17+ Medical Device Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Curious how the medical device industry keeps transforming healthcare? This article reveals a dynamic landscape, fueled by innovations like AI, wearables, and 3D printing, that are reshaping diagnosis and treatment.

As the global market nears $679 billion in 2025, these advancements not only improve patient outcomes but also promise a future of personalized, accessible care. Let’s explore the key trends and statistics driving this evolution.

Global Market Overview Of the Medical Device Industry: Growth and Forecasts

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Year-Over-Year Market Size Expansion

- From 2024’s USD 542.21 billion to an estimated USD 572.31 billion in 2025, the market shows a 5.7% increase in one analyst's data, focusing on a slightly different segmentation.

- North America’s market alone was valued at USD 207 billion in 2024, increasing to approximately USD 228 billion in 2025, demonstrating its dominant regional role.

- The U.S. medical device market size stands at roughly USD 180 billion in 2024, projected to grow to USD 328.65 billion by 2034, at a CAGR of 6.2%.

Revenue Drivers and Top-Selling Device Segments

- Diagnostic imaging devices command about 20% of the global medical device market revenue.

- Surgical equipment accounts for approximately 18% of total market revenue, driven by minimally invasive and robotic surgery devices.

- In-vitro diagnostics represents 10% of the total revenue, showing growth through advanced molecular diagnostics.

Breakthrough Technologies Transforming the Medical Device Industry

Artificial Intelligence and Machine Learning Integration

- The global medical device market incorporating AI and ML technologies reached approximately $679 billion in 2025, increasing from $640 billion in 2024.

- AI-enabled devices improve diagnostic accuracy, with applications growing by 15% annually in terms of adoption in the imaging and diagnostic sectors between 2023 and 2025.

- North America leads AI-driven device adoption with a market share exceeding 38%, driven by substantial R&D investments totaling over $3 billion in 2024 alone.

- The implementation of ML algorithms in predictive analytics has cut diagnostic errors by up to 20% compared to 2021 levels.

- AI integration is projected to contribute to a CAGR of 6.5% in related device innovations from 2025 to 2032.

Robotics and Minimally Invasive Surgery Devices

- The minimally invasive surgical device market experienced a growth from $120 billion in 2023 to $138 billion in 2025, marking a 15% increase over two years.

- Robotic-assisted surgery devices accounted for approximately 18% of total surgical equipment revenue in 2025, up from 14% in 2021.

- Investments spiked by over 25% from 2023 to 2025, reaching an estimated $5.2 billion in North America, with Europe following at around $3.1 billion.

- The global robotic surgery procedures crossed 1.2 million cases in 2025, a rise from 900,000 in 2021, driven predominantly by cardiac and orthopedic interventions.

Internet of Medical Things (IoMT) and Real-Time Monitoring

- The IoMT segment surged to a valuation of $70 billion in 2025, up from $52 billion in 2022, marking a 34% growth over three years.

- Wearable health monitors, a subset of IoMT, now represent 22% of the entire medical device market revenue, an increase from 17% in 2021.

- Real-time patient monitoring devices are utilized in over 35 million cases globally in 2025, rising from 26 million in 2022, driven by home-based care models.

- North America holds 40% market share of IoMT devices, reflecting widespread infrastructure and patient adoption.

- Growth in this sector is expected to maintain a CAGR of 8% through 2033, supported by emerging telehealth integration.

3D Printing and Customization in Device Manufacturing

- The global 3D printed medical device market reached $8.5 billion in 2025, nearly doubling from $4.3 billion in 2021 due to increased customization demand.

- Custom implants and prosthetics grew by 22% per year, representing 12% of the orthopedics segment revenue in 2025, compared to 8% in 2020.

- Adoption of 3D printing reduced production lead times by an average of 35% between 2021 and 2025, enabling faster patient-specific device delivery.

- Europe and North America collectively contribute over 70% to the 3D printing device market, with North America alone investing above $1.2 billion in 2025.

- Forecasts suggest the 3D printing market in medical devices could exceed $15 billion by 2030, growing at a CAGR of 11%.

Regulatory Shifts and Compliance Evolution in the Medical Device Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Changes in Global Regulatory Frameworks (FDA, MDR, etc.)

- In 2025, the FDA maintains its dominant role in regulatory approvals, with the U.S. medical device market forecasted at $180 billion, growing at a CAGR of over 6.2% since 2024, reflecting ongoing regulatory support for innovation.

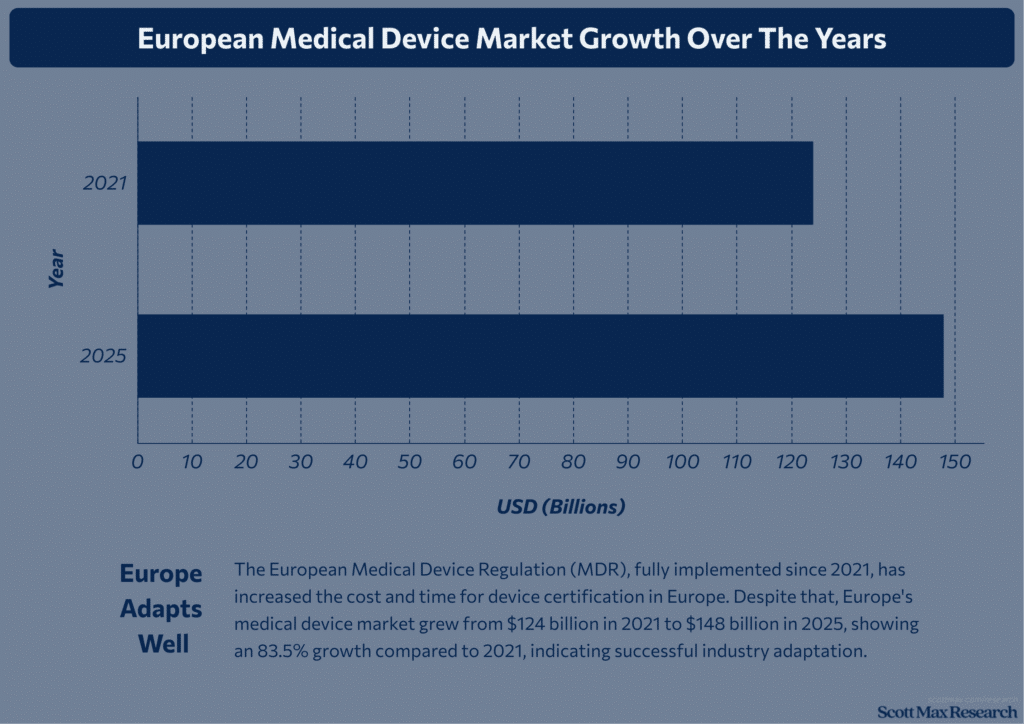

- The European Medical Device Regulation (MDR), fully implemented since 2021, has increased the cost and time for device certification in Europe. Despite that, Europe's medical device market grewfrom $124 billion in 2021 to $148 billion in 2025, showing an 83.5% growth compared to 2021, indicating successful industry adaptation.

- Globally, regulatory bodies are harmonizing standards with the International Medical Device Regulators Forum (IMDRF), streamlining requirements but raising safety benchmarks, reflected in a 6% CAGR expansion of the medical device market from 2024 to 2025.

- Asia-Pacific regulations are tightening: the region's market increased from $100 billion in 2021 to $128 billion in 2025, a growth of nearly 78%, driven by enhanced compliance aligned with FDA and MDR equivalents.

Fast-Track Approvals and Innovation Pathways

- Since 2020, the FDA's Expedited Access Pathway and Breakthrough Device Program have accelerated approvals, reducing review time by approximately 30%-50%, resulting in market entry faster by an average of 6 months.

- In 2025, over 15% of newly approved medical devices in the U.S. used fast-track pathways, contributing to a 5% faster commercialization pace relative to traditional routes (comparison with 2019 data).

- The EU's MDR framework includes accelerated pathways for innovative devices, supporting a 12% increase in novel device launches from 2023 to 2025.

- Investment in R&D related to breakthrough technologies increased by 20% from 2022 to 2025, aided by regulatory facilitation of innovation.

Growing Focus on Cybersecurity and Data Privacy

- Cybersecurity has become a top regulatory focus; FDA guidance updated in 2024 requires premarket cybersecurity risk management and postmarket threat monitoring, enforced with penalties up to $5 million for non-compliance.

- In 2025,cybersecurity budgets within medical device companies increased by 45% compared to 2022, reflecting the increasing complexity of connected devices and threat sophistication.

- Data breaches in the healthcare sector climbed by 18% from 2023 to 2024, pushing regulators worldwide to mandate tighter privacy controls and encryption standards for medical devices, particularly in wireless-enabled and IoMT devices.

- Compliance with frameworks such as HIPAA in the U.S. and GDPR in Europe has expanded to cover device manufacturers directly, leading to 30% faster adaptation of security features post-2021 regulations.

Impact of Postmarket Surveillance and Recalls

- The FDA's postmarket surveillance initiatives resulted in a 15% reduction in device-related adverse events reported in 2024 compared to 2020, signifying effective monitoring and recall execution.

- Between 2021 and 2025, the frequency of Class I recalls (highest risk) dropped by 22% globally due to enhanced vigilance and earlier detection through real-time data analytics.

- Manufacturers' investment in surveillance systems increased by 25% in 2025 compared to 2022, facilitating continuous safety assessments and compliance with evolving regulations.

- The European Union's EUDAMED database, fully operational since 2023, has improved transparency and traceability, contributing to a 20% increase in recall efficiency across EU member states.

Mergers, Acquisitions, and Competitive Landscape in the Medical Device Industry

Major Industry Consolidations and Strategic Partnerships

- In 2025, the global medical devices market size is estimated at around USD 679 billion, up from approximately USD 640 billion in 2024, showing steady growth supporting more merger and acquisition activity.

- Recent years saw over USD 30 billion worth of mergers and acquisitions globally, with top companies like Medtronic, Johnson & Johnson, and Abbott heavily investing in expanding portfolios and integrating advanced technologies.

- Strategic partnerships focusing on AI integration and digital health solutions increased by 18% in deal volume from 2023 to 2025, fueling innovation and speed to market.

- North America dominated consolidation activities with a market worth USD 210 billion in 2025, growing from USD 179 billion in 2021, highlighting increased capital flow into major strategic collaborations.

- Europe’s medical device market grew from USD 124 billion in 2021 to USD 148 billion in 2025, accompanied by numerous cross-border partnerships to tackle regulatory complexities and expand market reach.

Rise of Medical Device Startups and Disruptors

- Startup investments in 2025 exceeded USD 6 billion globally, a rise from USD 4.5 billion in 2022, reflecting accelerating interest in wearable tech, diagnostics, and AI-powered devices.

- The number of new startups entering the market grew by 22% year-over-year from 2023 to 2025, with emphasis on minimally invasive devices and home healthcare technology.

- Disruptive innovation by startups has contributed significantly to the 20% increase in medical device patents filed worldwide in 2025 compared to 2023, indicating a surge in proprietary technologies.

- Venture capital funding for digital health startups targeting medical device integration grew by 30% from 2022 through 2025, laying the foundations for cross-sector disruptive growth.

- Startups contributed to around 15% of new medical device market sales in 2025, compared to 10% in 2021, highlighting their growing impact on the industry’s competitive landscape.

Cross-Sector Collaborations in Digital Health

- Digital health partnerships involving medical device companies and IT firms grew by 25% from 2023 to 2025, fueled by demand for integrated healthcare solutions and IoMT devices.

- The medical device industry accounted for 38% of digital health investments in 2025, rising from 32% in 2022, marking an increased shift towards data-driven diagnostics and treatment monitoring.

- Collaborations with cloud service providers and AI developers led to a 15% reduction in device development time in 2025, compared to 2021, expediting innovation pipelines.

- The use of wearable devices for remote patient monitoring increased medical device revenues from digital health sectors by USD 14 billion in 2025, versus USD 9 billion in 2022.

- Regulatory adaptations for digital health integration accelerated, resulting in a 12% increase in fast-track approvals for cross-sector products in 2025 over 2023, enhancing market penetration speed.

Globalization and Supply Chain Management

- The medical device supply chain was valued at approximately USD 287 billion in North America alone in 2025, up from USD 210 billion in 2021, reflecting expanded production and distribution.

- Asia-Pacific’s medical device supply infrastructure grew by 28% from 2021 to 2025, with a total market value climbing to USD 128 billion in 2025.

- Global supply chain disruptions reduced significantly in 2025, with average lead times cut by 16% compared to 2023, due to strategic investments in resilient and regionalized supply chains.

- Logistics costs as a percentage of medical device market revenue decreased from 9.5% in 2023 to 7.8% in 2025, improving overall profitability.

- Increased outsourcing to specialized contract manufacturers grew by 20% between 2023 and 2025, enabling faster scale-up of production especially for high-demand devices.

Patient-Centric Trends In the Medical Device Industry and Market Demand Shifts

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Growth in Home Healthcare and Wearable Devices

- In 2025, the global home healthcare market involving medical devices contributed substantially to the $678.88 billion medical devices market, up from $640.45 billion in 2024, reflecting a market expansion driven largely by homecare technologies.

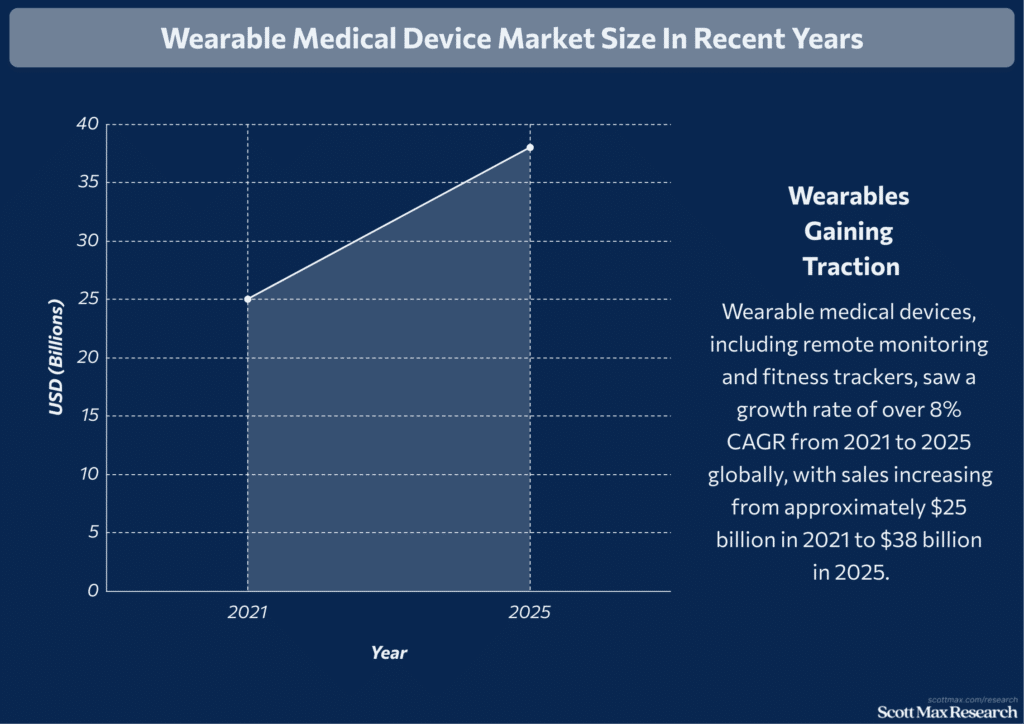

- Wearable medical devices, including remote monitoring and fitness trackers, saw a growth rate of over 8% CAGR from 2021 to 2025 globally, with sales increasing from approximately $25 billion in 2021 to $38 billion in 2025.

- The U.S., dominating over 60% of the wearable medical device segment, fueled this market with increasing adoption of home-use diagnostics and chronic disease monitors, up from $21 billion in 2021.

- Telehealth-driven device sales rose by 12% from 2023 to 2025 as home healthcare surged post-pandemic.

Personalized Medicine and Diagnostic Tools

- Diagnostic imaging and personalized diagnostic devices accounted for about 20% of the medical device market in 2025, totaling nearly $135 billion, growing from $120 billion in 2021.

- Investments in personalized medicine devices, including genomics-based diagnostic tools, rose to $14 billion in 2025, doubling from approximately $7 billion in 2018.

- In-vitro diagnostics contributed about 10% (~$68 billion) of the global market in 2025, up from $60 billion in 2021, reflecting growing demand for precision diagnostics.

- Sales of advanced diagnostic tools for oncology and cardiovascular diseases increased by 25% between 2020 and 2025 worldwide.

Aging Population and Chronic Disease Management

- The elderly population (65+) in North America grew by 5.3% annually from 2020 to 2025, resulting in heightened demand for chronic disease management devices, driving a 15% growth in device procurement over the same period.

- Devices targeting diabetes management, cardiac rhythm management, and respiratory diseases together accounted for over 35% ($238 billion) of the global medical device market in 2025, rising from $195 billion in 2021.

- The U.S. chronic disease medical device segment alone is expected to grow from $95 billion in 2021 to over $125 billion in 2025.

- Orthopedic implant markets expanded to about $45 billion globally in 2025, a 7% increase since 2021, driven by aging demographics.

Accessibility and Affordability Initiatives Worldwide

- Global initiatives to improve device accessibility contributed to the 26.8% ($148 billion) share of the European medical device market in 2025, increasing from $124 billion in 2021, with affordability programs boosting adoption in emerging geographies.

- North America held 38.1% ($210 billion) of the market in 2025, with government subsidies and insurance reimbursement enhancements aiding affordability; this represents an increase from $179 billion in 2021.

- Asia-Pacific's market share grew from $100 billion in 2021 to $128 billion in 2025, rising by 28%, driven by expanded healthcare access programs in countries like China, South Korea, and Japan.

Conclusion

The medical device industry has continually evolved, driven by cutting-edge technology, shifting regulations, and changing patient needs. Over the years, these trends have not only expanded market potential but also enhanced healthcare delivery worldwide. Looking ahead, innovation and patient-centered approaches will remain key to unlocking future growth and better outcomes.

Understanding these developments helps professionals and enthusiasts stay informed and prepared for what’s next. Take a moment to consider how these advancements might impact healthcare in your community—and stay curious about the exciting possibilities shaping the industry’s future.

Insights On Medical Device Industry Trends and Statistics

What is the current market size of the medical device industry?

The global medical device market reached approximately USD 679 billion in 2025 and is projected to grow to over USD 1.14 trillion by 2034, with a CAGR of 6%.

Which technologies are driving medical device innovations in 2025?

Key drivers include artificial intelligence, wearable devices, 3D printing, and robotic-assisted surgeries, enhancing patient care and operational efficiency.

How is the regulatory landscape evolving?

Regulatory bodies increasingly focus on accelerated approvals, cybersecurity, and postmarket surveillance to ensure a balance between safety and innovation.

What regions lead the medical device market?

North America remains the largest market hub, followed by Asia-Pacific and Europe, driven by advanced healthcare infrastructure and investment.

How is patient-centric care influencing market trends?

Growing demand for personalized medicine, home healthcare devices, and wearable health monitors is reshaping product development and market strategies.

References & Citations:

- Medical Devices Market Size, Share, and Trends 2025 to 2034

Deepa Pandey, Aditi Shivarkar (May 2025), Medical Devices Market Size, Share, and Trends 2025 to 2034 - Medical Device Industry Facts, Trends and Statistics 2025

Arterex Medical (Apr 2025), Medical Device Industry Facts, Trends and Statistics 2025 - Medical Devices Market Size, Share & Industry Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging Devices, In-vitro Diagnostics (IVD), Minimally Invasive Surgery Devices, Wound Management, Diabetes Care Devices, Ophthalmic Devices, Dental Devices, Nephrology Devices, General Surgery, and Others), By End-User (Hospitals & ASCs, Clinics, and Others), and Regional Forecast, 2025-2032

Fortune Business Insights (Jul 2025), Medical Devices Market Size, Share & Industry Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging Devices, In-vitro Diagnostics (IVD), Minimally Invasive Surgery Devices, Wound Management, Diabetes Care Devices, Ophthalmic Devices, Dental Devices, Nephrology Devices, General Surgery, and Others), By End-User (Hospitals & ASCs, Clinics, and Others), and Regional Forecast, 2025-2032 - Medical Devices – Worldwide

Statista (2025), Medical Devices – Worldwide - 2025 Forecast

Elizabeth Engler Modic (Jan 2025), 2025 Forecast - 2025 Medical Device Industry Report: Quality Challenges, Regulatory Complexity, and Economic Uncertainty

Matt McFarlane (Mar 2025), 2025 Medical Device Industry Report: Quality Challenges, Regulatory Complexity, and Economic Uncertainty - The Medical Device Market is Booming in the Future

Heena Singh (Jan 2025), The Medical Device Market is Booming in the Future - Future Outlook of the Medical Device Market: Trends, Investments, and Innovations

Occam Design (2025), Future Outlook of the Medical Device Market: Trends, Investments, and Innovations - Medical Devices Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Mordor Intelligence (Jul 2025), Medical Devices Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030) - The Global MedTech Industry Outlook 2025

MarketsandMarkets (2025), The Global MedTech Industry Outlook 2025 - Medical Devices Market Analysis, Size, and Forecast 2025-2029: North America (US and Canada), Europe (France, Germany, Italy, and UK), APAC (China, India, Japan, and South Korea), and Rest of World (ROW)

Technavio (Mar 2025), Medical Devices Market Analysis, Size, and Forecast 2025-2029: North America (US and Canada), Europe (France, Germany, Italy, and UK), APAC (China, India, Japan, and South Korea), and Rest of World (ROW)