23+ Motor Vehicle Manufacturing Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Have you ever wondered how the motor vehicle manufacturing industry has evolved amid rapid technological shifts and changing consumer demands? Motor Vehicle Manufacturing Trends reveal a fascinating journey of innovation, market growth, and sustainability efforts shaping the global economy today.

Tracking these trends and statistics is crucial for manufacturers, investors, and policymakers to stay ahead of the curve. This article dives deep into the key drivers and data shaping the industry's present and future landscape.

Global Production Trends in Motor Vehicle Manufacturing

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Historical Production Growth and Milestones

- Global motor vehicle production reached 94 million units in 2023, surpassing pre-pandemic levels by approximately 2 million units compared to 2019.

- The industry experienced a 1.1% growth from 2022 to 2023, with total output rising from 90.7 million to 91.7 million units.

- From 2008 to 2023, production nearly doubled in key markets, such as China, which increased from 9.3 million units in 2008 to 26.1 million units in 2023.

- The global vehicle production forecast anticipates exceeding 96 million units by 2030, marking a steady recovery and growth trajectory following the COVID-19 pandemic.

Impact of Raw Material Prices and Supply Chain Challenges

- Semiconductor shortages led to a 12.4% production dip in 2022, but recovery efforts resulted in a 3.8% increase in North American production by 2025, adding 434,000 units due to tariff improvements and improved supply chains.

- Raw material cost inflation, especially steel and lithium, increased manufacturing expenses by over 15% in 2023, slowing output growth in Europe and South America.

- South America's production declined slightly by 5,000 units in 2025, but a rebound of 16,000 units is expected in 2026, driven by increased demand for pickup trucks in Argentina.

- Japan’s production increased by 27,000 units in 2025, despite longer-term declines from project cancellations and transfers to Mexico.

Regional Production Leaders: China, Japan, and Europe

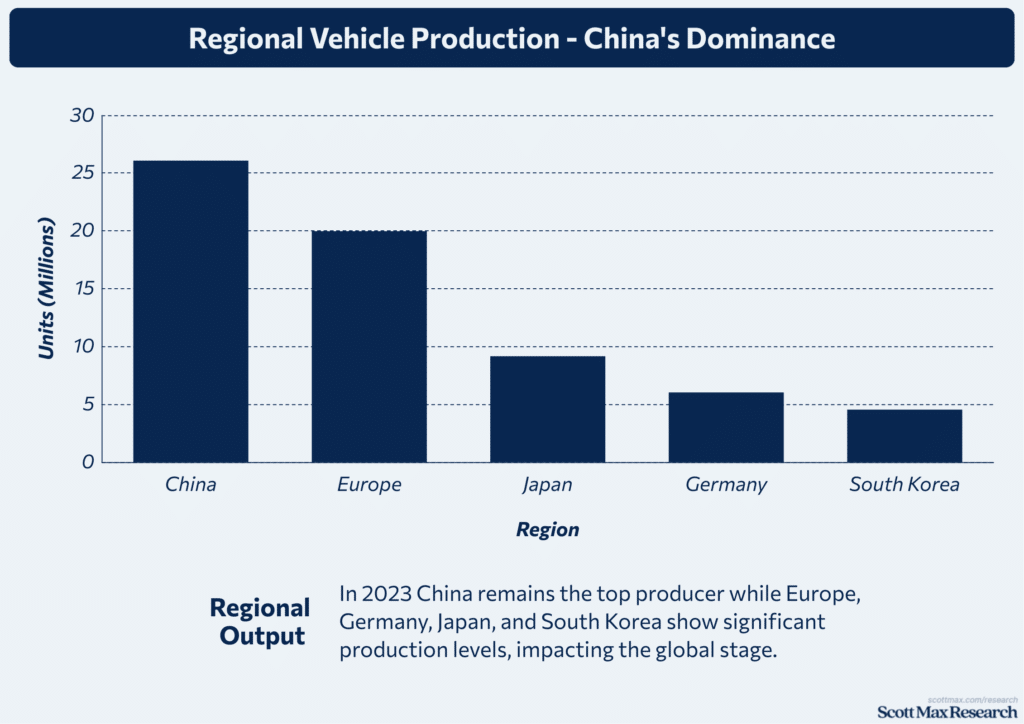

- China remains the top producer, with 26.1 million vehicles in 2023, over three times the 8.7 million units produced by Japan.

- Europe produced approximately 20 million vehicles in 2023, with Germany leading the way at 6 million units, representing a 2.1% increase from the previous year.

- Japan's production, although down from its 2008 peak of 11.5 million units, stabilized at around 9.2 million units in 2023, representing a 5.1% decline since 2015.

- South Korea’s output rose slightly by 0.7% to 4.56 million units in 2023, boosted by pre-tariff shipments to the US.

Segment-wise Production Analysis: Passenger Cars vs. Commercial Vehicles

- Passenger cars accounted for 68.5 million units in 2023, a 1.1% increase from 2022. China produced 21 million cars, nearly three times the US output of 7.9 million cars.

- Commercial vehicle production reached 22.2 million units globally in 2023, growing steadily from 17.9 million in 2008, but still lagging behind the growth rates of passenger cars.

- In North America, commercial vehicle production reached 7.9 million units in 2023, a 3.8% increase from 2019, driven by strong demand for pickups and trucks.

Technological Innovations Shaping the Industry: Motor Vehicle Manufacturing Trends

Rise of Electric Vehicles (EVs) and Alternative Powertrains

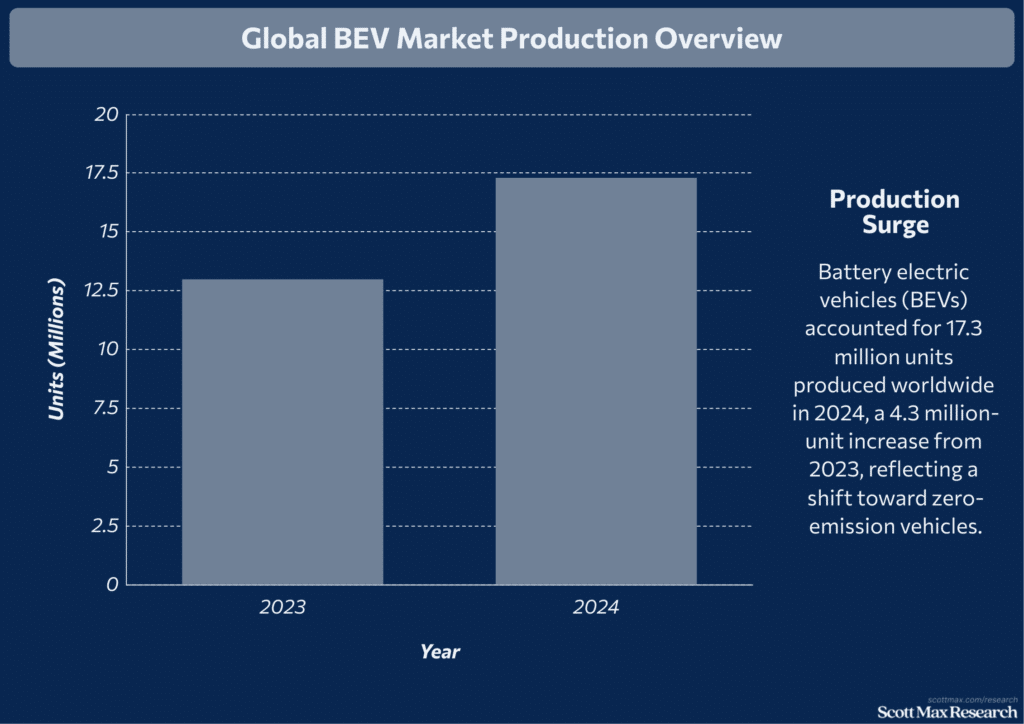

- Global electric vehicle production reached 17.3 million units in 2024, a 4.3 million-unit increase from 2023, primarily driven by a surge in output from China.

- China produced over 12 million EVs in 2024, accounting for nearly 70% of global EV production, while Europe and North America lagged with 3.5 million and 1.8 million units, respectively.

- Hybrid vehicles contributed significantly, with global sales reaching 6.8 million units in 2024, up from 5.2 million in 2023, supporting growth amid slowing pure EV adoption in some regions.

- By 2030, EVs are projected to represent 50-55% of new vehicle sales in Europe and China, with North America expected to reach 20-30% penetration.

Advancements in Semiconductor and Chip Technologies

- Semiconductor shortages led to a 12.4% decline in vehicle production in 2022; however, improvements resulted in a 3.8% production increase in North America in 2025, adding 434,000 units.

- South Korea’s chip manufacturing ramp-up contributed to a production increase of 22,000 units in 2025, ahead of US tariff changes.

Automation and Robotics in Manufacturing Plants

- Automation adoption rose sharply, with robot density in automotive manufacturing reaching 1,200 robots per 10,000 employees in 2024, up from 950 in 2020.

- Robotics investments increased by 22% globally in 2024, enabling higher precision and faster assembly lines, which reduced production cycle times by an average of 15%.

- Major plants in Germany and Japan integrated AI-driven quality control systems, reducing defects by 30% and increasing throughput by 12%.

Research and Development Investments by Leading Manufacturers

- The Volkswagen Group led R&D spending, investing $18.5 billion in 2024, with a focus on alternative powertrains and lifecycle engineering, representing a 10% increase over 2023.

- Toyota invested $14 billion in 2024, with a focus on hybrid technologies and fuel cell development, up from $12.5 billion in 2023.

- Global automotive R&D expenditure reached $120 billion in 2024, a 7% rise compared to 2023, with over 60% allocated to electrification and software development.

Market Dynamics and Consumer Demand Shifts: Motor Vehicle Manufacturing Trends

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Global Sales Trends and Recovery Post-Pandemic

- Global vehicle sales are projected to reach 98.8 million units in 2025, up from 95.9 million units in 2023, reflecting a modest growth of 2.9 million vehicles amid economic pressures.

- North America's light vehicle sales forecast is expected to increase by 248,000 units in 2025, supported by tariff improvements and a stronger production cadence.

- China remains the largest automotive market, with domestic sales hitting 26.5 million vehicles in 2024, a rise of 1.8 million units compared to 2023, driven mainly by EV demand.

- Europe’s new vehicle registrations reached 15.3 million units in 2024, showing a slight decline of 200,000 units compared to 2023 due to regulatory changes and supply chain issues.

Changing Consumer Preferences: From SUVs to EVs

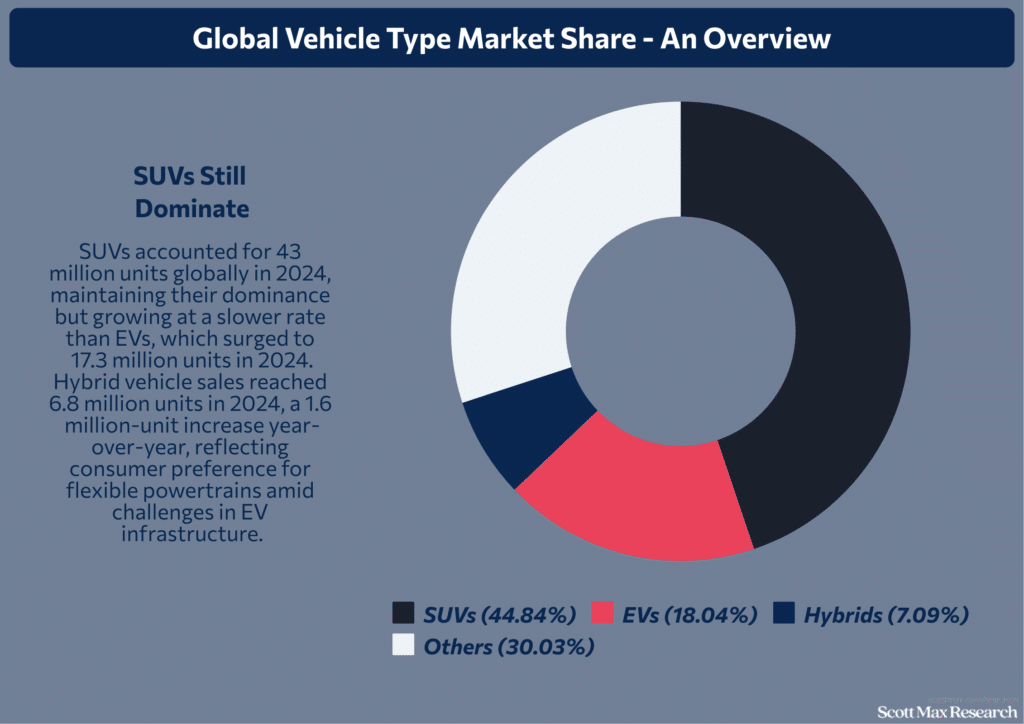

- SUVs accounted for 43 million units globally in 2024, maintaining their dominance but growing at a slower rate than EVs, which surged to 17.3 million units, representing a 4.3 million-unit increase from 2023.

- Hybrid vehicle sales reached 6.8 million units in 2024, a 1.6 million-unit increase year-over-year, reflecting consumer preference for flexible powertrains amid challenges in EV infrastructure.

- EVs are expected to represent 10% of all new car sales by 2025, with projections reaching 58% by 2040, signaling a long-term shift in consumer demand.

Influence of Environmental Regulations on Vehicle Design

- The EU’s 2025 CO2 emission target of 93.6 grams per kilometer is prompting manufacturers to accelerate the production of zero-emission vehicles, with BEVs and hybrids accounting for over 30% of new models in 2024.

- Compliance costs increased vehicle prices by approximately $1,200 per unit in 2024, influencing consumer purchasing decisions and encouraging the adoption of hybrids.

Competitive Landscape: Key Players and Market Shares

- China leads EV production with 12 million units in 2024, controlling nearly 70% of the global EV market, while legacy automakers such as Volkswagen and Toyota hold a combined 20% market share in their efforts to electrify their fleets.

- Volkswagen Group increased its EV sales by 1.5 million units in 2024, reaching 4.8 million units —a 45% increase from 2023 —supported by partnerships with Chinese manufacturers.

- Toyota’s hybrid sales hit 2.3 million units in 2024, up from 1.9 million in 2023, maintaining leadership in hybrid technology.

- Emerging markets such as India and Brazil showed a 15% growth in EV and hybrid sales combined, with India’s EV market expected to reach 30% of new car sales by 2030.

Regional Insights and Manufacturing Clusters: Motor Vehicle Manufacturing Trends

Asia-Pacific: China and India’s Manufacturing Hubs

- China produced 26.1 million light vehicles in 2023, a 355,000-unit increase from 2022, maintaining its position as the world's largest motor vehicle manufacturing hub.

- Domestic demand and export recovery contributed to this growth, with electric vehicle (EV) production surpassing 12 million units in 2024, accounting for nearly 70% of global EV output.

- India produced approximately 4 million vehicles annually in 2024, ranking as the world's fourth-largest vehicle manufacturer. The automotive sector contributed 49% to India's manufacturing GDP and 7.1% to the country's total GDP.

- The Indian automotive market value reached $129.4 billion in 2025, expected to grow to $276.5 billion by 2034 at a CAGR of 8.8%, fueled by low labor costs and abundant raw materials.

Europe: Germany’s Automotive Powerhouse and Emerging Markets

- Europe produced approximately 20 million vehicles in 2023, with Germany leading the way at 6 million units, representing a 2.1% increase from the previous year.

- The European market saw EVs and plug-in hybrids make up over 30% of new vehicle models in 2024, driven by stringent CO2 emission regulations targeting 93.6 grams/km by 2025.

- Emerging markets like Poland and the Czech Republic increased production by 150,000 units combined in 2024, supported by investments in EV manufacturing and battery plants.

North America: US and Mexico’s Production Trends

- North America’s light vehicle production forecast for 2025 increased by 434,000 units, reaching approximately 17 million units, driven by tariff improvements and reshoring efforts.

- The U.S. accounted for 11 million vehicles produced in 2024, while Mexico’s production rose to 4.5 million units, up by 22,000 units from 2023, partially due to advanced shipments ahead of tariff changes.

- Commercial vehicle production in North America grew by 3.8% in 2024, with pickups and light trucks comprising over 60% of sales.

Emerging Clusters and Future Growth Regions

- South America’s vehicle production slightly declined by 5,000 units in 2025 but is expected to rebound with a 16,000-unit increase in 2026, driven by Argentina’s pickup truck market.

- Southeast Asia, including Thailand and Vietnam, increased production by 120,000 units in 2024, with a focus on affordable EVs and hybrid models.

- African automotive manufacturing remains nascent but grew by 35,000 units in 2024, supported by local assembly plants and government incentives.

Future Outlook and Industry Challenges: Motor Vehicle Manufacturing Trends

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Sustainability and Circular Economy in Vehicle Manufacturing

- Global vehicle production is forecasted to exceed 96 million units by 2030, surpassing the pre-COVID peak of 93 million units in 2019, around 2028, driven largely by electrification and sustainability efforts.

- Battery electric vehicles (BEVs) accounted for 17.3 million units produced worldwide in 2024, a 4.3 million-unit increase from 2023, reflecting a shift toward zero-emission vehicles.

Supply Chain Resilience and Risk Management

- Semiconductor shortages led to a 12.4% decline in vehicle production in 2022; however, recovery efforts resulted in a 3.8% increase in North American production in 2025, adding 434,000 units due to improved sourcing and tariff adjustments.

- South America’s vehicle production saw a slight dip of 5,000 units in 2025, but a rebound of 16,000 units is forecast for 2026, driven by improved supply chain logistics.

Impact of Global Economic Factors and Trade Policies

- North America’s light vehicle production forecast increased by 434,000 units for 2025, driven by tariff improvements and the sourcing of USMCA-compliant parts.

- Europe’s light vehicle production outlook rose by 18,000 units in 2025, despite anticipated demand declines in the latter half of the year, with positive revisions for 2026 due to expected tariff reductions on US imports.

- Japan’s production forecast improved by 27,000 units in 2025, while South Korea’s increased by 22,000 units due to advanced shipments ahead of US tariff changes.

Predicted Trends for 2025 and Beyond

- Global motor vehicle production is expected to grow steadily, reaching over 96 million units by 2030, with China and South Asia leading the growth, while Europe and North America are projected to remain below pre-pandemic levels beyond 2030.

- BEV penetration is projected to reach 50-55% in Europe and China by 2030, with North America trailing at 20-30%, supported by government incentives and infrastructure expansion.

- Hybrid vehicle sales are resurging, supporting growth amid BEV production challenges, with global hybrid sales increasing by 1.6 million units in 2024 compared to 2023.

- Software-defined vehicles and digitalization will dominate new models, impacting OEMs and suppliers, with over 25% of innovation projects in 2024 focused on connectivity and autonomous driving technologies.

Conclusion

As the motor vehicle manufacturing industry rapidly evolves, key trends such as electrification, software integration, and sustainability are transforming the design and manufacturing of vehicles. Statistical insights reveal a shift toward hybrid models, flexible manufacturing, and the emergence of growing regional hubs, highlighting an industry that is adapting to economic pressures and consumer demands.

For manufacturers and stakeholders, embracing innovation and resilience is essential to thrive in this dynamic landscape. Reflecting on these trends can inspire smarter strategies and a more sustainable future, making it clear that the road ahead is both exciting and transformative.

Insights On Motor Vehicle Manufacturing Industry Trends and Statistics

What are the latest global production trends in motor vehicle manufacturing?

Global motor vehicle production reached approximately 94 million units in 2023, marking an 11% year-on-year increase. China leads with a 35.4% market share, while production in regions like the EU and North America has seen slight declines recently.

How is electrification impacting the motor vehicle industry?

Electric vehicle (EV) sales surged globally, with over 17 million EVs sold in 2024, representing a 25% increase from the previous year. EVs are expected to account for more than 50% of all new vehicle models by 2030, driven by consumer demand and stricter emissions regulations.

What role does technology play in shaping industry trends?

Technological advances, such as autonomous driving, connected cars, and AI-powered manufacturing, are transforming production efficiency and customer experience, making software and electrification key drivers of growth.

Which regions are experiencing significant growth in vehicle manufacturing?

The Asia-Pacific region, particularly China and India, is experiencing rapid expansion. India's EV sales crossed 2 million in 2024, growing 24%, while Brazil and South America also show steady production increases.

What challenges does the industry face moving forward?

Supply chain disruptions, geopolitical tensions, and evolving emission regulations create uncertainty. Manufacturers must focus on sustainability, innovation, and resilient supply chains to maintain growth and competitiveness.

References & Citations:

- June 2025 Light Vehicle Production Forecast

Mike Wall (Jun 2025), June 2025 Light Vehicle Production Forecast - Production Statistics

OICA (2025), Production Statistics - Automotive industry worldwide – statistics & facts

Mathilde Carlier (Nov 2024), Automotive industry worldwide – statistics & facts - The Automobile Industry Pocket Guide 2024/2025

ACEA (Sep 2024), The Automobile Industry Pocket Guide 2024/2025 - Global Automotive Supplier Study 2025

Felix Mogge, Florian Daniel (May 2025), Global Automotive Supplier Study 2025 - Production Statistics Overview

OICA (2024), Production Statistics Overview - Global EV Outlook 2025

IEA (May 2025), Global EV Outlook 2025 - Global Automotive Supplier Study 2025

Roland Berger, Lazard (2025), Global Automotive Supplier Study 2025 - Key Technology Trends in the Automotive Industry in 2025

Anastasia Andriiuk, Victoria Sokolova (Jun 2025), Key Technology Trends in the Automotive Industry in 2025 - Trends and challenges shaping the automotive industry in 2025

Dr. Michael Malterer (Jan 2025), Trends and challenges shaping the automotive industry in 2025 - Automotive Industry in 2025 – Trends That Will Define the Future

Niranjana R (Apr 2025), Automotive Industry in 2025 – Trends That Will Define the Future - 10 Important Auto Industry Trends (2025-2027)

Josh Howarth (Jun 2025), 10 Important Auto Industry Trends (2025-2027) - 2025 Global Automotive Consumer Study

Lisa Walker, Dr. Harald Proff (Jan 2025), 2025 Global Automotive Consumer Study - 50 Automotive Statistics that Will Shape Your Strategy in 2025

John (2025), 50 Automotive Statistics that Will Shape Your Strategy in 2025 - Auto Industry Sales Performance of March 2025, Q4 (Jan– March 2025) and April 2024 – March 2025

Rajesh Menon, SIAM (Apr 2025), Auto Industry Sales Performance of March 2025, Q4 (Jan– March 2025) and April 2024 – March 2025 - Motor Vehicles Global Market Report 2025 – By Type (Motorcycle And Bicycle, Passenger Car, Commercial Vehicle), By Fuel Type (Gasoline, Diesel, Other Fuel Types), By Engine Capacity (<1000 cc, <1000-1500 cc, <1500-2000 cc, >2000 cc), By Propulsion Type (IC Engine, Electric Vehicle) – Market Size, Trends, And Global Forecast 2025-2034

The Business Research Company (Jan 2025), Motor Vehicles Global Market Report 2025 – By Type (Motorcycle And Bicycle, Passenger Car, Commercial Vehicle), By Fuel Type (Gasoline, Diesel, Other Fuel Types), By Engine Capacity (<1000 cc, <1000-1500 cc, <1500-2000 cc, >2000 cc), By Propulsion Type (IC Engine, Electric Vehicle) – Market Size, Trends, And Global Forecast 2025-2034 - Global Automotive Outlook: Predictions For 2025

Sarwant Singh (Jan 2025), Global Automotive Outlook: Predictions For 2025