21+ Energy Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Curious how the energy industry trends have shaped our world and what’s on the horizon? Over the years, the energy sector has seen remarkable shifts—from booming fossil fuel use to a surge in renewables like solar and wind.

Today, with climate goals accelerating and new tech emerging, understanding these trends is more important than ever. Let’s explore the data and insights driving this dynamic industry’s future evolution.

Renewable Energy Growth and Market Penetration

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

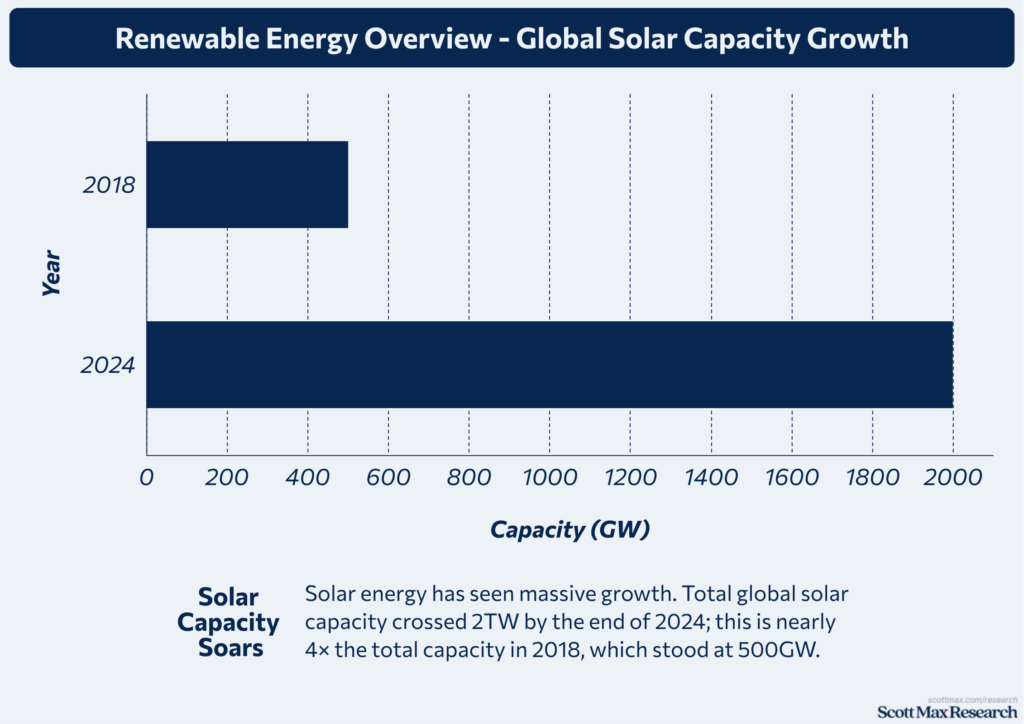

Surge in Solar Power Installations

- Global solar installations reached 597GW in 2024, up from 450GW in 2023, marking an increase of 147GW in just a year.

- Total global solar capacity crossed 2TW by the end of 2024; this is nearly 4× the total capacity in 2018, which stood at 500GW.

Advancements in Wind Energy Generation

- A record 117GW of wind capacity was added in 2024, identical to 2023, keeping pace with the previous year’s record growth.

- Global cumulative wind capacity reached 1,136GW in 2024, up from 1,019GW in 2023, showing a net annual increase of 117GW.

- Onshore wind contributed 109GW and offshore wind 8GW to 2024’s new capacity, with a total of 55 countries installing new wind turbines in 2024.

- Europe added 16.4GW, with the European Union accounting for 12.9GW; the U.S. added 4,058MW, Germany 4,022MW, Brazil 3,278MW.

Expansion of Hydropower Resources

- Global hydropower generation rose 10% to 4,578TWh in 2024; in 2023, it was 4,161TWh, reflecting an increase of 417TWh.

- 24.6GW of new hydropower capacity was commissioned in 2024, up from previous years, with 8.4GW from pumped storage and 16.2GW from conventional hydropower.

- End of 2024 global hydropower capacity reached nearly 1,450GW, compared to 1,412GW at the end of 2023; China leads with 421GW, Brazil 110GW, U.S. 102GW, and Canada 84GW.

- The hydropower development pipeline surpassed 1,075GW in 2024, growing 8% (or roughly 80GW) compared to 2023.

Rise of Emerging Renewables (Geothermal & Biomass)

- Geothermal energy production grew to 7.49PJ in 2024 in the Netherlands, a rise of over 10% from 2023’s 6.8PJ; global estimates predict geothermal could scale from present levels to 800GW by 2050.

- U.S. geothermal could supply up to 90GW of firm power by 2050, up from 3.7GW installed currently; in 2024, new commercial projects reached depths of 2.8 miles in Germany, with 200 miles of wellbores established.

- Global biomass electricity capacity reached 150GW in 2024, up from 141GW in 2023, led by increased waste-to-energy projects in Europe and expansion in the U.S. and Brazil.

Fossil Fuel Consumption and Shifting Dynamics

Coal Consumption: Decline or Plateau?

- Global coal consumption increased slightly by 0.8% in 2024, reaching approximately 7,900 million tonnes of coal equivalent (Mtce), compared with 7,835 Mtce in 2023.

- Coal accounted for 27% of the global energy mix in 2024, down from 29% in 2020, reflecting a slow structural decline primarily in OECD countries.

- Despite this, coal-fired power generation grew by 2% in 2024, driven mainly by non-OECD Asia, where volume increased by 120 TWh, offsetting decreases in Europe and North America.

- New coal capacity added globally in 2024 was about 5GW, a reduction from 7GW in 2023, signaling a plateau rather than a sharp decline.

Oil Market Fluctuations and Demand Drivers

- Total global oil demand reached 99.2 million barrels per day (b/d) in 2024, an increase of 1.3 million b/d from 97.9 million b/d in 2023.

- By 2025, demand is projected to peak near 100 million b/d, according to IEA’s Announced Pledges Scenario (APS), then decline gradually by about 1 million b/d annually to reach 77 million b/d by 2050.

- The petrochemical sector’s oil consumption increased to 14 million b/d in 2024, up from 13.2 million b/d in 2023, reflecting ongoing industrial demand.

Natural Gas as a Transitional Fuel

- Global natural gas consumption grew by 2.5% in 2024 to approximately 4,150 billion cubic meters (bcm), up from 4,050 bcm in 2023.

- LNG exports increased to 540 million tonnes in 2024, rising by 45 million tonnes compared to 2023, driven mainly by expanded liquefaction capacity in the U.S. and Qatar.

- Gas-fired power generation grew by 3.1% globally, with notable increases in Asia (+5%), Europe (+1%), and the Middle East (+4%), totaling an additional 200 TWh in 2024.

- Despite growth, the IEA projects natural gas demand will peak by 2030, declining thereafter under net-zero scenarios, dropping from 4,150 bcm in 2024 to 3,200 bcm by 2050.

Impact of Regulatory Policies on Fossil Fuels

- In 2024, approximately 53 countries and the EU, representing two-thirds of global CO₂ emissions, enacted or reinforced net-zero emission pledges to 2050, influencing fossil fuel demand trajectories.

- Carbon pricing mechanisms expanded, with worldwide carbon prices averaging $27 per tonne of CO₂ in 2024, up from $22 in 2023, creating economic pressures on coal and oil consumption.

- Fossil fuel subsidies declined globally by an estimated $150 billion in 2024, down from $175 billion in 2023, contributing to a modest reduction in consumption incentives.

- Stricter emission standards reduced coal plant utilization rates in OECD countries to an average of 50% in 2024, down from 58% in 2022.

- Regulatory frameworks supporting clean energy investments helped avoid an estimated 2.6 gigatonnes of CO₂ emissions in 2024, limiting fossil fuel growth despite increasing energy demand.

Global Energy Demand and Consumption Patterns

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

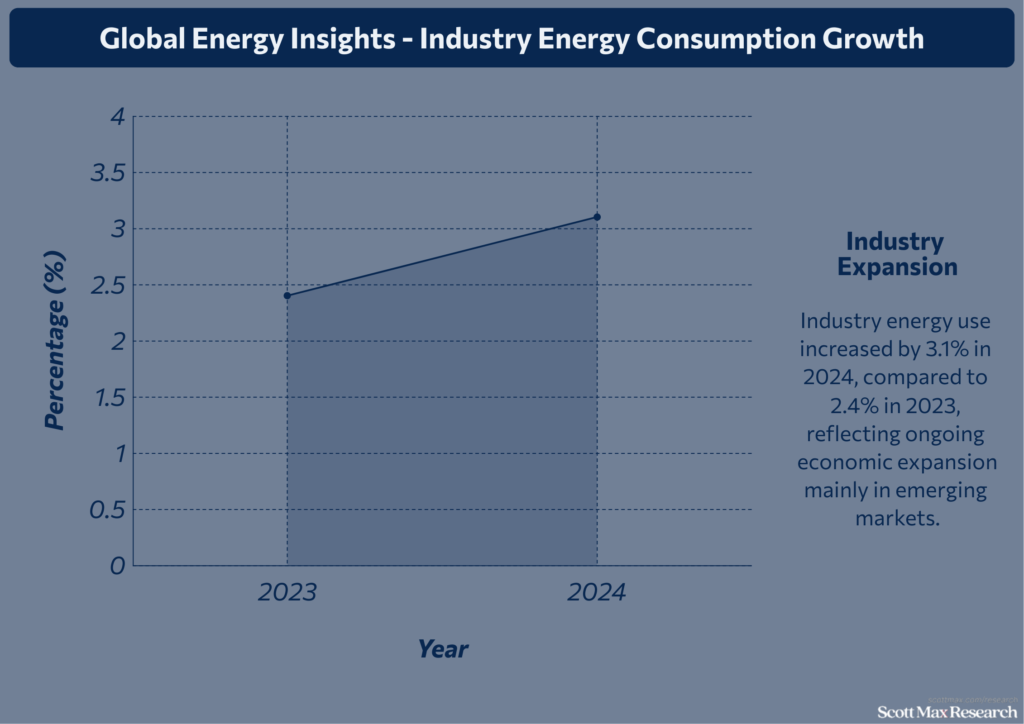

Sector-Wise Energy Consumption Analysis

- Global energy consumption rose by 2.2% in 2024, reaching approximately 592 exajoules (EJ), up from 579 EJ in 2023, marking the fastest growth since 2010-2019’s average of 1.5% per year.

- Industry energy use increased by 3.1% in 2024, compared to 2.4% in 2023, reflecting ongoing economic expansion mainly in emerging markets.

- Buildings sector electricity use surged by 4.8% in 2024, versus 3.5% in 2023, powered primarily by electrification of heating and cooling systems.

Regional Trends in Energy Demand

- BRICS nations accounted for 43% of global energy use in 2024, with energy consumption growth at 3%, up from 2.7% in 2023; China’s energy demand rose by 4%, returning to its 2010-2019 average after a 7% rebound in 2023.

- Non-OECD countries experienced overall energy consumption growth of 3.5% in 2024, compared to 3% in 2023, driven by Indonesia (+6%), Vietnam (+9%), Russia (+2%), and Brazil (+3%).

- OECD countries saw a modest growth of 1% in 2024, with the U.S. increasing consumption by 1%, South Korea by 2%, and Türkiye by 6%; EU, Mexico, and Canada remained stable, while Japan’s consumption declined by 1%.

- Africa’s energy demand rose by 2.5% globally, with Egypt growing 5%; Middle East consumption increased overall by 1.5%, balanced by a 5% rise in Iran and a 1% drop in Saudi Arabia.

Population Growth and Energy Needs

- Global population reached approximately 8.1 billion people in 2024, contributing to increased energy demand growth relative to previous years (e.g., 7.8 billion in 2020).

- Urbanization trends resulted in a 3.7% rise in energy demand in urban areas, driven by improved access to electricity and appliances, compared to 2.9% in rural areas.

Energy Efficiency and Demand Reduction

- Despite rising energy consumption, energy intensity (energy use per unit of GDP) improved globally by 1.3% in 2024, continuing a trend since 2010 where improvements averaged 1% annually.

- Buildings have achieved electricity efficiency gains, reducing energy per square meter by an average of 1.8% in 2024, compared to 1.4% in 2023, driven by LED lighting and efficient HVAC systems.

- Smart grid and demand-side management technologies expanded, cutting peak electricity demand by an estimated 4.2 TWh in 2024, up from 3.1 TWh in 2023 in OECD countries.

- Industrial energy efficiency programs avoided approximately 150 million tonnes of CO₂ emissions in 2024, a 10% improvement over 2023 efforts, via process optimization and waste heat recovery.

Energy Investment and Economic Impact Over the Years

Global Investment Trends in Energy Infrastructure

- In 2024, global energy investment reached $2.3 trillion, up from $2.0 trillion in 2023, showing a growth of $300 billion fueled largely by renewables and energy storage projects.

- Investment in renewable energy infrastructure accounted for $1.5 trillion in 2024, an increase of $250 billion from 2023, led by solar PV projects adding 160 GW capacity worldwide versus 120 GW the previous year.

- Energy storage market investments surged to $40 billion in 2024, marking a 35% increase compared to 2023, with installed capacity hitting 94 GW/247 GWh, and projected to reach 220 GW by 2035.

- Fossil fuel investments declined slightly, with oil and gas capital expenditures dropping by 5% in 2024 to about $400 billion compared to $420 billion in 2023, reflecting regulatory pressures and market uncertainties.

Economic Impact of Energy Transitions

- The renewable energy sector generated approximately 12 million jobs worldwide in 2024, up from 10.7 million in 2023, a rise of 1.3 million jobs, driven by solar PV, wind, and battery manufacturing.

- In contrast, traditional fossil fuel sectors lost 250,000 jobs globally in 2024, predominantly in coal mining and oil exploration regions.

- Countries adopting aggressive net-zero policies saw GDP growth linked to energy investments exceed 3% in 2024, compared to under 2% in non-transition economies.

- Investment in grid infrastructure improvements exceeded $200 billion in 2024, a 20% increase from 2023, facilitating integration of variable renewables and enhancing energy security.

Technology Innovations Driving Energy Investments

- Battery technology costs fell by 15% in 2024, bringing average lithium-ion battery pack prices to $120 per kWh compared to $140 per kWh in 2023, accelerating energy storage deployment.

- Grid-scale battery storage capacity additions reached 94 GW in 2024, a 35% increase over 2023, with average storage duration improving from 2.3 hours to 2.6 hours.

- Artificial intelligence and digital grid management technologies attracted $8 billion in venture capital in 2024, double the investments seen in 2022, improving demand response and operational efficiency.

- Green hydrogen projects increased to 3.4 GW electrolyzer capacity in 2024 from 2.1 GW in 2023, supported by government grants and corporate commitments.

Challenges and Risks in Energy Financing

- Financing risks increased marginally, with project delays rising by 12% in 2024 compared to 2023, primarily due to inflationary pressures on material costs and supply chain disruptions.

- Despite falling battery costs, upfront financing for storage projects remains high, with average loan interest rates increasing from 4.2% in 2023 to 5.1% in 2024, slowing some market segments.

Decarbonization and Future Outlook

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Progress Towards Carbon-Neutral Targets

- Global energy investment in 2025 is projected to hit $3.3 trillion, a 2% increase from 2024, with clean energy technologies attracting $2.2 trillion—more than double fossil fuel investments at $1.1 trillion.

- Solar power investment leads with $450 billion expected in 2025, up from $390 billion in 2024, making it the largest single sector in energy infrastructure spending worldwide.

Sustainable Energy Policies and Governance

- Grid infrastructure investment reached over $300 billion in 2024, growing 20% year-on-year, yet still lagging behind the rate needed to integrate expanding renewable capacity and maintain energy reliability.

- Regulatory frameworks supporting electrification and efficiency have contributed to $773 billion in energy efficiency and end-use investments in 2025, up from $700 billion in 2024.

Consumer Behavior and Renewable Adoption

- Consumer demand for renewables grew significantly: rooftop solar installations rose to 120 GW globally in 2024, a 15% increase over 2023, largely driven by residential and commercial segments in Europe and North America.

- Electric vehicle (EV) sales reached 11.7 million units in 2024, up from 9.9 million in 2023, representing roughly 18% of all vehicle sales worldwide, accelerating the shift away from fossil fuels.

- Renewables accounted for 40% of the global electricity generation mix in 2024, up from 35% in 2023, attributed to increased consumer and corporate power purchase agreements (PPAs) globally.

- The growth in prosumer participation (consumers who both produce and consume energy) increased by 30% in 2024, facilitated by smart meters and distributed generation technologies.

Innovations Shaping the Future of Energy

- Battery storage deployment surged to 94 GW installed capacity in 2024, a 35% increase compared with 2023, with lithium-ion battery pack costs dropping to about $120 per kWh, down from $140 in 2023.

- Green hydrogen electrolyzer capacity expanded to 3.4 GW in 2024 from 2.1 GW in 2023, driven by public and private investments focused on decarbonizing heavy industry and transport.

- Floating offshore wind projects tripled capacity additions in 2024, reaching 2 GW, primarily concentrated in Europe and Japan, compared with 0.7 GW added in 2023, signaling rapid adoption of new offshore technologies.

Conclusion

As the energy landscape continues to evolve rapidly, understanding energy industry trends offers a clear window into where the sector is headed. Renewables are expanding at record pace, electrification and digitalization are reshaping consumption, and strategic investments are fueling innovation—all while balancing ongoing fossil fuel roles.

This dynamic shift highlights the urgent need for adaptable strategies and informed decisions in business and policy alike. Keep exploring these critical trends to stay ahead and contribute meaningfully to the energy future that’s unfolding before us.

Insights On Energy Industry Trends and Statistics

What are the key global energy trends in 2025?

Global energy demand grew 2.2% in 2024, with renewables accounting for the largest share of new supply. Electricity demand surged 4.3%, fueled by greater electrification, digitalization, and extreme weather, while energy-related CO₂ emissions growth slowed to 0.8%.

How fast is the renewable energy sector expanding?

Renewable energy capacity is growing rapidly, with global market size projected to rise from $1,194.93B in 2025 to $1,735.29B by 2029—nearly 10% CAGR. Solar and wind led this expansion, alongside ongoing innovations and supportive policy measures.

What’s happening with fossil fuel consumption?

Demand for fossil fuels remains high, but growth is slowing; global oil demand is up about 1 million bpd in 2025, mainly due to EV adoption and evolving industrial needs. Coal and gas consumption growth rates continue to moderate, especially in developed economies.

Which regions are driving the most significant energy consumption increases?

Emerging markets, notably in Asia, accounted for 43% of global energy use in 2024, with China and India leading due to strong economic and population growth. BRICS nations have consistently outpaced OECD countries in consumption rates.

What future trends will shape the energy market?

Expect ongoing growth in renewables, stronger digital transformation with AI and IoT, decentralized energy systems, and increased investment in energy security. Clean energy investment is forecasted to double that of fossil fuels, reshaping global strategies for sustainability.

References & Citations:

- New report: World installed 600 GW of solar in 2024, could be installing 1 TW per year by 2030

Bethany Meban (May 2025), New report: World installed 600 GW of solar in 2024, could be installing 1 TW per year by 2030 - Solar power continues to surge in 2024

Euan Graham, Nicolas Fulghum (Sep 2024), Solar power continues to surge in 2024 - Global Market Outlook for Solar Power 2025-2029

Walburga Hemetsberger, Sonia Dunlop, Michael Schmela (May 2025), Global Market Outlook for Solar Power 2025-2029 - Global Wind Energy Capacity Grew 117 GW in 2024: Global Wind Report

Paige Bennett (Apr 2025), Global Wind Energy Capacity Grew 117 GW in 2024: Global Wind Report - Global wind power capacity sees record growth in 2024

Gülşen Çağatay (Apr 2025), Global wind power capacity sees record growth in 2024 - Wind industry installs record capacity in 2024 despite policy instability

The GWEC Team (Apr 2025), Wind industry installs record capacity in 2024 despite policy instability - Wind Power Breaks Records in 2024, Paving the Way for a Greener Future

The Renewable Energy Institute (2025), Wind Power Breaks Records in 2024, Paving the Way for a Greener Future - Global hydropower generation jumps 10% in 2024 as pumped storage surges

Carrieann Stocks (Jun 2025), Global hydropower generation jumps 10% in 2024 as pumped storage surges - Over 24 GW of hydropower capacity added worldwide in 2024

Enerdata (Jun 2025), Over 24 GW of hydropower capacity added worldwide in 2024 - Further growth in geothermal energy production in 2024

Jeroen van der Molen (Jul 2025), Further growth in geothermal energy production in 2024 - 2024: next-generation geothermal energy’s breakout year

Eavor Technologies Inc. (Feb 2025), 2024: next-generation geothermal energy’s breakout year - 2024 RE statistics highlight lagging growth of geothermal for electricity

Carlo Cariaga (Jul 2024), 2024 RE statistics highlight lagging growth of geothermal for electricity - Energy Institute releases 2025 Statistical Review of World Energy

The Energy Institute (Jun 2024), Energy Institute releases 2025 Statistical Review of World Energy - Global Energy Review 2025

International Energy Agency (Mar 2025), Global Energy Review 2025 - Fossil fuel use ‘will peak by 2025’ if countries meet climate pledges, says IEA

Simon Evans (Oct 2021), Fossil fuel use ‘will peak by 2025’ if countries meet climate pledges, says IEA - Global Energy Trends

Enerdata (Jun 2025), Global Energy Trends - Global Energy Storage Market Remains Resilient Amid US and China Policy Changes

Mercom India (Jun 2025), Global Energy Storage Market Remains Resilient Amid US and China Policy Changes - InfoLink: 222 GWh more energy storage worldwide in 2025

Pilar Sanchez Molina (Feb 2025), InfoLink: 222 GWh more energy storage worldwide in 2025 - Global energy storage market: review and outlook

InfoLink Consulting (Jan 2025), Global energy storage market: review and outlook - TrendForce: Global Installations Outlook for Energy Storage Market in 2025

EnergyTrend – Energy-Market-Research (Jan 2025), TrendForce: Global Installations Outlook for Energy Storage Market in 2025 - Global Electricity Review 2025

Euan Graham, Nicolas Fulghum, Katye Altieri (Apr 2025), Global Electricity Review 2025 - Energy Storage Market Driven by Renewable Integration and Grid Stability Demand

Precedence Energy and Power Experts, Aditi Shivarkar (Jul 2025), Energy Storage Market Driven by Renewable Integration and Grid Stability Demand - World Energy investment 2025 highlights electricity demand and energy security as new drivers

Kritti Bhalla (Jun 2025), World Energy investment 2025 highlights electricity demand and energy security as new drivers - Global energy investment set to rise to $3.3 trillion in 2025 amid economic uncertainty and energy security concerns

International Energy Agency (Jun 2025), Global energy investment set to rise to $3.3 trillion in 2025 amid economic uncertainty and energy security concerns - India's Energy Landscape

Press Information Bureau (Jun 2025), India's Energy Landscape - IEA: Clean energy investment to hit US$2.2 trillion in 2025

Will Norman (Jun 2025), IEA: Clean energy investment to hit US$2.2 trillion in 2025 - IEA World Energy Investment Report 2025: Where is global capital flowing?

Hanwha Group (Jul 2025), IEA World Energy Investment Report 2025: Where is global capital flowing? - Global energy investment to touch record $3.3 trillion in 2025; clean energy to attract $2.2 trillion: IEA

Saurav Anand (Jun 2025), Global energy investment to touch record $3.3 trillion in 2025; clean energy to attract $2.2 trillion: IEA - World Energy Investment 2025 10th Edition

International Energy Agency (Jun 2025), World Energy Investment 2025 10th Edition - 2025 Renewable Energy Industry Outlook

Marlene Motyka, Thomas L. Keefe, Kate Hardin, Carolyn Amon (Dec 2024), 2025 Renewable Energy Industry Outlook