19+ Music Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

The music industry is entering a new era defined by rapid technological innovation and data-driven decision-making. AI-powered tools are revolutionizing music creation and curation, while analytics enable hyper-personalized listener experiences and targeted marketing.

As streaming, immersive audio, and virtual concerts reshape the way people consume music, data, and analytics will be central to predicting trends, optimizing revenue, and guiding artists and labels toward future growth.

The Rise and Fall of Physical Music Sales

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Global Physical Revenue Trends

- In 2024, global physical music revenues reached $4.8 billion, representing a 3.1% decline from the previous year. This follows a strong 14.5% increase in 2023.

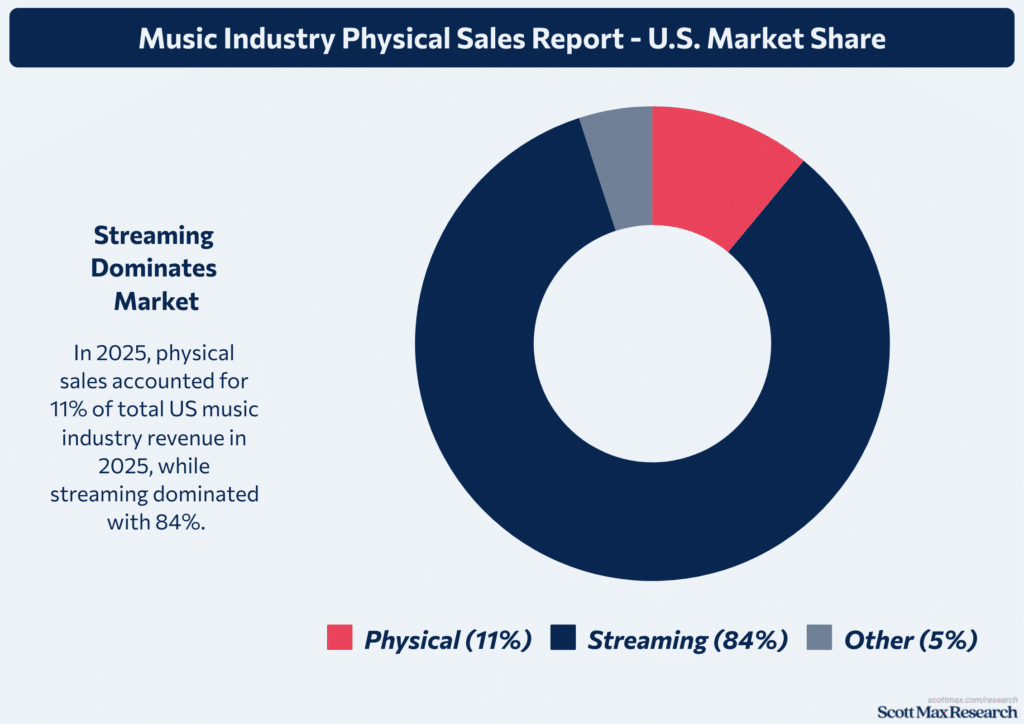

- Physical sales accounted for 11% of total US music industry revenue in 2025, while streaming dominated with 84%.

- In the UK, overall physical sales rose by 5.7% in Q1 2025 (4,112,208 units), compared to just 2.4% growth in Q1 2024.

- Physical album sales in the UK increased by 3.2% year-on-year to 8,044,760 units in the first half of 2025. In the same period in 2023, growth was negative at -0.3%.

CD and Vinyl Sales

- CD revenues fell by 6.1% in 2024, while music video revenues dropped by 15.5%.

- Vinyl revenues grew by 4.6% in 2024, marking the 18th consecutive year of vinyl growth.

- In the US, independent retail sales of physical formats in 2024 totaled 22.9 million units, comprising 17.3 million vinyl records and 5.4 million CDs.

- In the UK, Sam Fender’s album “People Watching” sold 103,101 physical units in Q1 2025 (out of 142,419 total), showing strong demand for physical releases.

- Sam Fender’s previous No.1 album saw 91,833 physical sales out of 107,000 total units.

Cassette and Other Formats of Music Storage

- Cassette sales in the UK surged by 204.7% in Q1 2025, reaching 63,288 units, compared to 20,776 units sold in Q1 2024.

- In 2024, UK cassette sales totaled 195,000 units, up from 110,000 units in 2023.

- The highest-selling cassette in Q1 2025 was Sam Fender’s “People Watching,” with 8,912 cassette units sold.

- In the US, cassette sales reached 320,000 units in 2024, compared to 270,000 units in 2023.

- In Japan, cassette sales for 2024 totaled 45,000 units, down from 52,000 units in 2023, indicating regional variations in trends.

- Globally, total cassette sales are estimated at 1.1 million units in 2024, compared to 900,000 units in 2023.

Market Share and Historical Comparison

- In 1999, global recorded music sales (adjusted for inflation) would equate to $70 billion in 2023; the actual 2023 value was $41 billion.

- The recorded music industry’s total revenue in 2020 was $23.1 billion, with streaming accounting for 56% and the remainder coming from physical sales.

- In 2019, physical media sales increased, with vinyl sales rising by 5% and CD sales by 13%. In the first half of the year, CDs generated $485 million, while vinyl sales reached $224 million.

Artist and Consumer Trends

- 76% of Generation Z (ages 18–24) buy vinyl records, with 80% owning a record player and 30% identifying as “die-hard collectors”.

- Over 2,500 Gen Z respondents were surveyed across the US, UK, and Germany, confirming that three-quarters buy records at least once a month.

- 84% of Gen Z music fans prefer purchasing music in record shops rather than online, emphasizing community and physical experience.

- 87% of Gen Z vinyl fans value high-quality sound and invest in equipment for intentional listening.

- In the UK, vinyl manufactured orders rose by 50% from January to May 2025 compared to the same period in 2024, with the average order quantity per order up 41%.

- The vinyl record market is valued at $2.42 billion in 2025 and is projected to reach $5.06 billion by 2032.

- In Canada, vinyl outsold CDs in 2024, with 1,867,640 vinyl LPs sold versus 1,854,710 CDs, a difference of 13,930 units; vinyl sales increased by 32.4% year-over-year.

- In early 2025, Canada sold 39,517 LPs and 32,277 CDs in the first full week, giving vinyl a lead of 7,240 units.

- The decline in CD sales slowed to -2.9% in the UK in 2024, while vinyl album sales rose for the 17th consecutive year by 9.1%.

- High-profile releases drive physical sales: Sam Fender’s “People Watching” sold 103,101 physical units (Q1 2025), and Sabrina Carpenter’s recent album saw over 50,000 physical sales in its debut week in the UK (2025 figures).

The Digital Revolution: Downloads to Streaming in the Music Industry

Global Revenue Shift

- In 2014, global recorded music revenue totaled $14 billion, with CDs remaining the primary source.

- By 2024, the industry’s value more than doubled to $29.6 billion, driven by digital innovation and licensing.

- Streaming accounted for 69% of total revenue in 2024, compared to a much smaller share a decade prior.

- In 2024, streaming revenue surpassed $20 billion for the first time.

- Subscription streaming alone contributed over 50% of global recorded music revenues in 2024.

- The number of paid streaming subscription accounts reached 752 million in 2024, up from 263 million in 2014 and a 10.6% increase from the previous year.

- Streaming’s share of industry revenue reached 84% in 2024.

Decline of Digital Downloads

- In 2012, global digital download revenue reached its peak at $4.4 billion.

- By 2014, digital downloads generated $3.6 billion, accounting for 37% of global recorded music revenue.

- In the US, 1.1 billion digital tracks were sold in 2012; this fell to 429 million in 2017 and further to 151 million in 2023.

- Global digital album sales dropped from 207 million units in 2014 to 28 million units in 2023.

- In the UK, digital download revenue was £122 million in 2014, declining to just £27 million in 2024.

- Digital downloads represented 13% of global recorded music revenue in 2015, falling to 3% in 2024.

- In 2024, global digital download revenue was estimated at $0.9 billion, compared to $2.8 billion in 2018.

- Major platforms, such as iTunes, experienced a 60% reduction in download sales between 2015 and 2024.

- The number of digital download users worldwide decreased from 500 million in 2014 to under 100 million in 2024.

- In Japan, digital download sales fell from ¥45 billion in 2014 to ¥9.8 billion in 2024.

- In Australia, digital download revenue dropped from A$43 million in 2014 to A$7 million in 2024.

- The transition to streaming accelerated after 2015, with streaming revenue surpassing download revenue globally for the first time in 2016.

- By 2024, over 752 million people subscribed to streaming services, compared to fewer than 100 million regular download purchasers.

- The global market share of digital downloads is projected to decline further, with estimates indicating a decline below 2% by 2026.

Market and User Expansion

- Global music streaming revenue reached $17.5 billion in 2024.

- Over 600 million people subscribed to music streaming platforms in 2024.

- In 2024, 78% of people listened to music via streaming services.

- Paid music streaming made up 23% of all music streaming revenue in 2024.

- The number of subscription account users increased from 680 million in 2023 to 752 million in 2024.

Streaming’s Dominance and Market Growth in the Music Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Global Revenue Growth

- The global music streaming market reached $46.7 billion in early 2025, up from $34.5 billion in 2022, representing a growth of $12.2 billion over a three-year period.

- Streaming revenue surpassed $20.4 billion in 2024, accounting for 69.0% of total recorded music revenues, and added $1.4 billion in growth compared to the previous year.

- Revenue from music streaming is projected to reach $47.06 billion in 2025 and is forecasted to grow to $143.89 billion by 2032.

Subscriber Growth

- The number of global music streaming subscribers reached 667 million in 2023, up from 589 million in 2021, representing an increase of 78 million subscribers over a two-year period.

- Over 600 million people were subscribed to a music streaming platform in 2025.

- Paid music streaming accounted for 23% of all music streaming users in 2025.

Market Share and Usage Patterns

- Streaming made up 84% of total music industry revenue in 2025, up from previous years.

- In 2025, 78% of people listened to music via a streaming service.

- The on-demand streaming segment is set to account for more than half of the global music streaming market share in 2025.

- The audio content segment is anticipated to account for nearly half of the total revenue share in 2025.

Regional Performance

- North America is projected to lead the market with $20.98 billion in revenue by 2025.

- The Asia Pacific is expected to see the fastest growth, projected to account for over one-third of the global market revenue by 2025, driven by expansion in India and China.

- In Japan, the market size is forecasted to reach $3.3 billion by 2025.

- China is expected to add approximately $13.9 billion in market opportunity by 2025, with a growth rate of 40.1%.

The Role of Major Labels and Industry Consolidation in the Music Industry

Market Share Shifts Among Major Record Labels

- Universal Music Group (UMG) achieved a 36.82% market share in Q1 2025, up from 33.90% in 2024, representing a nearly 3 percentage point increase.

- Interscope Geffen A&M (IGA), under UMG, surged to 12.67% in Q1 2025, up from 9.10% in Q1 2024, overtaking Republic Records.

- Republic Records held a 12.52% share in Q1 2025, slightly down from 12.84% in Q1 2024.

- Sony Music Group increased its market share to 27.37% in 2025, up from 26.91% in 2024.

- Warner Music Group (WMG) maintained relative stability, with a 15.89% share in 2025, down marginally from 15.98% in 2024.

- In 2023, UMG led globally with a 31.8% share, followed by independents at 30.6% and Sony at over 22%.

The Rise of Independent Labels in the Digital Era

- Independents collectively held a 19.92% market share in Q1 2025, down from 23.21% in 2024, indicating a loss of over 3 percentage points in one year.

- In 2023, independents’ share was 30.6% globally, just below UMG’s 31.8%.

- By 2025, independents are estimated to have a 30–35% global market share, driven by digital distributors like Believe and regional leaders such as T-Series (India) and Avex (Japan).

Impact of Industry Consolidation

- The industry consolidated from four major labels to three after EMI split in 2012, with UMG, Sony, and WMG now controlling over 60% of the global market, collectively generating $25–$26 billion in annual revenue by the mid-2020s.

- UMG’s acquisitions include PolyGram (1998), BMG Music Publishing, Univision Music Group, Sanctuary Music Group, and V2, expanding its artist roster and catalog.

- Sony’s merger with BMG in 2004 and subsequent acquisition of BMG’s stake in 2008 for $1.2 billion solidified its position as the second-largest label.

Regional and Global Dynamics

- The USA remains the largest recorded music region, holding a 40.3% share of global revenues in 2024.

- Sony’s music segment generated over $10 billion in revenue in 2024, more than double the $4.5 billion it reported in 2014.

- Warner Music Group's global market share in 2025 is 19.09%, with a roster that includes Ed Sheeran and the Red Hot Chili Peppers.

Emerging Trends: Live Music, AI, and Globalization in the Music Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Live Music Resurgence

- The global live music market is projected to reach $38.2 billion by 2025, up from $37.7 billion in 2024, representing a $0.5 billion increase year-over-year.

- The electronic music sector, a major driver of live events, hit a record $12.9 billion in 2025, up from $12.2 billion in 2024, a 6% annual increase.

Integration of Artificial Intelligence

- AI-generated music currently accounts for approximately 0.1% of the global royalty pool, according to industry estimates as of 2025.

- In 2023, artist and repertoire (A&R) and marketing spending reached an all-time high of $8.1 billion, with a significant portion allocated to AI-driven tools for music discovery and production.

- AI is increasingly used for playlist curation, sync licensing, and audience targeting, driving efficiency and innovation across the value chain.

Globalization and Regional Growth Patterns

- Global recorded music revenues reached $29.6 billion in 2024, a $1.36 billion increase from $28.24 billion in 2023.

- Every region experienced growth in 2024, with the Middle East and North Africa (MENA) leading at 22.8% growth, followed by Sub-Saharan Africa at 22.6% (surpassing $110 million for the first time), and Latin America at 22.5%.

- 55 of 58 markets recorded revenue growth in 2024, including 8 of the top 10 global music markets.

- Paid streaming subscriptions reached 752 million users in 2024, up 10.6% from 680 million in 2023.

Conclusion

The music sector has undergone a remarkable transformation, driven by digital adoption, AI integration, and the global rise of streaming services. Streaming remains the primary revenue engine, with AI-curated playlists and personalized experiences reshaping how audiences engage with music. Emerging markets, particularly in Asia and Africa, are driving growth and fostering cross-border collaborations.

As short-form video and influencer-driven marketing become industry standards, the sector’s future will be defined by innovation, new revenue streams, and ongoing adaptation to technological change.

Insights On Music Industry Trends and Statistics

How is the global music industry performing financially

Global recorded music revenues grew for the tenth consecutive year in 2024, reaching $29.6 billion, with streaming as the main growth engine

What are the dominant trends in music consumption

Streaming platforms and personalized AI-curated playlists drive user engagement, while physical formats continue to decline, except for vinyl, which has seen its 18th consecutive year of growth.

How is technology shaping music creation and marketing

AI is transforming music production, talent discovery, and sync licensing while short-form video and influencer collaborations drive marketing strategies.

Which regions are fueling industry growth

Emerging markets in Asia and Africa are driving the global music market's expansion and fostering cross-border collaborations.

What challenges does the industry face

Illegal downloads, piracy, and rising concert ticket prices remain significant hurdles, even as mergers, acquisitions, and new technologies reshape the landscape.

References & Citations:

- Global Music Report 2025

IFPI (2025), Global Music Report 2025 - Music Streaming Services Stats (2025)

Fabio Duarte (Apr 2025), Music Streaming Services Stats (2025) - Goldman Sachs lowers its forecasts for global music industry

Stuart Dredge (Jun 2025), Goldman Sachs lowers its forecasts for global music industry - IMS Business Report 2025: The Global Electronic Music Industry Hits a Record $12.9 Billion

International Music Summit (Apr 2025), IMS Business Report 2025: The Global Electronic Music Industry Hits a Record $12.9 Billion - IFPI Global Music Report 2025: Paid streaming lifts the market but overall revenue growth slows

Andre Paine (Mar 2025), IFPI Global Music Report 2025: Paid streaming lifts the market but overall revenue growth slows - IFPI looks at a decade of digital transformation in the music industry

Lauri Rechardt (Apr 2025), IFPI looks at a decade of digital transformation in the music industry - Q1 2025 Record Label Market Share: Interscope Surges Into Lead as Universal, Sony Make Gains

Dan Rys (Apr 2025), Q1 2025 Record Label Market Share: Interscope Surges Into Lead as Universal, Sony Make Gains - Record Labels in the World 2025

Magnus Torstensson (2025), Record Labels in the World 2025 - Digital and physical revenue market share of the largest record companies worldwide from 2012 to 2023

Statista Research Department (Jun 2025), Digital and physical revenue market share of the largest record companies worldwide from 2012 to 2023 - The Biggest Music Labels Companies in the World

Arash F (Jun 2025), The Biggest Music Labels Companies in the World - Music Industry Statistics and Trends for 2025

Lev Baker (Feb 2025), Music Industry Statistics and Trends for 2025 - Record Label Industry Statistics, Market Share, Size & Future Outlook

Record Label Mavericks (2025), Record Label Industry Statistics, Market Share, Size & Future Outlook - Music Streaming Report: Trends and Forecasts 2025-2033

Data Insights Market (Jun 2025), Music Streaming Report: Trends and Forecasts 2025-2033 - Music Streaming – Worldwide

Statista (2025), Music Streaming – Worldwide - Music Streaming Market is Expanding Rapidly with 17.3% CAGR by 2032, Driven by On-Demand Audio and Subscription Growth

Coherent Market Insights (May 2025), Music Streaming Market is Expanding Rapidly with 17.3% CAGR by 2032, Driven by On-Demand Audio and Subscription Growth - Online Music Streaming – Global Market Trajectory & Analytics to 2025

Research and Markets (May 2020), Online Music Streaming – Global Market Trajectory & Analytics to 2025 - Music Streaming Market Report and Forecast 2025-2034

Claight Corp. (Dec 2024), Music Streaming Market Report and Forecast 2025-2034 - The State of Physical Music in 2025: Vinyl, CDs & A Message to Record Labels

Phil Aston (Mar 2025), The State of Physical Music in 2025: Vinyl, CDs & A Message to Record Labels - Ahead of Record Store Day, physical sales surge in Q1 as UK artists make a chart impact

Andre Paine (Apr 2025), Ahead of Record Store Day, physical sales surge in Q1 as UK artists make a chart impact - Inside the physical sales surge including fandom, CD's resilience and the price of vinyl

Andre Paine (Jul 2024), Inside the physical sales surge including fandom, CD's resilience and the price of vinyl - Omdia forecasts new highs for recorded-music retail sales, but growth set to slow

Omdia (Jun 2023), Omdia forecasts new highs for recorded-music retail sales, but growth set to slow - 23 Music Industry Statistics: 2025 Sales, Trends & More

Christopher Benitez (2025), 23 Music Industry Statistics: 2025 Sales, Trends & More - US Music Industry Update, February 2025

Simon Dyson (Feb 2025), US Music Industry Update, February 2025