21+ Fintech Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Ever wondered how your quick tap-to-pay or instant money transfer became possible? The answer lies in the rapid evolution of Fintech Industry Trends—transforming how the world banks, invests, and spends.

With fintech projected to surpass $460 billion by 2025 and new AI-powered solutions continually reshaping the financial services industry, staying informed isn't just smart—it's essential. Let's explore how these trends and statistics reveal the future of finance.

The Growth of Fintech: Global Adoption and Market Size

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Rapid Expansion of Fintech Startups Worldwide

- In 2024, the estimated number of fintech startups globally surpassed 30,000, compared to approximately 12,000 in 2017.

- The United States led fintech innovation with 10,755 active fintech startups in 2024, up from 5,686 in 2018.

- The United Kingdom recorded 2,456 fintech startups in 2024, increasing from 1,600 in 2018.

- Global fintech funding hit USD 226.71 billion in 2024, climbing from approximately USD 110 billion in 2019.

- The United States received USD 81 billion in fintech investments in 2024, compared to USD 30 billion back in 2017.

Fintech Market Size: Year-on-Year Growth Stats

- The worldwide fintech market value was USD 340.1 billion in 2024, rising from USD 193.5 billion in 2018. By 2025, the market is projected to be USD 394.88 billion. Forecasts indicate that the global market size will surge to USD 1,126.64 billion by 2032.

- In 2024, the digital payment segment boasted over 3 billion users, up from 2.1 billion in 2019.

- Key segments: digital payments led with more than USD 6.7 trillion transacted in 2024, a substantial increase from USD 4.1 trillion in 2019.

- Mergers & Acquisitions: Global M&A in fintech topped USD 70 billion in 2024, compared to just USD 33 billion in 2019.

Regional Hotspots for Fintech Development

- The Asia-Pacific region accounted for approximately USD 57.83 billion in fintech revenue in 2024, representing a growth of USD 16.80 billion from USD 41.03 billion in 2021. The region's growth rate hit 21.2% CAGR from 2024 to 2031.

- North America was the top region, holding34% of the global fintech market share in 2024.

- Europe featured leading hubs, with the UK's fintech sector contributing over USD 15 billion to GDP in 2024, up from USD 10.5 billion in 2019.

- Emerging markets in Africa and Latin America saw fintech revenues together exceed USD 8 billion in 2024, up from USD 4.8 billion in 2019.

User Demographics in Fintech Adoption

- Users aged 18-34 constituted over 60% of new fintech service adopters in 2024, up from 52% in 2019.

- The global number of digital wallet users surpassed 3 billion in 2024, growing from 1.75 billion in 2018.

- Gen Z and Millennials formed over 65% of digital banking users in 2024, compared to 48% in 2017.

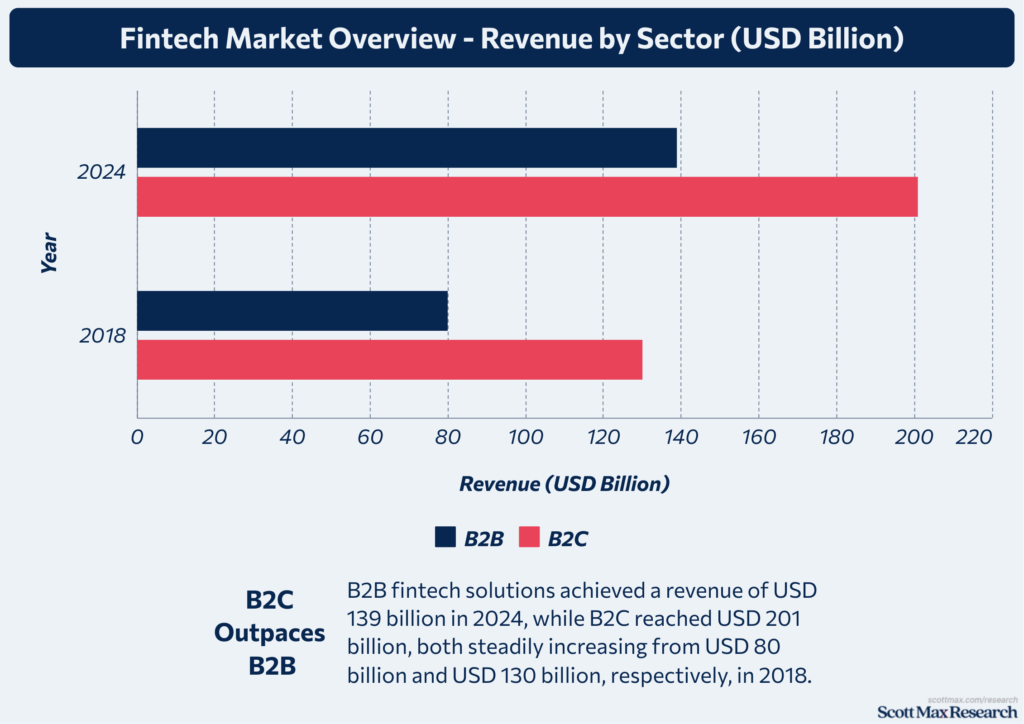

- B2B fintech solutions achieved a revenue of USD 139 billion in 2024, while B2C reached USD 201 billion, both steadily increasing from USD 80 billion and USD 130 billion, respectively, in 2018.

- Female fintech users accounted for 41% globally in 2024, up from 33% five years prior.

Key Innovations Shaping the Fintech Industry

The Rise of Digital Payments and Contactless Solutions

- In 2024, over $11.55 trillion in digital payments were made globally, representing a rise from $8.7 trillion in 2021, a nearly $3 trillion increase in three years.

- The number of users of digital payment solutions surpassed 3 billion in 2024, compared to 2.1 billion in 2019. By 2029, projections indicate that the total number of users will reach 4.45 billion.

- Contactless payments, including NFC and tap-to-pay transactions, reached $2.5 trillion globally in 2024, up from $1.1 trillion in 2020.

- The volume of cross-border payments exceeded $156 trillion in 2023, compared to $136 trillion in 2020.

- Fraud prevention technology investment in digital payments grew to $10.3 billion in 2024, rising from $7.8 billion in 2021.

Peer-to-Peer (P2P) Lending and Crowdfunding Platforms

- Global P2P lending transaction volume reached $218.1 billion in 2024, compared to $119.1 billion in 2021.

- North America accounted for $67.6 billion of the P2P lending market in 2024.

- Regulatory approval for crowdfunding platforms expanded to 57 countries in 2024, from only 39 in 2019.

- Borrowers aged 25-34 represent the largest demographic for P2P loans, with a total of 21 million users expected in 2024.

- Net returns for P2P lending averaged 5.8% in 2024, up from 4.7% in 2021; default rates dropped from 3.4% to 2.1% during the same period.

The Evolution of Neobanks and Challenger Banks

- Active neobank users worldwide reached 456 million in 2024, up from 232 million in 2021.

- The neobank market value hit $94.7 billion in 2024, nearly doubling from $48.2 billion in 2021.

- Neobank customer acquisition costs dropped to $24 per customer in 2024, from $41 in 2020.

- Retention rates for neobanks averaged 82% in 2024.

- Regulatory sandboxes supported 95 neobanks in launching in 2024, as compared to 54 in 2020.

Robo-Advisors and AI-Driven Finance Solutions

- Global assets under management (AUM) for robo-advisors increased to $2.87 trillion in 2024, up from $1.19 trillion in 2021.

- Wealth management firms using AI tools totaled 2,400 in 2024, compared to 1,350 in 2020.

- Customer digital engagement rates on AI-powered investing platforms reached 74% in 2024, up from 61% in 2021.

- Over 67% of top-performing financial institutions deployed machine learning algorithms for forecasting and risk analytics in 2024.

Blockchain Technology and Cryptocurrency in Fintech

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Uptake of Blockchain Solutions Across Financial Services

- The global blockchain market in financial services was valued at $4.66 billion in 2024, showing rapid growth from only $0.53 billion in 2018. By 2029, the sector is projected to reach $31.84 billion, an increase of over $27 billion in five years.

- International regulators are expected to verify over 220 blockchain pilots in banks and payment firms by 2024, compared to 89 in 2019.

- Investment in blockchain solutions for the financial sector reached $5.1 billion in 2024, up from $1.8 billion in 2018.

- Partnerships between global banks and blockchain startups resulted in 142 strategic alliances in 2023, a sharp increase from 59 alliances in 2017.

Cryptocurrency Adoption, Trading Volumes, and Market Trends

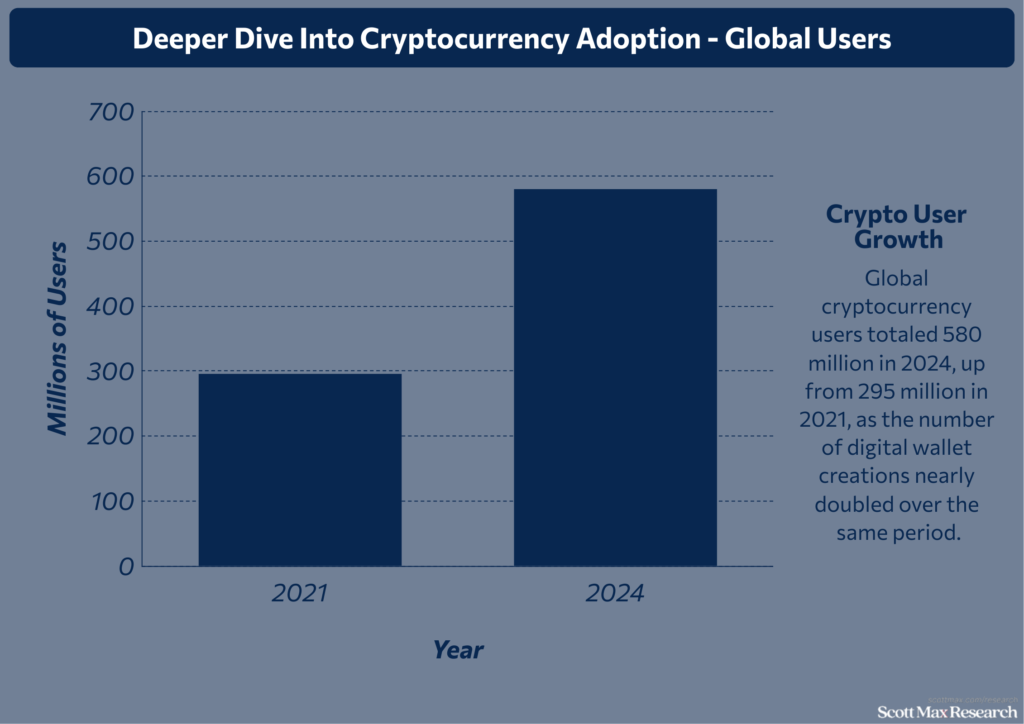

- Global cryptocurrency users totaled 580 million in 2024, up from 295 million in 2021, as the number of digital wallet creations nearly doubled over the same period.

- In 2024, total crypto trading volume hit $36 trillion, compared to $18.7 trillion in 2020.

- Bitcoin's average daily transaction volume reached $35 billion in 2024, up from $17 billion in 2020; Ethereum saw a daily volume of $16.2 billion, compared to $7.8 billion four years earlier.

- Institutional investment in digital assets reached $94 billion in 2024, up from $28 billion in 2020.

- Regulation impacted the market as the U.S. approved the first spot Bitcoin ETFs in 2024, resulting in $4.6 billion in inflows within the first week of launch.

Decentralized Finance (DeFi) Platforms: Statistics and Trends

- The DeFi market’s total value locked (TVL) reached $88 billion in June 2024, after starting at $13 billion in 2020.

- Uniswap, the leading DeFi protocol, managed over $10 billion in user assets in 2024, while Aave and MakerDAO each held more than $8 billion in assets.

- There were 7.3 million unique DeFi users by mid-2024, representing a growth from 1.27 million in 2021.

- Security incidents totaled 120 in 2023, resulting in $1.95 billion in losses, a decrease from the $3.1 billion lost in 2022.

- DeFi insurance platforms processed $407 million in claims in 2024, versus $79 million in 2021.

Central Bank Digital Currencies (CBDCs): The Emerging Landscape

- In 2024, 134 countries (representing 98% of global GDP) were exploring CBDCs, up from 35 countries in 2020.

- 11 countries, including the Bahamas and Nigeria, launched retail CBDCs; the European Central Bank’s e-euro pilot reached over 2,000 test users by June 2024.

- China's digital yuan is expected to process over $249 billion in transactions by 2024, up from $14 billion in 2021.

- The Bahamas’ Sand Dollar reported $62 million in circulation, surpassing $35 million in 2022.

Regulatory Developments and Security in Fintech

Evolving Regulatory Frameworks and Compliance Statistics

- The global fintech market is projected to reach $258.8 billion in 2025, up from $206.8 billion in 2024. Regulatory clarity, especially in North America and Europe, played a major role in sustaining this increase.

- Open banking adoption expanded, with the EU’s PSD2 directive spurring over 5,000 API integrations by the end of 2024, compared to just 860 in 2018. The UK counted over 4 million open banking users in 2024.

- Investment in regulatory technology (RegTech) rose to $19.9 billion in 2024, up from $12.2 billion in 2020. North America accounted for $8.1 billion of that spend.

Cybersecurity Trends and Risk Management in Fintech

- Reported cyberattacks on fintech firms worldwide increased to 2,650 incidents in 2024, up from 1,840 in 2019.

- Average spending on advanced security systems in fintech hit $7.6 billion in 2024, up from $4.9 billion in 2020. Multi-factor authentication was implemented by over 78% of leading firms.

- Data breaches affecting fintech users resulted in losses of $2.91 billion in 2024, compared to $2.03 billion in 2022. The largest single breach, which occurred in 2024, comprised 27 million compromised accounts.

- Cyber insurance adoption among fintech firms reached 61% in North America and 48% in Europe as of 2024, compared to rates of 36% and 28%, respectively, in 2020.

Data Privacy and User Protection in Digital Finance

- GDPR and CCPA drove compliance investments to $4.8 billion in 2024, up from $3.5 billion in 2021.

- Worldwide, customer consent tracking tools were deployed at almost 290,000 fintech apps in 2024, up from 160,000 in 2020.

Innovation vs. Regulation: Striking the Right Balance

- As of 2024, 117 regulatory sandboxes had been launched globally, a sharp increase from 68 in 2019.

- Patents related to fintech regulation and RegTech increased to 4,910 in 2024, up from 2,840 in 2020.

- Startups engaged in regulatory pilot programs numbered 312 in the U.S. and UK in 2024, up from 181 in 2019.

- Looking ahead, risk-based regulation is a key focus, with over 57% of regulators in G20 countries prioritizing proactive monitoring and AI-based supervision in 2025.

The Future of Fintech: Predictions and Opportunities

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Upcoming Trends: AI, Embedded Finance, and More

- The global fintech market is set to reach $258.8 billion in 2025, up from $206.8 billion in 2024. By 2029, projections indicate a surge to $644.6 billion, driven by significant technological shifts.

- AI-driven fintech solutions are expected to account for $54.3 billion in spend by 2028, compared to $19.5 billion in 2022.

- Embedded finance revenue across industries is forecast to reach $622.9 billion globally by 2025, more than double the $250.3 billion recorded in 2021.

- Voice authentication for banking transactions was implemented at more than 190 million user accounts worldwide in 2024, up from 81 million in 2020.

- IoT-enabled finance platforms processed over $66 billion in transactions in 2024, up from $32 billion in 2021.

Sustainability and Green Fintech Statistics

- Global issuance of green bonds surpassed $780 billion in 2024, a sharp rise from $270 billion in 2020.

- ESG-focused fintech assets reached $356 billion in 2024, growing from $152 billion five years earlier.

- User accounts on ethical investment platforms reached 87 million in 2024, up from 36 million in 2019.

- Regulatory support for sustainable fintech rose, with the EU introducing rules covering over $2.1 trillion in sustainable assets in 2024, compared to $1.1 trillion in regulated ESG assets in 2021.

Investment Outlook and Venture Capital in Fintech

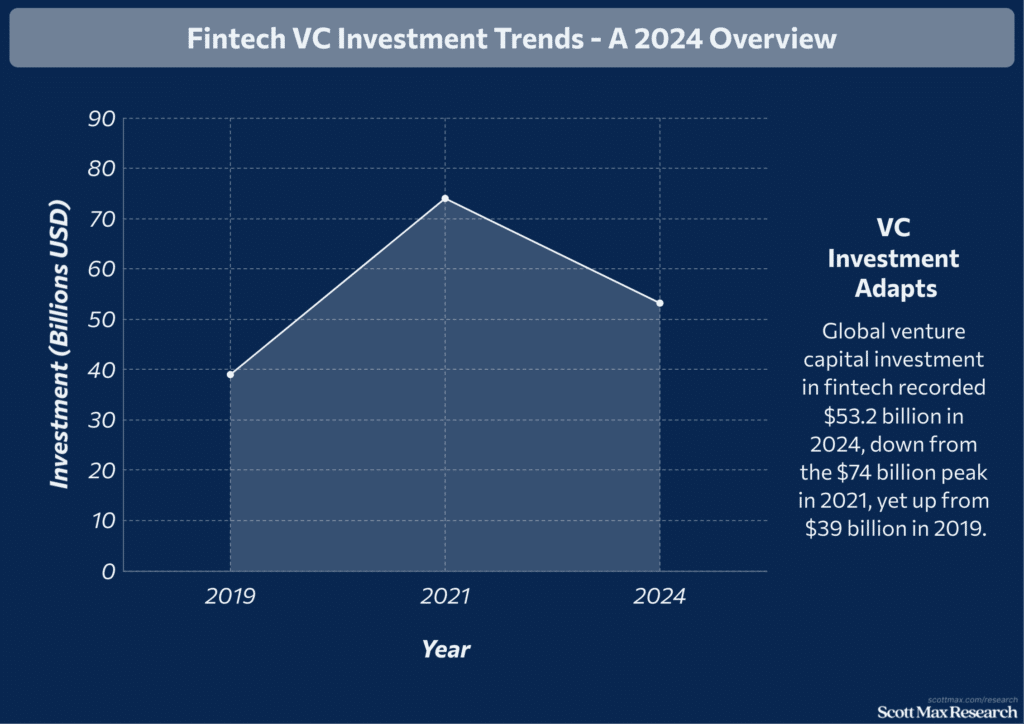

- Global venture capital investment in fintech recorded $53.2 billion in 2024, down from the $74 billion peak in 2021, yet up from $39 billion in 2019.

- Worldwide fintech M&A activity totaled $70.1 billion in deal value for 2024, representing a 60% increase from $44 billion in 2019.

- In 2024, Latin American fintech startups attracted $5.9 billion in funding, compared to only $840 million in 2018, making it a leading emerging market.

- The number of fintech unicorns (valued at over $1 billion) reached 324 globally by 2024, up from 164 in 2019.

Customer Experience and Personalization

- Analytics-driven personalization in digital banking platforms was deployed for more than 1.8 billion accounts in 2024, compared to 985 million in 2020.

- Customer journey mapping initiatives helped banks in North America boost retention by $2.6 billion in net new revenue in 2024, compared to $1.1 billion in 2019.

- Omnichannel banking services supported 2.44 billion active users globally in 2024, increasing from 1.35 billion in 2018.

- More than 687 million customer support conversations were handled by AI-based chatbots and agents in global fintech companies in 2024, a significant increase from 104 million in 2018.

Conclusion

The fintech industry’s evolution is nothing short of remarkable, revealing how fast-changing technology and shifting consumer habits continue to shape the future of finance. From digital banking and blockchain to the rise of AI-driven solutions, trends and statistics showcase a dynamic landscape filled with innovation and opportunity.

Whether you're an entrepreneur, investor, or everyday user, understanding these patterns prepares you to make informed decisions. Stay curious and open to the next wave of fintech transformations—what you discover today could redefine how you manage, save, or invest tomorrow. Reflect, explore further, and join this exciting journey in financial technology.

Insights On Fintech Industry Trends and Statistics

How much has the global fintech industry grown recently?

The fintech sector surged from a market size of $218.8 billion in 2024 to a projected $828.4 billion by 2033, growing at a CAGR of 15.8%. North America leads the market, but Asia-Pacific is rapidly closing the gap.

What role does artificial intelligence play in fintech?

AI adoption in fintech is booming, shaping customer service, security, and personalized recommendations. Around 72% of fintechs use AI, which is set to save banks $900 million in operational costs by 2028.

How significant is the impact of blockchain technology in fintech?

Blockchain in fintech is projected to surge from $4.66 billion in 2024 to $31.84 billion by 2029, driven by the demand for secure and fast financial transactions, as well as the rise of decentralized finance (DeFi) platforms.

What are the biggest trends in fintech for 2025 and beyond?

Emerging trends include embedded finance, open banking APIs, real-time payments, green fintech, and the growth of digital wallets, with digital payment users expected to reach 8.34 billion worldwide by 2030.

How are changing consumer behaviors influencing fintech growth?

Mobile adoption and digital-first preferences are dominant, with 53% of U.S. consumers opting for wallets over cash, and Gen Z and Millennials leading the shift to digital banking and payment solutions.

References & Citations:

- FinTech Market Size and Share Outlook – Forecast Trends and Growth Analysis Report (2025-2034)

Claight (Dec 2024), FinTech Market Size and Share Outlook – Forecast Trends and Growth Analysis Report (2025-2034) - Asia Pacific FinTech Market Report 2025

Vinayak Bali (May 2025), Asia Pacific FinTech Market Report 2025 - FinTech Market Size, Share & Industry Analysis, By Technology (AI, Blockchain, RPA, and Others), By Application (Fraud Monitoring, KYC Verification, and Compliance & Regulatory Support), By End Use (Banks, Financial Institutions, Insurance Companies, and Others), and Regional Forecast, 2025–2032

Fortune Business Insights (Jun 2025), FinTech Market Size, Share & Industry Analysis, By Technology (AI, Blockchain, RPA, and Others), By Application (Fraud Monitoring, KYC Verification, and Compliance & Regulatory Support), By End Use (Banks, Financial Institutions, Insurance Companies, and Others), and Regional Forecast, 2025–2032 - 70+ Fintech Statistics You Need To Know for 2025 and Beyond

Katie Greene (May 2025), 70+ Fintech Statistics You Need To Know for 2025 and Beyond - Fintech Market Size & Future Growth (2025-2029)

Fabio Duarte (Nov 2024), Fintech Market Size & Future Growth (2025-2029) - Fintech Market Size, Trends, Share & Forecast 2024–2033

Market Data Forecast (Jul 2025), Fintech Market Size, Trends, Share & Forecast 2024–2033 - India's Fintech Market to Reach $990 Billion by 2032 at 30.2% CAGR – Fintech Firms Eye Untapped Indian Digital Payments Market with Secure, Low-Cost Digital Financial Solutions

Research and Markets (May 2025), India's Fintech Market to Reach $990 Billion by 2032 at 30.2% CAGR – Fintech Firms Eye Untapped Indian Digital Payments Market with Secure, Low-Cost Digital Financial Solutions - India Fintech Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Mordor Intelligence (Jun 2025), India Fintech Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030) - Fintech – statistics & facts

Statista Research Department (Feb 2025), Fintech – statistics & facts