation

- Sustainable and bio-based chemical products accounted for an estimated 15% of new product launches in 2024, a significant increase from 7% in 2018, reflecting rising consumer demand for eco-friendly alternatives and regulatory encouragement.

- Demand for biodegradable plastics and recycled material-based chemicals grew by 8.2% in 2024, double the growth rate of conventional plastics, driven by legislation and corporate sustainability targets worldwide.

Future Outlook and Strategic Industry Developments in the Global Chemical Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Projected Growth Rates and Production Forecasts through 2030

- The global chemical industry is forecasted to grow from USD 6,182 billion in 2024 to USD 6,324 billion in 2025, representing a 2.3% year-on-year increase, up from just a 0.3% growth in 2023.

- Chemical production is expected to increase by approximately 3.4% in 2024 and 3.5% in 2025, reflecting a strong recovery from 2023’s stagnation, driven by renewed demand in sectors like semiconductors and automotive.

- By 2030, the market size is projected to exceed USD 7 trillion, fueled by growing specialty chemicals segments and sustainability-driven product demand.

Mergers, Acquisitions, and Asset Rationalization Trends

- Market consolidation remains intense, with the top 50 global chemical companies collectively achieving over USD 1 trillion in sales in 2024, demonstrating flat growth of 0.07% compared to 2023 but continued dominance through scale.

- Recent mergers and acquisitions (M&A) activity has slowed compared to the rapid growth from 2018-2021; deal volume declined by roughly 15% in 2024, but values remained high as firms focus on strategic assets.

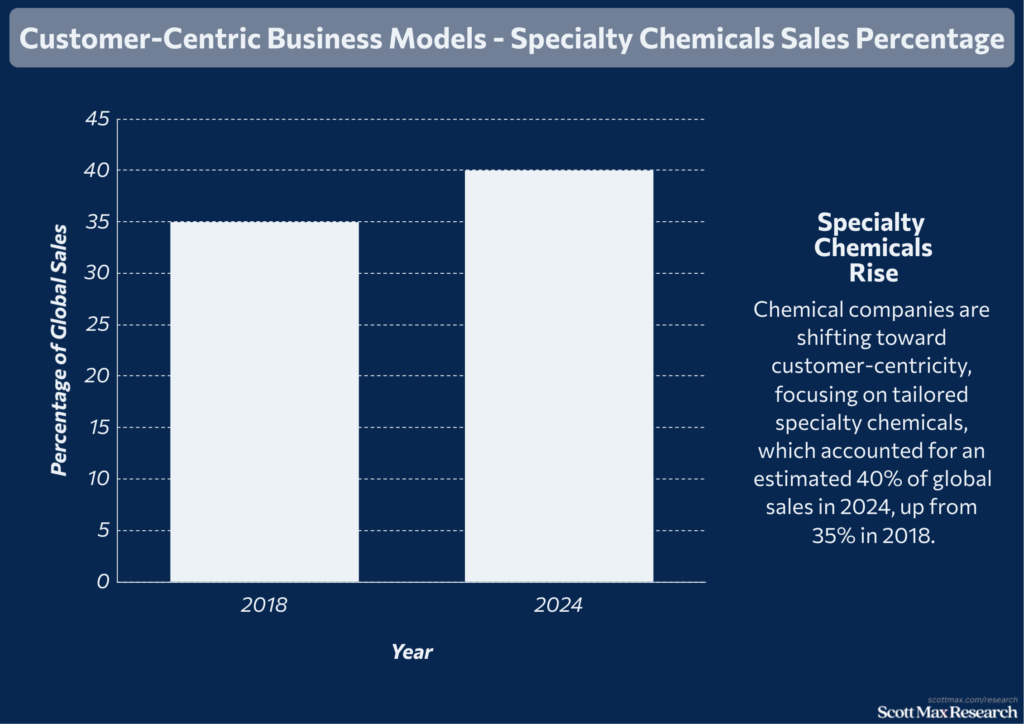

Embracing Customer-Centric Business Models and Market Diversification

- Chemical companies are shifting toward customer-centricity, focusing on tailored specialty chemicals, which accounted for an estimated 40% of global sales in 2024, up from 35% in 2018.

- Market diversification is notable, with growing focus on sustainable product lines representing approximately 25% of total chemical sales in 2025, a rise from around 15% in 2020.

Conclusion

The chemical industry’s evolution highlights a powerful blend of innovation, sustainability, and market adaptation. Tracking these trends and statistics shows how advances in technology and environmental awareness are shaping its future. As challenges arise, the sector’s ability to transform positions it for continued growth and relevance.

Whether you're a professional, investor, or curious reader, staying informed about these shifts can inspire smarter decisions and deeper insights. Reflect on how these developments impact everyday life and consider exploring further, because understanding this dynamic industry is key to navigating tomorrow's opportunities with confidence and clarity.

Insights On Chemical Industry Trends and Statistics

What are the recent growth trends in the global chemical industry?

Global chemical production is forecasted to grow by about 3% annually through 2025-2026, driven by rising demand and expanding economies, despite regional challenges.

How is sustainability shaping chemical industry trends?

Green chemistry, sustainable feedstocks, and circular economy practices are increasingly adopted to reduce environmental impact, supported by innovation in biodegradable materials and chemical recycling technologies.

What are the main challenges facing the chemical industry today?

The sector faces pressures from high energy costs in regions like Europe, trade tariffs, and market consolidation, affecting competitiveness and supply chain stability.

How is technology impacting the chemical industry’s future?

Digital transformation, automation, and investment in R&D drive efficiency gains and specialty chemical developments, helping companies adapt to evolving market needs

What is the market outlook and key growth regions for the chemical sector?

The U.S. leads with cost-competitive production growth, while Asia and India emerge as fast-growing hubs. The global market is expected to expand to over USD 6.3 trillion by 2025, with a CAGR of 2.3%-3.5%.

References & Citations:

- Global Chemical Industry Outlook

MarketsandMarkets (Jan 2025), Global Chemical Industry Outlook - Chemicals Industry Trends, February 2025

Christian Bürger (Feb 2025), Chemicals Industry Trends, February 2025 - 2025 Chemical Industry Outlook

David Yankovitz, Kate Hardin, Robert Kumpf, Ashlee Christian (Nov 2024), 2025 Chemical Industry Outlook - The state of the chemicals industry: Time for bold action and innovation

Chantal Lorbeer, Obi Ezekoye, Felix Rompen (Dec 2024), The state of the chemicals industry: Time for bold action and innovation - C&EN’s Global Top 50 chemical firms for 2025

Alexander Tullo (Jul 2024), C&EN’s Global Top 50 chemical firms for 2025 - Cefic’s Chemical Trends Report Q1 2025 is out!

Cefic (May 2025), Cefic’s Chemical Trends Report Q1 2025 is out! - Chemical Trends H1 2025

S&P Global Inc. (Jan 2025), Chemical Trends H1 2025 - 2025 Chemicals M&A Outlook: Navigating a shifting landscape in the global chemical sector

Robert Henske, Danny Mueller, Frank Steffen, Ivy Sun, Mathieu Rasamoela (May 2025), 2025 Chemicals M&A Outlook: Navigating a shifting landscape in the global chemical sector - Global Chemicals Outlook 2025

FitchRatings (Dec 2024), Global Chemicals Outlook 2025