25+ Financial Service Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

In the near future, the financial services industry will be transformed by digital innovation, evolving customer expectations, and emerging technologies such as AI, blockchain, and embedded finance.

These trends will drive hyper-personalization, automation, and decentralized ecosystems. Data-driven insights will be crucial for navigating complex challenges, optimizing risk management, and delivering tailored financial solutions that meet the demands of a rapidly changing market.

Artificial Intelligence and Automation Revolutionizing Financial Services

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

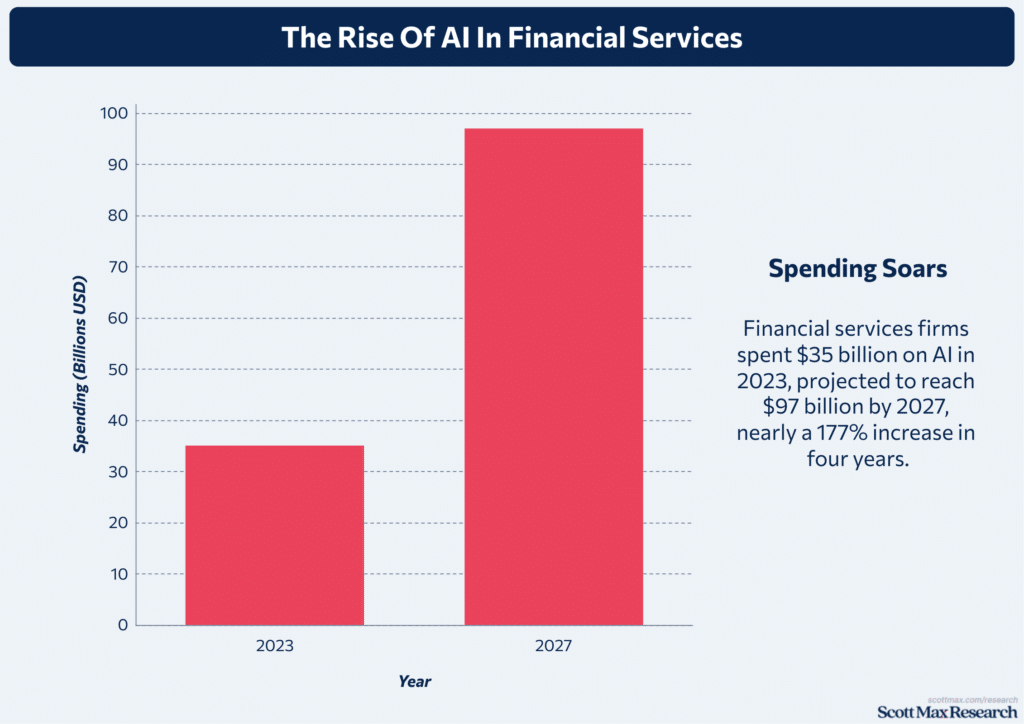

AI Investment and Market Growth

- Financial services firms spent $35 billion on AI in 2023, projected to reach $97 billion by 2027, nearly a 177% increase in four years.

- The global AI in finance market is expected to grow from $712.4 million in 2022 to $12.3 billion by 2032, a 33% annual growth rate.

- The banking AI market alone is forecasted to expand from $6.8 billion in 2022 to over $27 billion by 2027, a nearly 300% increase.

- AI adoption in finance surged from 45% in 2022 to an expected 85% by 2025, with 60% of companies deploying AI across multiple business areas.

- By 2025, 75% of banks with assets over $100 billion will fully integrate AI strategies, up from about 50% in 2023.

AI in Fraud Prevention

- 91% of U.S. banks use AI for fraud detection in 2025, up from 78% in 2020.

- Financial institutions reported a 30% decrease in fraud losses after AI implementation between 2021 and 2024.

- AI systems process suspicious transaction data up to 90% faster than legacy systems, enabling near real-time threat identification.

- Globally, 85% of financial institutions use AI to enhance operational security, including fraud detection and cybersecurity.

AI in Risk Assessment

- 77% of financial services firms use AI to mitigate risks in 2025, up from 60% in 2021.

- 66% of banks report significant performance gains in risk management due to AI, compared to 42% in 2019.

- AI models reduce credit risk assessment time by 40-50%, accelerating loan approvals and improving accuracy.

- AI-driven compliance automation reduces regulatory breaches by 25% in financial institutions between 2022 and 2025.

Personalized Financial Advice and Customer Interaction

- AI supports 95% of customer interactions in finance by 2025, a sharp rise from 65% in 2021.

- Robo-advisors manage $1.4 trillion in assets globally in 2025, up from $987 billion in 2022 (a 42% increase).

- 46% of financial firms report higher customer satisfaction after integrating AI-powered personalized advice, up from 30% in 2020.

- Chatbots handle 70% of routine inquiries in 2025, compared to 40% in 2019, reducing human agent workload significantly.

Automation and Hyperautomation Efficiency Gains

- AI and automation are expected to save banks up to $487 billion by 2024, primarily in front and middle-office operations, a 50% increase from 2020 estimates.

- 50% of financial services organizations automate key processes using AI in 2025, up from 30% in 2020.

- AI-driven automation cuts operational costs by 20-30% on average in financial institutions between 2020 and 2025.

- Machine learning automates 32-39% of tasks across capital markets, insurance, and banking, with an additional 34-37% of tasks augmented by AI.

Regional AI Adoption in Financial Services

- North America leads with 88% AI adoption in financial services in 2025, followed by Europe at 75% and Asia-Pacific at 70%.

- The U.S. AI market in finance is valued at $73.98 billion in 2025, with a CAGR of 26.95% projected through 2031.

- Emerging markets in Asia show a 40% year-over-year increase in AI investments since 2022, driven by fintech innovation.

Winning Customer Loyalty in a Dynamic Market

Customer Acquisition Costs and Loyalty Trends

- Customer acquisition costs have surged by 60% over the last five years (2019-2024), with merchants losing an average of $29 per new customer acquired in 2024, up from approximately $18 in 2019.

- Despite rising acquisition costs, 69% of consumers remain loyal to specific brands in 2024, down from 77% in 2022, indicating an increase in brand switching facilitated by AI-enabled comparison tools.

- Millennials exhibit the highest loyalty rate at 73% in 2024, compared to the overall average of 69%.

- 86% of CX professionals in 2025 agree that customer loyalty will grow in importance as a business metric, up from 78% in 2023.

- 87% of CX leaders confirm that investing in loyalty initiatives delivers a positive ROI, with 97% agreeing loyalty drives overall business success.

Customer Retention and Spending Impact

- A 5% increase in customer retention correlates with at least a 25% increase in profit, a figure consistent since 2020 but gaining renewed focus in 2025 due to rising acquisition costs.

- 57% of consumers spend more on brands to which they are loyal, a figure that has grown from 50% in 2021.

- Consumers actively engage with an average of 6-7 loyalty programs out of 16.7 programs they belong to, showing a 10% increase in active engagement since 2020.

- 64% of loyalty program members increase spending to maximize rewards, rising to 60% for paid loyalty programs, up from 55% and 50%, respectively, in 2022.

Loyalty Program Adoption and Effectiveness

- 60% of brands prioritize Customer Lifetime Value (CLV) as a key metric in 2025, a 15% increase from 2022.

- Personalization investments have risen to 58% of businesses in 2025, compared to 45% in 2021.

- 31% of brands leverage automation to scale personalization, a 12% increase from 2019.

- Gamification adoption in loyalty programs has reached 43% in 2025, up from 25% in 2020, reflecting a growing trend toward interactive engagement.

- Loyalty initiatives have increased customer engagement for 70% of brands, with 58% reporting boosts in repeat purchases—both figures up by roughly 10 percentage points since 2022.

- Over 40% of loyalty programs achieve higher redemption rates through personalization, a 20% increase from 2019.

The Rise of Embedded Finance and Decentralized Financial Ecosystems

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

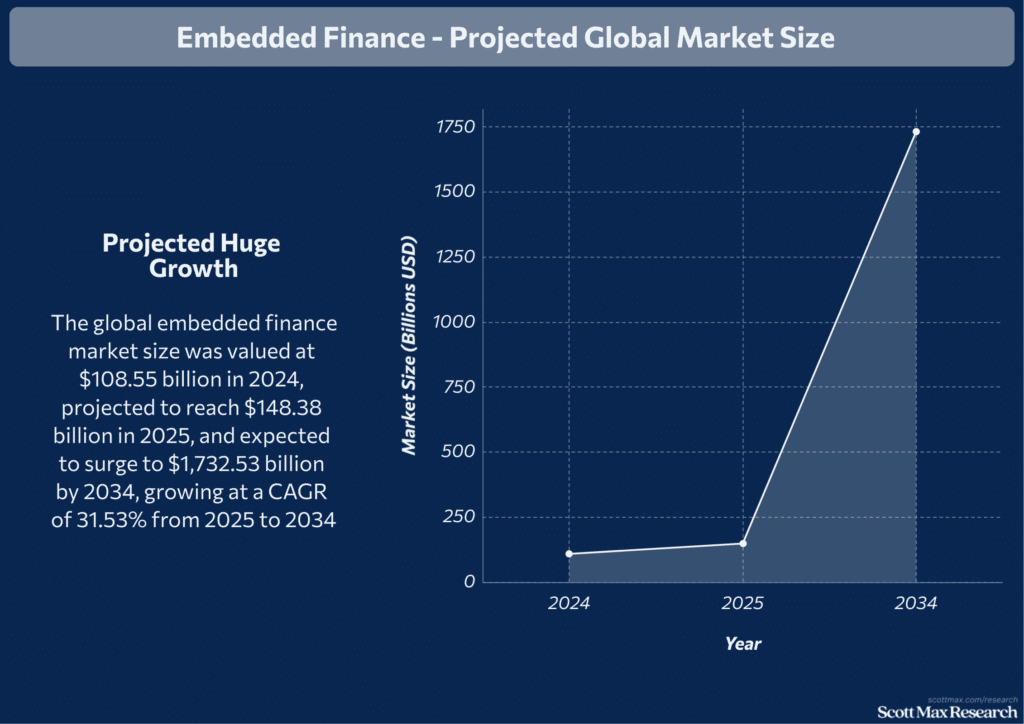

Embedded Finance Market Size and Growth

- The global embedded finance market size was valued at $108.55 billion in 2024, projected to reach $148.38 billion in 2025, and expected to surge to $1,732.53 billion by 2034, growing at a CAGR of 31.53% from 2025 to 2034.

- Alternative forecasts estimate the market at $146.17 billion in 2025, with growth to $690.39 billion by 2030 at a CAGR of 36.41%.

- Another report projects the market to reach $251.5 billion by 2029, growing at a CAGR of 16.8% from 2024 to 2029.

- North America accounted for over 33% of the global revenue share in 2024, with the U.S. market alone valued at $36.87 billion in 2024, expected to grow to $468.25 billion by 2034 at a CAGR of 31.85%.

- The embedded finance market grew from approximately $99.6 billion in 2023 to $115.8 billion in 2024, a year-on-year increase of 16.3%.

Transaction Volume and Revenue Projections

- Embedded finance is forecasted to generate $3.5 trillion in transaction volume by 2030, producing $500 billion in annual revenues, according to Bain & Company.

- Embedded payments alone are estimated to reach $65 billion in global revenue by 2025, with embedded lending surpassing $30 billion and embedded insurance projected between $10-15 billion in 2025.

- E-money transactions in Europe increased by 6.9% to 4.4 billion transactions in the first half of 2023, with transaction value rising by 7.0% to €0.2 billion.

- Non-cash payment transactions in Europe grew by 10.1% to 67.0 billion in the first half of 2023.

Industry Segments Driving Growth

- Retail and e-commerce sectors lead, driven by buy-now-pay-later (BNPL) and integrated wallets, contributing over 40% of embedded finance revenues in 2025.

- Logistics and gig economy platforms contribute through instant payouts and cash flow financing, accounting for approximately 15% of market revenues.

- SaaS platforms embedding payments, lending, and insurance for SMEs represent about 20% of the market.

Integration and Technology Adoption

- API and open banking infrastructure adoption increased by 35% from 2019 to 2024, enabling seamless integration of financial services into non-financial platforms.

- Digital platforms embedding financial services grew from $60 billion in 2020 to over $115 billion in 2024, nearly doubling in four years.

- Mobile banking and online payment portals contributed to 45% of embedded finance transactions in 2024, up from 30% in 2020.

Blockchain, Cryptocurrency, and Programmable Value Networks

- Blockchain-based embedded finance solutions constitute approximately 12% of the total embedded finance market in 2025, up from 5% in 2021.

- Cryptocurrency transaction volumes linked to embedded finance platforms grew from $150 billion in 2022 to $280 billion in 2024, an 87% increase.

- Programmable value networks, including DeFi protocols, handled $400 billion in transaction volume in 2024, up from $120 billion in 2021, a 233% increase.

- Cross-border blockchain transactions increased by 45% year-over-year from 2022 to 2024, enabling near-instant settlement and reduced costs.

Data Analytics and Hyper-Personalization Driving Risk and Customer Insights

Financial Analytics Market Growth and Segmentation

- The global financial analytics market is projected to reach USD 15.2 billion in 2025, expanding to USD 34.1 billion by 2035 at a CAGR of 9.2% over the decade.

- Key segments by 2025:

- Assets and Liability Management (ALM) holds a 22.8% market share, up from 20.5% in 2023.

- Database Management Systems (DBMS) account for 19.7% of the market, driven by cloud databases and AI-based real-time analytics.

- Query, reporting, and analysis solutions represent about 20% of the market and are essential for actionable insights.

- Payables management segment is forecasted at 21.3% share, growing due to AI-powered invoice processing and blockchain verification.

AI and Data Analytics Adoption in Financial Services

- AI in the BFSI market was valued at USD 26.2 billion in 2024 and is expected to grow at a CAGR of 22% between 2025 and 2034.

- Generative AI in the financial services market is forecasted to grow from USD 1.44 billion in 2024 to USD 1.89 billion in 2025, a CAGR of 31.2%.

- Augmented analytics market size was USD 11.04 billion in 2024, projected to reach USD 60.12 billion by 2031 at a CAGR of 23.6%.

- Approximately 72% of financial institutions use data analytics for risk assessment and management, reducing losses by up to 20%.

AI-Driven Risk Assessment and Financial Modeling

- ALM solutions adoption increased from 20.5% market share in 2023 to 22.8% in 2025, driven by AI-enabled predictive modeling and scenario analysis.

- AI-driven compliance automation has lowered regulatory breaches by 25% between 2022 and 2025.

- Real-time transaction monitoring and anomaly detection have increased by 30% since 2020, enhancing fraud detection.

Hyper-Personalization and Customer Insights

- AI supports 95% of customer interactions in finance by 2025, up from 65% in 2021.

- Personalized financial products adoption increased by 35% between 2022 and 2025, driven by AI data modeling.

- AI-driven sentiment analysis and transaction pattern recognition enable personalized advice, increasing customer satisfaction by 46% compared to 30% in 2020.

- Robo-advisors manage $1.4 trillion in assets globally in 2025, up 42% from $987 billion in 2022.

Advanced Analytics for Decision-Making and Compliance

- Cloud-based financial modeling platforms grew by 50% between 2020 and 2024, enabling scalable analytics.

- Query and reporting tools usage increased by 20% in market share from 2020 to 2025, facilitating real-time financial insights.

- Blockchain-secured financial reporting adoption grew by 30% between 2022 and 2025, enhancing transparency and compliance.

Challenges and Risks

- Data privacy concerns and cybersecurity risks remain critical, with financial firms reporting a 15% increase in cyberattacks in 2024 compared to 2022.

- Integration complexity with legacy systems slows adoption; 40% of small and medium enterprises cite this as a major barrier.

- Regulatory compliance costs increased by 12% from 2021 to 2024, driven by GDPR, SOX, and PCI DSS frameworks.

Democratization of Investment and Sustainable Finance Trends

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

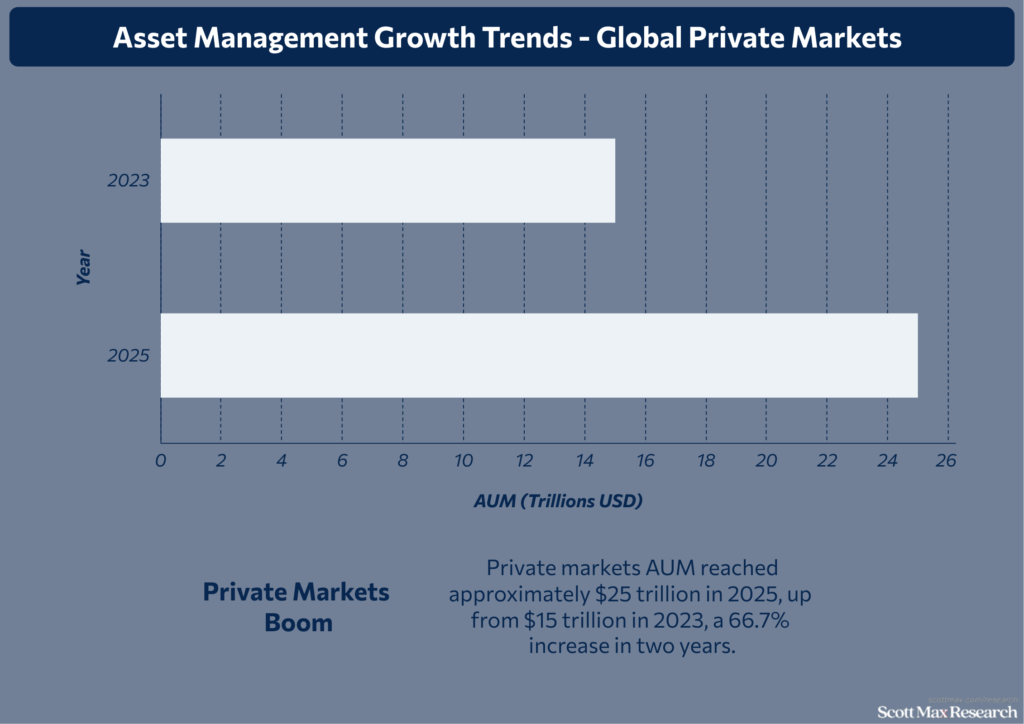

Expansion of Retail Investors into Private Capital

- Global private markets assets under management (AUM) reached approximately $25 trillion in 2025, up from $15 trillion in 2023, a 66.7% increase in two years.

- Retail investors' exposure to private capital in the U.S. and EU combined is estimated at $1 trillion in 2024, representing less than 7% of the total private capital AUM of $14.5 trillion globally.

- U.S. retail investors' private capital holdings are projected to grow from 0.2% of registered fund assets in 2024 to 5% by 2030, narrowing the gap with European retail investors, who hold 11.3% in 2024, expected to increase to 30% by 2030.

- The number of U.S. retail investors with investable assets between $100,000 and $1 million is approximately 110 million, with an estimated net financial wealth of $38 trillion. In contrast, Europe has 173 million such investors with $10 trillion in wealth.

- Retail private capital AUM in the U.S. is forecasted to expand to $2.4 trillion by 2030, a 12-fold increase from current levels, driven by regulatory changes and product innovation.

- Interval funds and ETFs allowing up to 15% illiquid securities are increasing retail access to private assets, with minimum investments ranging from $1,000 to $50,000.

Growth of Active ETFs and Retail Participation

- Active ETF assets under management grew from $1.3 trillion in 2021 to $2.1 trillion in 2024, a 61.5% increase in three years.

- Retail investors account for 45% of active ETF inflows in 2025, up from 35% in 2022, indicating a growing retail appetite for active management.

- The number of retail brokerage accounts globally increased by 18% in 2024, reaching 240 million accounts, up from 203 million in 2021.

- Retail investors contributed $150 billion in net inflows into active ETFs in 2024, a 25% increase over 2023.

Mainstream Adoption of ESG Portfolios

- Global ESG assets under management reached $42 trillion in 2024, up from $35 trillion in 2022, a 20% increase in two years.

- ESG assets are projected to hit $53 trillion by 2025, representing over one-third of total global AUM.

- Retail investors account for approximately 30% of ESG fund inflows in 2024, up from 22% in 2021.

- AI-optimized ESG portfolios grew by 45% in assets under management between 2022 and 2025, driven by demand for personalized, sustainable investing solutions.

- ESG ETFs saw inflows of $120 billion in 2024, a 40% increase compared to 2023.

AI-Optimized Wealth Management Solutions

- AI-driven wealth management platforms manage over $1.4 trillion in assets globally in 2025, up from $987 billion in 2022, a 42% increase.

- Robo-advisors now serve 45 million users worldwide, up from 30 million in 2021, with an annual growth rate of 17%.

- Personalized portfolio recommendations powered by AI reduce churn rates by 15-18% and increase average client AUM by 12% compared to traditional advisory models.

- AI adoption in wealth management firms increased from 50% in 2021 to 78% in 2025, with 60% of firms integrating ESG data into AI models.

- AI-enabled tax-loss harvesting and rebalancing algorithms improved after-tax returns by 0.5-1.2% annually for retail investors between 2022 and 2025.

Retail Investment Trends and Market Impact

- Retail investors’ share of total equity market participation increased from 25% in 2019 to 38% in 2024, driven by easier access to private capital and ETFs.

- The number of retail investors holding private equity or private debt increased by 35% between 2021 and 2024.

- Retail investors allocated 12% of portfolios to private capital in 2024, up from 5% in 2020.

Conclusion

The financial services industry in recent years is being reshaped by transformative trends such as AI-driven automation, decentralized finance, embedded finance, and sustainable investing. To thrive, institutions must embrace advanced technologies and prioritize customer-centric innovation, enhancing personalization, security, and operational efficiency.

The continued evolution fueled by AI, data analytics, and blockchain will enable financial firms to navigate complex challenges, unlock new growth opportunities, and build resilience in an increasingly dynamic and competitive landscape.

Insights on Financial Service Industry Trends and Statistics

What are the key technological trends shaping financial services in 2025?

AI-driven automation, embedded finance, blockchain, and hyper-personalization are transforming operations, customer engagement, and risk management.

How is customer experience evolving in financial services?

Banks and insurers are leveraging AI to offer personalized, real-time financial advice and customized insurance policies, enhancing convenience and loyalty.

What role does sustainability play in future financial services?

Sustainable investing and ESG portfolios are becoming mainstream, aligning investment choices with environmental and social values.

How are security concerns addressed amid digital transformation?

Financial firms are adopting AI-powered threat detection, phishing awareness, and regulatory compliance to combat increasingly sophisticated cyberattacks.

What impact do changing interest rates have on the industry?

Lowering interest rates in 2025 is expected to boost borrowing demand and mortgage refinancing, influencing lending and investment services.

References & Citations:

- Top 2025 Customer Loyalty Statistics CX Professionals Need to Know

Andrew Custage (Mar 2025), Top 2025 Customer Loyalty Statistics CX Professionals Need to Know - Financial services contact center trends: Don't be loyalty laggards in 2025

Wes Humphrey (2025), Financial services contact center trends: Don't be loyalty laggards in 2025 - Loyalty Program Trends 2025 report

Weronika Masternak, Carlos Oliveira (May 2025), Loyalty Program Trends 2025 report - Banking Consumer Study 2025

Michael Abbott, Kim Kim Oon, Antonio Coppolecchia, Mauro Centonze (2025), Banking Consumer Study 2025 - 40+ Financial Services Marketing Statistics You Need to Know in 2025

Owen Ray (Mar 2025), 40+ Financial Services Marketing Statistics You Need to Know in 2025 - Artificial Intelligence in Financial Services

World Economic Forum (Jan 2025), Artificial Intelligence in Financial Services - Artificial intelligence (AI) in finance – statistics & facts

Statista Research Department (May 2025), Artificial intelligence (AI) in finance – statistics & facts - 100+ AI Statistics Shaping Business in 2025

Vena Solutions (May 2025), 100+ AI Statistics Shaping Business in 2025 - 50 NEW Artificial Intelligence Statistics (May 2025)

Josh Howarth (Jun 2025), 50 NEW Artificial Intelligence Statistics (May 2025) - AI in Finance: 40+ Statistics You Need to Know in 2025

Shalwa (Nov 2024), AI in Finance: 40+ Statistics You Need to Know in 2025 - The state of AI: How organizations are rewiring to capture value

Alex Singla, Alexander Sukharevsky, Lareina Yee, and Michael Chui, with Bryce Hall (Mar 2025), The state of AI: How organizations are rewiring to capture value - Why embedded finance is a disruptive force financial institutions can’t ignore

Tariq Bin Hendi (Apr 2025), Why embedded finance is a disruptive force financial institutions can’t ignore - How Big is the Embedded Finance Market?

Fintech Review (Jun 2025), How Big is the Embedded Finance Market? - Embedded Finance Market Size, Share, Trends and Forecast by Type, Business Model, End Use, and Region, 2025-2033

IMARC Group (2024), Embedded Finance Market Size, Share, Trends and Forecast by Type, Business Model, End Use, and Region, 2025-2033 - Embedded Finance Market – Forecasts from 2025 to 2030

Research and Markets (Dec 2024), Embedded Finance Market – Forecasts from 2025 to 2030 - Embedded Finance Market Surges to $251.5 billion by 2029 – Dominated by Plaid, Inc. (US) and Klarna Bank AB (Sweden)

MarketsandMarkets Research Pvt. Ltd. (Mar 2025), Embedded Finance Market Surges to $251.5 billion by 2029 – Dominated by Plaid, Inc. (US) and Klarna Bank AB (Sweden) - Embedded Finance Market: Growth, Size, Share, and Trends

MarketsandMarkets (Feb 2025), Embedded Finance Market: Growth, Size, Share, and Trends - Financial Analytics Market Analysis by Type, Application, and Region through 2025 to 2035

Future Market Insights (Mar 2025), Financial Analytics Market Analysis by Type, Application, and Region through 2025 to 2035 - AI in BFSI Market Size

Preeti Wadhwani, Aishvarya Ambekar (May 2025), AI in BFSI Market Size - Generative Artificial Intelligence (AI) In Financial Services Global Market Report 2025

The Business Research Company (Jan 2025), Generative Artificial Intelligence (AI) In Financial Services Global Market Report 2025 - Artificial Intelligence – Worldwide

Statista (2025), Artificial Intelligence – Worldwide - Data Analytics Trends in 2025 for Financial Institutions

Quinte Financial Technologies (Mar 2025), Data Analytics Trends in 2025 for Financial Institutions - Increasing retail client exposure to private capital investing

Eric Fox, Sean Collins (Apr 2025), Increasing retail client exposure to private capital investing - Private Capital Retail Investment Trends 2025

Jordan B. (Jun 2025), Private Capital Retail Investment Trends 2025 - India Private Equity Report 2025

Arpan Sheth, Sriwatsan Krishnan, Aditya Shukla, Prabhav Kashyap Addepalli, Ashish Kumar, Arjita Sharma (May 2025), India Private Equity Report 2025 - ICI CEO: Make Private Markets More Accessible to Retail Investors

Investment Company Institute (May 2025), ICI CEO: Make Private Markets More Accessible to Retail Investors - More people want to make financial investments than ever before. How do we empower them?

Dean Frankle, Edoardo Bizzarri (May 2025), More people want to make financial investments than ever before. How do we empower them? - 40 years of innovation in pursuit of alpha

Raffaele Savi, Ronald Kahn, Jeff Shen, Tom Parker (May 2025), 40 years of innovation in pursuit of alpha