17+ Commercial Real Estate Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Ever wondered how shifts in commercial real estate—office spaces, warehouses, and even hospitals—are quietly shaping the world around you? Commercial Real Estate industry trends reveal a market in rapid transformation, driven by technology, sustainability, and changing work habits.

Understanding these dynamics isn't just for investors—it's essential for anyone curious about the future of business and communities. Let's delve into the key trends and game-changing insights that will shape tomorrow's landscape.

Global Commercial Real Estate Market Overview and Key Growth Statistics

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Current Market Size and Projected Growth Rates

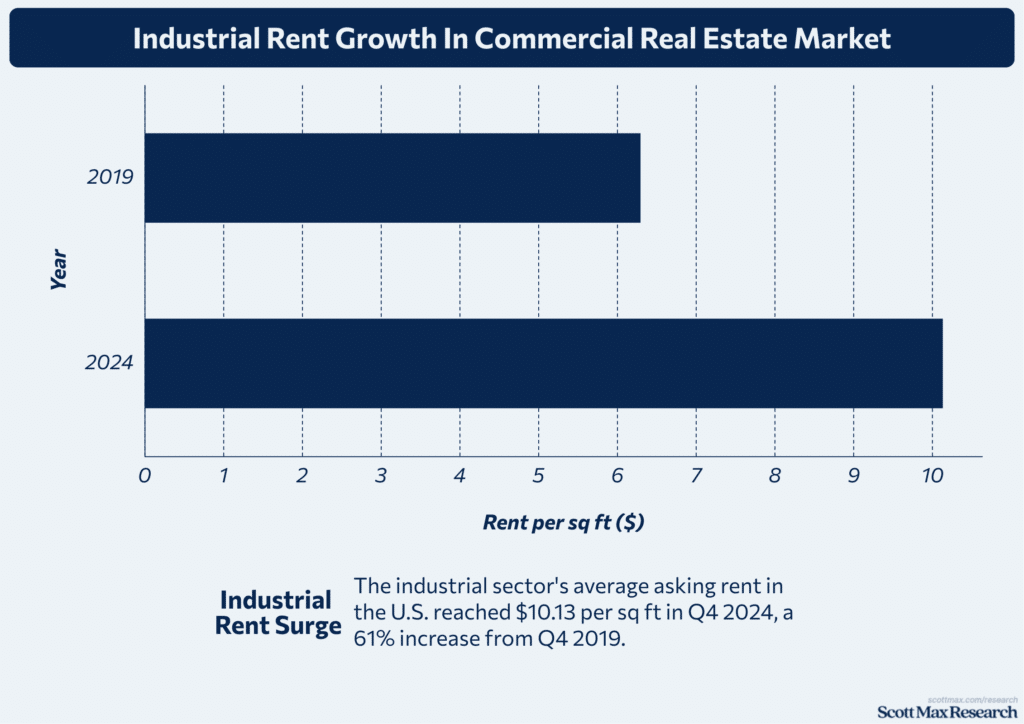

- The industrial sector's average asking rent in the U.S. reached $10.13 per sq ft in Q4 2024, a 61% increase from Q4 2019.

- The global CRE sector is projected to grow at a CAGR of 4.1% through 2028.

- Multifamily annual rent growth is forecasted at 2.6% in 2025, down from 7.3% in 2023, due to increased supply.

- Office net absorption dropped 42% YOY to 114 million sq ft in early 2025 compared to 197 million sq ft in early 2024, with little sign of a rebound in secondary markets.

Major Players and Regional Leaders in CRE Investment

- Major global investors include Blackstone (over $585 billion AUM), Brookfield, and Prologis, the latter controlling industrial REIT assets valued at nearly $200 billion.

- Regionally, New York swung from an 8.4 million sq ft loss in 2024 to a gain of 3.4 million sq ft net absorption in 2025; London and Paris saw the largest European inflows, while Shanghai led Asia-Pacific.

Capital Flows and Foreign Direct Investment Trends

- Aggregate national transaction activity fell 8.0% YOY in Q1 2025 in the U.S.

- Foreign direct investment (FDI) in the U.S. CRE market averaged $15.2 billion in Q1 2025, a reduction from $19.8 billion in Q1 2024.

- Price per square foot of transacted single properties rose 2.6% YOY across all U.S. sectors, except industrial (which saw a 4.6% decline during the same period).

Post-Pandemic Recovery and Transformation Insights

- Industrial development has declined by 53% since 2022, with new projects dropping from 711 million sq ft to 331 million sq ft, signaling a slowdown but still at double the pre-pandemic levels.

- Warehouse lease renewal prices have increased by 61% since 2019, indicating persistent supply shortages despite higher vacancy rates.

- Office move-outs dropped threefold, from 61.5 million sq ft in 2024 to 20.5 million sq ft by early 2025.

- Multifamily construction is at a 50-year high, with 300,000 new units added in 2024, which is expected to drive down rent growth and push vacancy rates to 4.9% in 2025 (compared to 4.2% in 2023).

Emerging Technology Transformations in Commercial Real Estate

Adoption of PropTech and Digital Platforms

- In 2025, PropTech adoption accelerated, with over $35 billion invested globally in real estate technology by the first quarter, marking a 25% increase from the previous year.

- Digital platform usage for property transactions increased by 30% year-over-year, resulting in a reduction in average deal closing times from 90 days in 2023 to 65 days in 2025.

- Commercial lease management platforms experienced a 15% increase in transaction volume, while usage oftenant engagement apps doubled compared to 2023.

AI, IoT, and Big Data Impact on Property Management

- AI-driven predictive maintenance reduced operational costs by an average of 12% across CRE portfolios in 2025, resulting in a 20% improvement in equipment uptime compared to 2022.

- IoT sensor deployments have reached 35 million devices in commercial buildings worldwide, representing a 40% increase from 2023, and provide real-time data on energy use and occupancy.

- Big Data analytics enhanced tenant retention strategies, increasing lease renewal rates to 78% in 2025, up from 70% in 2021.

- Smart HVAC and lighting systems integrated with AI yielded energy savings of up to 25% per building annually, surpassing 2019 benchmarks by 10%.

Virtual Tours, Digital Twin, and Smart Building Innovations

- The usage of virtual tours in CRE marketing increased by 50% between 2023 and 2025, with more than 60% of listings offering immersive 3D experiences.

- The adoption of digital twins for commercial buildings is expected to expand to cover 20% of large CRE properties in North America by early 2025, doubling from 10% in 2022.

Cybersecurity and Data Privacy in CRE Transactions

- Cybersecurity incidents related to CRE platforms increased by 20% in 2024, prompting a 30% growthin security solution investments in 2025 compared to 2023.

- The adoption of blockchain technology for transaction verification increased from 5% in 2022 to 18% by early 2025, enhancing transparency and reducing the risk of fraud in transactions.

- Multi-factor authentication and encryption have become standard for 75% of major CRE platforms, compared to 50% in 2021, thereby safeguarding sensitive leasing and financial data.

Sustainability and ESG Trends Shaping CRE Investment in 2025

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Green Building Certifications and Eco-Friendly Construction

- In 2025, 53% of newly constructed commercial properties in the U.S. have obtained green building certifications such as LEED or WELL, marking a rise from 41% in 2022.

- The global market for green building materials in CRE surged to $320 billion in 2024, a 27% increase since 2021, driven by higher demand for sustainable construction.

- Eco-friendly construction investments accounted for 18% of total CRE developments by Q1 2025, up from 12% in 2022, reflecting stronger regulatory and tenant pressure.

- Energy-efficient retrofitting projects on existing CRE properties increased by 34% year-over-year, with over 12,000 projects initiated in 2024, compared to 9,000 in 2023.

Investor Demand for Sustainable Assets

- Investment in sustainable CRE assets reached $105 billion in the U.S. during the first half of 2025, growing 20% year-over-year, outpacing overall CRE investment growth of 8%.

- Portfolio diversification into climate-resilient properties rose by 22% from 2022 to 2025, with ESG funds outperforming traditional CRE portfolios by 3.5% annually over the past three years.

- Tenant demand for sustainable workplaces influenced over 42% of new lease agreements in 2024, compared to 30% in 2021, signaling a stronger market preference for eco-friendly buildings.

Regulatory Changes Driving ESG Compliance

- New regulations mandating ESG disclosures affected 58% of CRE companies in North America by mid-2025, up from 40% in 2022.

- Building codes mandating energy performance standards became effective in 32 states and provinces by 2025, compared to 18 in 2022, raising the bar for new and renovated CRE properties.

- Enforcement of ESG compliance contributed to a 28% increase in green bond issuances for CRE projects from 2023 to 2025, totaling over $35 billion in financing.

Energy Efficiency, and CRE Valuation

- Buildings with ENERGY STAR certification achieved an average rent premium of $5.45 per square foot in 2024, up from $3.95 in 2021, reflecting growing market valuation for energy-efficient CRE assets.

- CRE properties demonstrating significant carbon reductions showed a valuation uplift averaging 7-9% over conventional assets during the period from 2023 to 2025, according to NAREIT data.

- Net-zero energy buildings accounted for 5.7% of CRE stock in 2025, doubling from 2.8% in 2022, with ongoing projects expected to increase this share to 10% by 2030.

Shifts in Demand Across CRE Asset Classes

Office Space Utilization and Hybrid Work Models

- The office vacancy rate in the U.S. rose to 14.1% by mid-2025, surpassing the previous high of 13.8% in 2024, as companies continue to navigate hybrid work environments.

- Rent growth for office spaces slowed to 0.8% annually in 2025, down from 2.2% in 2023, reflecting cautious demand due to continued remote work trends.

- Class A office buildings experienced the highest vacancy rate at 20.5%, representing an improvement from the 22% recorded in 2023 in major metros such as New York and Boston.

Industrial and Logistics Growth Post-eCommerce Boom

- The industrial sector’s vacancy rate was 6.6% in Q3 2024, expected to peak at 6.8% by mid-2025, slightly higher than the 5.5% seen in 2022 as supply begins to catch up with demand.

- Industrial rents increased by 6.8% year-over-year in early 2025, reaching an average of $8.35 per square foot, despite a slower growth rate compared to the 10.4% rental growth recorded in 2022.

- New industrial development has declined sharply, with projects under construction dropping by 53% since 2022, from 711 million square feet to 331 million square feet, signaling a slowdown in supply following the boom.

Retail Real Estate Reimagined: Omnichannel and Experiential Trends

- Retail absorption has been negative since 2020; however, the overall vacancy rate stabilized around 8.0% in early 2025, similar to the 7.9% rate in 2024, indicating a slower deterioration.

- Rent growth in retail spaces is modest at 1.1% in 2025, down from 3.0% in 2023, reflecting changes in consumer behavior as omnichannel strategies reshape demand.

- Retail landlords are focusing on experiential retail and integrating e-commerce logistics, with approximately 35% of retail properties now incorporating flexible space uses, up from 20% in 2020.

- New supply entering the retail sector remains constrained, projected to grow by just 2% annually through 2025, compared to the 5% growth seen from 2018 to 2020, which helps maintain relative market tightness.

Multifamily, Hospitality, and Specialized Property Performance

- Multifamily vacancy rates remain stable at 4.9% in 2025, closely mirroring the 4.7% rate in 2024, indicating steady tenant demand.

- Rent growth in multifamily units is expected to slow to 2.6% annually in 2025, a substantial decline from the double-digit growth seen during 2020-2022.

- New multifamily supply is surging, with completions expected to reach 385,000 units in 2025, the highest level since the 1970s. This growth is primarily concentrated in the Sun Belt and Mountain regions, which have experienced strong population growth.

- Hospitality continues to face headwinds, with occupancy rates averaging 62% in Q1 2025, slightly lower than the 64% recorded in 2024, as the travel and event sectors recover at a moderate pace.

Challenges, Opportunities, and the Future Outlook of Commercial Real Estate

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Navigating Market Volatility and Economic Uncertainty

- In early 2025, the U.S. GDP contracted by 0.9% compared to Q4 2024, signaling economic uncertainty that is affecting CRE demand.

- Inflation hovered at 2.4%, slightly above the Federal Reserve’s 2% target, which held interest rates stable at 4.5%, keeping financing costs steady but cautious.

- Office vacancy rates reached a record high of 14.1% in May 2025, up from 12.3% in 2023, primarily due to corporate downsizing and the adoption of hybrid work models.

- Industrial vacancy increased to 6.8% from 5.4% in 2023, reflecting an oversupply that resulted from rapid expansion during the COVID-19 e-commerce boom.

- Retail remains constrained, with vacancy below 5%, improving slightly from 6% in 2023, due to limited new supply and resilient consumer demand.

CRE Financing, Interest Rates, and Investment Strategies

- Following the Federal Reserve's pause at a 4.5% interest rate in 2025, loan originations in CRE rose by 8% year-over-year in Q1 2025, signaling cautious optimism among investors.

- Cap rates for industrial assets compressed to 5.2% in 2025 from 5.8% in 2023, reflecting strong investor demand despite slowing growth.

- Multifamily sector cap rates have increased slightly, rising to 5.9% from 5.6% in 2023, reflecting new supply pressure and a moderation in rent growth.

- Transaction volume grew by 5%, hitting $350 billion in Q1 2025, compared to $332 billion in 2023, driven by industrial and multifamily deals.

Regulatory, Zoning, and Taxation Impact on CRE Markets

- New zoning reforms in major metropolitan areas reduced permitting times by 20% in 2025 compared to 2023, thereby accelerating development cycles.

- Approximately 15% of CRE properties experienced higher property taxes due to reassessment practices in 2024 and 2025, which impacted their net operating income.

- Opportunity zones continue to attract capital, with $50 billion invested in CRE projects in 2025, a 30% increase from 2023, driven by tax incentives.

Conclusion

The commercial real estate industry stands at a pivotal crossroads, shaped by powerful trends—innovative technology, sustainability standards, and evolving asset demand. These shifts are redefining how spaces are used and valued across office buildings, logistics centers, and even hospitals.

Staying informed about real estate statistics and new developments is essential for both professionals and those with a keen interest in the field. As the market continues to adapt, those who keep pace with these changes will be best positioned for success. Ready to discover more or share your insights? Let's keep the conversation on the future of real estate moving forward.

Insights On Commercial Real Estate Industry Trends and Statistics

What is the 2025 outlook for commercial real estate?

The commercial real estate market is optimistic for 2025, with the industrial and multifamily sectors expected to outperform. Office and retail are stabilizing despite lingering challenges, and investment activity is rising as capital becomes more accessible.

Which sectors are leading in growth and investment?

Industrial real estate, driven by e-commerce logistics and multifamily housing, with robust demand, leads growth. Data centers, healthcare, and sustainable buildings are emerging as high-performing assets.

How are technology and sustainability shaping the CRE market?

Adoption of PropTech, smart building solutions, and green certifications is increasing. These advances support operational efficiency and attract tenants seeking sustainable, future-proof properties.

What are the major challenges facing CRE in 2025?

Vacancy rates in office properties and retail adaptation are key hurdles. Interest rate uncertainty and climate-related risks also impact asset valuations and leasing activity.

Are there new opportunities for investors in 2025?

Yes, with a rise in distressed assets, regional market divergence, and new financing prospects, investors are finding opportunities in alternative sectors and value-add properties.

References & Citations:

- 2025 commercial real estate trends

Al Brooks (Jan 2025), 2025 commercial real estate trends - Emerging Trends in Real Estate® 2025

PwC (2025), Emerging Trends in Real Estate® 2025 - Commercial Real Estate Market Analysis, Size, and Forecast 2025-2029: North America (US and Canada), Europe (France, Germany, Italy, and UK), Middle East and Africa (Egypt, KSA, Oman, and UAE), APAC (China, India, and Japan), South America (Argentina and Brazil), and Rest of World (ROW)

Technavio (Dec 2024), Commercial Real Estate Market Analysis, Size, and Forecast 2025-2029: North America (US and Canada), Europe (France, Germany, Italy, and UK), Middle East and Africa (Egypt, KSA, Oman, and UAE), APAC (China, India, and Japan), South America (Argentina and Brazil), and Rest of World (ROW) - 80+ Commercial Real Estate Statistics: Market in Motion (2025)

Sharad Mehta (Apr 2025), 80+ Commercial Real Estate Statistics: Market in Motion (2025) - Commercial Real Estate Market Update: Key Trends for 2025

Bethany A Williams (Mar 2025), Commercial Real Estate Market Update: Key Trends for 2025 - Commercial Real Estate Market Insights Report

National Association of REALTORS® (Mar 2025), Commercial Real Estate Market Insights Report - Commercial Real Estate Market Insights Report

National Association of REALTORS® (May 2025), Commercial Real Estate Market Insights Report - Commercial Real Estate Market Insights Report

National Association of REALTORS® (Jun 2025), Commercial Real Estate Market Insights Report - Commercial Real Estate in 2025: Hurdles and Horizons

The CCIM Institute (Jan 2025), Commercial Real Estate in 2025: Hurdles and Horizons - US commercial real estate transaction analysis – Q1 2025

Omar Eltorai (Jun 2025), US commercial real estate transaction analysis – Q1 2025 - 2025 commercial real estate outlook

Jeffrey J. Smith, Kathy Feucht, Renea Burns, Tim Coy (Sep 2024), 2025 commercial real estate outlook - Ten Challenges Facing Commercial Real Estate in 2025

Anthony F. DellaPelle (Winter 2024/2025), Ten Challenges Facing Commercial Real Estate in 2025 - SoCal Commercial Real Estate Market Outlook 2025: Key Charts and Insights

Anthony F. DellaPelle (Year-End 2024), SoCal Commercial Real Estate Market Outlook 2025: Key Charts and Insights