19+ Payment Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Ever wondered how the way we pay for things has changed so dramatically in just a few years? Payment industry trends reveal a fascinating shift from cash and cards to digital wallets, real-time payments, and embedded finance.

As consumers demand faster, safer, and more convenient options, this evolution is reshaping global commerce and opening doors to innovations like AI-driven fraud prevention and crypto payments. Let’s dive into the key data and future trends driving this transformation.

Evolution of Payment Methods: From Cash to Digital Dominance

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Decline of Cash Payments Worldwide

- Cash usage in in-person transactions globally dropped to 18% in 2023 from 31% in 2016. In Sweden, just 1 in 10 in-store purchases used cash by 2024, down significantly from 2010.

- Over 70 million merchants globally accepted digital wallets in 2024, compared to 15 million in 2017, marking a major infrastructure shift away from cash payments.

- In the U.S., cash usage has consistently decreased, with digital payments becoming the norm for 9 out of 10 consumers as of 2023, rising from approximately 8 out of 10 in 2018.

Rise of Card Payments and Their Market Share

- The global cards & payments market grew from $1,040.5 billion in 2024 to $1,131.6 billion in 2025.

- Contactless card usage surpassed 80% of all card-present transactions in the U.S. by the end of 2023, up from just 53% in 2020.

- Debit and credit card spending worldwide increased annually, with card transaction value in Europe rising 15% from 2022 to 2024.

- In Sweden, card payments dominate, accounting for over 85% of all retail payments by 2024, compared to 70% in 2016.

Growth of Mobile Wallets and Contactless Solutions

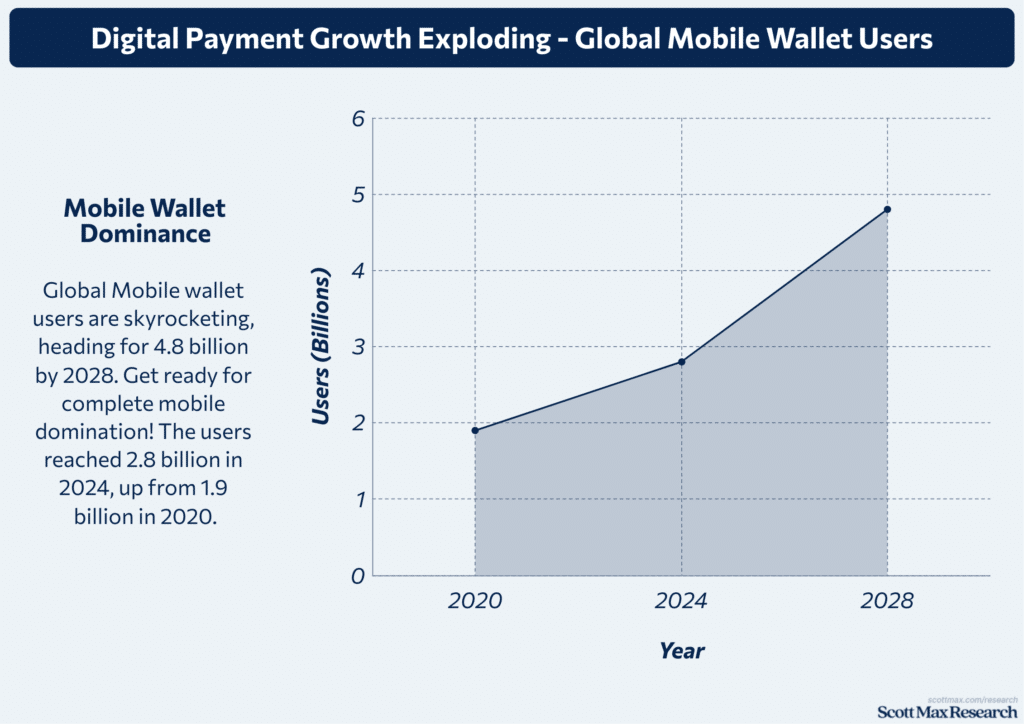

- Global mobile wallet users reached 2.8 billion in 2024, projected to hit 4.8 billion by 2028. This is up from 1.9 billion in 2020.

- Consumer spending through digital wallets surged to over $10 trillion in 2025, compared to $5.5 trillion in 2020.

- Digital wallets made up 49% of all e-commerce payments and 32% of POS transactions globally in 2023; by 2026, they're expected to rise to 52% and 39% respectively.

- In the U.S., the number of people using proximity mobile payments rose to 125 million in 2025 from 92.3 million in 2020, a 35% increase over five years.

Peer-to-Peer (P2P) and QR Code Payments Surge

- The P2P payments market expanded from $3.32 billion in 2024 to $3.78 billion in 2025 at a CAGR of 13.9%. Projections show it reaching $7.77 billion by 2029.

- Global QR code payments grew from $14.74 billion in 2024 to $17.66 billion in 2025, reflecting a robust 19.8% CAGR. By 2029, the market is expected to hit $36.07 billion.

- NFC-enabled smartphones, critical for contactless and QR code payments, now account for 85% of all smartphones in use worldwide as of 2024, up from 60% in 2019.

- Asia leads QR code payment adoption, with more than 1.5 billion registered users in 2025, compared to under 1 billion in 2019.

Digital Payments Market Growth: Key Statistics and Regional Insights

Global Digital Payment Market Size and CAGR

- The global digital payments market size expanded from $119.40 billion in 2024 to an expected $137.43 billion in 2025, reflecting a solid 9.1% CAGR year-over-year.

- Forecasts indicate growth to $198.99 billion by 2029 and a staggering $32.07 trillion by 2033, sustaining a long-term CAGR of 13.59% from 2025 to 2033.

- Digital payment transaction volume jumped from $9.46 trillion in 2023 to an estimated $13.91 trillion in 2025, a nearly 47% rise in just two years.

- Non-cash transactions are predicted to grow at over 10% CAGR globally, reaching close to 3 trillion transactions by 2028, with a total payment revenue exceeding $3 trillion.

Regional Leaders: North America, Asia-Pacific, and Europe

- Asia-Pacific dominates the digital payments landscape, contributing nearly 50% of global revenue by 2028, up from approximately 42% in 2023.

- In North America, digital wallets accounted for 49% of e-commerce payments and 32% of POS payments in 2023, expected to rise to 52% and 39% by 2026, highlighting the region’s steady adoption.

- Europe has experienced a 15% increase in card transaction value between 2022 and 2024, with contactless payments reaching over 75% business acceptance by 2024.

- The U.S. shows 9 out of 10 consumers using digital payments in 2023, an increase from 80% in 2018, driven by mobile wallet and P2P adoption trends.

- Taiwan recorded nearly 10 million mobile payment users in 2024, 43% of its population of 23 million, illustrating rapid regional uptake.

Emerging Markets and Financial Inclusion

- Mobile wallet users globally surged to 2.8 billion in 2024, expected to reach 4.8 billion by 2028, with emerging economies contributing the largest share of this growth.

- Internet penetration and smartphone access increased by 25% in emerging markets between 2019 and 2024, enabling more seamless onboarding to digital payment platforms.

Government Initiatives Accelerating Digital Adoption

- European and North American regulators prioritize real-time payment infrastructure, increasing instant payments market share from 15% in 2023 to a forecasted 20% by 2028 globally.

- Subsidies and tax benefits for merchants adopting contactless and QR code payments resulted in a 40% growth in merchant acceptance between 2022 and 2024 in many developed countries.

- The global push for digital identity schemes and biometric authentication adoption rose by 60% from 2021 to 2024, streamlining user verification and bolstering trust in digital payments.

Technology Shaping the Future of Payments

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Artificial Intelligence and Fraud Prevention in Payments

- Global digital payment fraud losses reached $32 billion in 2024, but AI-driven fraud detection systems have reduced losses by up to 30% since 2022 through real-time anomaly detection and behavioral analytics.

- AI adoption in payment security grew from 12% of fintechs in 2020 to over 45% by 2024, contributing notably to reducing chargebacks and false positives.

- Regional data shows North America leads AI integration with over 70% of banks deploying AI for fraud prevention, compared to less than 40% in 2019.

Biometric Authentication for Secure Transactions

- By 2025, biometric payment authentication users worldwide are expected to reach 1.1 billion, up from 400 million in 2020, fueled by increased adoption in mobile wallets and banking apps.

- Facial recognition and fingerprint scanning contributed to a 40% reduction in payment fraud rates in Asia-Pacific between 2020 and 2024.

- According to market data, 75% of smartphones sold globally in 2024 include biometric authentication features—a 35% rise over five years, which directly boosts secure digital payment adoption.

- Retail payment terminals compatible with biometric verification grew from 5 million in 2018 to over 25 million in 2024, underscoring rapid merchant adoption for contactless security.

Blockchain, Cryptocurrencies, and Decentralized Finance (DeFi)

- The blockchain-based payment solutions market size expanded from $3.5 billion in 2022 to $7.8 billion in 2025, exhibiting a CAGR of approximately 28%.

- Over 200 million cryptocurrency wallet users were recorded worldwide in 2024, increasing by 50% since 2020, signaling growing mainstream acceptance.

- DeFi transaction volume hit $100 billion in 2024, tripling the amount transacted in 2021, driven by expanded global participation and institutional interest.

- Despite volatility, over 30% of global businesses reported accepting crypto payments by 2024, a 10% increase compared to 2020.

Real-Time Payments and Open Banking Innovations

- Real-time payment transaction values reached $8.2 trillion globally in 2024, doubling the $4.1 trillion reported in 2019, reflecting rapid real-time infrastructure implementation.

- The number of countries with real-time payment systems grew from 56 in 2019 to over 75 in 2024, upping global coverage by 34%.

- Open banking API calls worldwide surged past 100 billion annually in 2024, a rise of 120% from 2019, enabling seamless integration of diverse payment and financial services.

- North America observed real-time payment transactions grow from $1.5 trillion in 2020 to $3.4 trillion in 2024, with an anticipation to surpass $5 trillion by 2027.

Consumer Behavior and Adoption Patterns in Digital Payments

Generational Differences in Payment Preferences

- In 2023, 81% of Gen Z and 75% of Millennials used digital wallets, compared to 65% of Gen X and 45% of Boomers, reflecting a clear generational shift in payment adoption.

- Gen Z shoppers prefer mobile-first payment methods, contributing to 29% of all online digital wallet payments in 2023, up from 15% in 2019.

- Boomers rely more on traditional card payments, with credit/debit cards accounting for over 60% of their transaction volume in 2024, down slightly from 65% in 2020, as some have begun adopting mobile options.

Mobile-First Experiences and Embedded Payments

- Digital transactions via mobile accounted for over 70% of global e-commerce sales in 2024, increasing from about 58% in 2019.

- Embedded finance solutions for small businesses are expected to reach a market value of $124 billion in 2025, up from $90 billion in 2022.

- Mobile wallet usage surged with 2.8 billion users in 2024, forecasted to grow to 4.8 billion by 2028, doubling adoption over four years.

- Instant payments through mobile accounts increased from $4.1 trillion in 2019 to $8.2 trillion in 2024, enabled by real-time infrastructure and APIs.

Buy Now, Pay Later (BNPL) Services Adoption

- BNPL transaction volume grew from $120 billion in 2022 to an estimated $240 billion in 2025, doubling in just three years.

- The number of BNPL users globally reached 130 million in 2024, a 60% jump from 81 million in 2020.

- Millennials represent the largest BNPL demographic at 58% of users in 2024, increasing from 49% in 2020, while Gen Z’s share increased from 22% to 32% in four years.

- BNPL’s share of total e-commerce transactions rose from 3.5% in 2019 to 8% in 2024, propelled by greater merchant adoption and consumer preference for flexible payments.

Sector-Specific Trends: E-commerce, Retail, and Subscription Services

- Digital wallets accounted for 49% of global e-commerce payments in 2023, expected to exceed 52% by 2026, up from 35% in 2018.

- Point-of-sale digital wallet payments reached 32% in 2023, projected to grow to 39% by 2026, nearly doubling from 17% in 2017.

- Subscription services revenue tied to digital payments increased from $85 billion in 2019 to $160 billion in 2024, driven by streaming and software-as-a-service industries.

- Retail digital payment volumes jumped by 40% globally between 2021 and 2024, matching accelerated contactless and mobile payment adoption amid evolving consumer habits.

Challenges, Opportunities, and the Road Ahead in the Payment Industry

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Payment Security and Fraud Statistics

- In 2024, 74% of digital payment fraud incidents involved mobile devices, showing the growing vulnerability as mobile transactions surged globally.

- The global digital payment fraud volume flagged for review reached $1.3 trillion in 2024, with $40 billion confirmed as fraudulent, a rise from $28 billion in 2022.

- E-commerce fraud losses escalated from $44.3 billion in 2024 to a projected $107 billion by 2029, growing over 140% within five years.

- AI fraud detection accuracy improved to 92% in 2023, yet consumer exposure to fraud schemes surged by 89% in early 2025, driven by the widespread availability of stolen payment data.

Cross-Border Payments and Globalization

- Cross-border payment volumes reached $140 trillion in 2024, growing over 30% since 2020, fueled by expanding global e-commerce and remittance flows.

- Digital wallets handling international payments increased from 20% adoption in 2019 to 55% in 2024, driven by emerging technologies and regional integration.

- Fraud in cross-border payments increased by 19% year-over-year and accounted for nearly 42% of global fraud cases originating in the Asia-Pacific region in 2024.

Sustainability and the Future of Cashless Societies

- Cash usage dropped to 18% of in-person transactions globally in 2024, down from 31% in 2016, indicating a strong movement toward cashless economies.

- Contactless payment adoption reached over 80% of all POS transactions in advanced economies by 2024, with expected continued growth.

- Governments across Europe and North America invested over $2 billion in cashless infrastructure upgrades from 2022 to 2024, supporting green payment solutions and reducing reliance on cash.

Conclusion

The payment industry has evolved rapidly, driven by technology and changing consumer needs. From cash to contactless and mobile wallets, the trends and statistics reveal a clear move toward faster, more secure, and convenient payment methods. Understanding these shifts helps businesses and consumers stay ahead in a dynamic market.

As innovation continues to accelerate, staying informed about emerging trends like AI, real-time payments, and digital currencies will be key. Take a moment to reflect on how these changes impact your daily transactions and explore how you can leverage this knowledge for smarter financial decisions.

Insights On Payment Industry Trends and Statistics

How fast is the digital payment industry growing?

The global digital payments market is projected to reach $13.91 trillion in 2025, up from $9.46 trillion in 2023, with a compound annual growth rate (CAGR) of over 13% through 2033.

What are the most popular payment methods today?

Digital wallets now account for over 49% of e-commerce payments and 32% of point-of-sale transactions globally, with adoption expected to surpass 52% and 39% respectively, by 2026.

Which technologies are shaping payment trends?

AI-powered fraud prevention, biometric authentication, real-time payments, and blockchain are transforming payment security, speed, and convenience.

How are consumer behaviors changing?

More than 90% of U.S. consumers used at least one digital payment method in 2023, while Buy Now, Pay Later (BNPL) services and QR code payments are surging, especially among Gen Z and Millennials.

What’s next for the payment industry?

Expect further growth in embedded payments, open banking, and cryptocurrency adoption, as well as a continued shift toward seamless, cashless, and cross-border transactions.

References & Citations:

- Digital Payment Trends in 2025: A In-Depth Analysis by Industry Leaders

Vinayak Purshan (May 2025), Digital Payment Trends in 2025: A In-Depth Analysis by Industry Leaders - The Swedish payments market is almost entirely digital

Sveriges Riksbank (Mar 2025), The Swedish payments market is almost entirely digital - And so we pay: more digital and faster, with cash still in play

Alberto Di Iorio, Anneke Kosse, Ismail Mustafi (Mar 2025), And so we pay: more digital and faster, with cash still in play - Cards & Payments Global Market Report 2025 – By Type (Cards, Payments), By Institution Type (Banking Institutions, Non-Banking Institutions), By Application (Food And Groceries, Health And Pharmacy, Restaurants And Bars, Consumer Electronics, Media And Entertainment, Travel And Tourism, Other Applications) – Market Size, Trends, And Global Forecast 2025-2034

The Business Research Company (Jan 2025), Cards & Payments Global Market Report 2025 – By Type (Cards, Payments), By Institution Type (Banking Institutions, Non-Banking Institutions), By Application (Food And Groceries, Health And Pharmacy, Restaurants And Bars, Consumer Electronics, Media And Entertainment, Travel And Tourism, Other Applications) – Market Size, Trends, And Global Forecast 2025-2034 - Digital wallet spending to grow to more than $10tn in 2025

Alkesh Sharma (Jan 2021), Digital wallet spending to grow to more than $10tn in 2025 - Half of Mobile Users to Pay by Wallets by 2025 As Contactless Booms

Steve Cocheo (Apr 2021), Half of Mobile Users to Pay by Wallets by 2025 As Contactless Booms - Top Trend In P2P Payment Market 2025: Innovative Security Layers in P2P Payments Protecting Users with Advanced Technology

Oliver Guridham (Feb 2025), Top Trend In P2P Payment Market 2025: Innovative Security Layers in P2P Payments Protecting Users with Advanced Technology - P2P Payment Market Report 2025

Research and Markets (Mar 2025), P2P Payment Market Report 2025 - P2P Payment Global Market Report 2025 – By Transaction Mode (Mobile Web Payments, Near Field Communication, SMS or Direct Carrier Billing, Other Transaction Modes), By Payment Type (Remote, Proximity), By Application (Media and Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, Other Applications), By End User (Personal, Business) – Market Size, Trends, And Global Forecast 2025-2034

The Business Research Company (Jan 2025), P2P Payment Global Market Report 2025 – By Transaction Mode (Mobile Web Payments, Near Field Communication, SMS or Direct Carrier Billing, Other Transaction Modes), By Payment Type (Remote, Proximity), By Application (Media and Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, Other Applications), By End User (Personal, Business) – Market Size, Trends, And Global Forecast 2025-2034 - Global QR Code Payments Drivers 2025, Forecast To 2034

The Business Research Company (Mar 2025), Global QR Code Payments Drivers 2025, Forecast To 2034 - QR Code Payment Market

Future Market Insights, Inc. (Jun 2025), QR Code Payment Market - Digital payment trends worldwide in 2025 – statistics & facts

Raynor de Best (Apr 2025), Digital payment trends worldwide in 2025 – statistics & facts - 10 top payments trends for 2025 — and beyond

Vicki Hyman (Dec 2024), 10 top payments trends for 2025 — and beyond - Digital Payments Market Report 2025

Research and Markets (Mar 2025), Digital Payments Market Report 2025 - Global Payments Market Report 2025: Digital Payments Growth Continues to Accelerate, with Market Set to Exceed USD 3 Trillion by 2028

Research and Markets (Mar 2025), Global Payments Market Report 2025: Digital Payments Growth Continues to Accelerate, with Market Set to Exceed USD 3 Trillion by 2028 - Digital Payment Industry Report 2025: Market to Hit $32.07 Trillion by 2033 – Government Initiatives Propel Global Shift to Cashless Transactions

Research and Markets (May 2025), Digital Payment Industry Report 2025: Market to Hit $32.07 Trillion by 2033 – Government Initiatives Propel Global Shift to Cashless Transactions - Key Digital Payment Trends to Watch in 2025

Worldline (Feb 2025), Key Digital Payment Trends to Watch in 2025 - Digital Payment Market Size, Share, and Trends 2025 to 2034

Shivani Zoting, Aditi Shivarkar (Jun 2025), Digital Payment Market Size, Share, and Trends 2025 to 2034 - Digital Payments – Worldwide

Statista (2025), Digital Payments – Worldwide - Payments – Worldwide

Statista (2025), Payments – Worldwide - Digital Payments Market Worth $132.5 Billion by 2025 | CAGR: 17.6%

Grand View Research (Nov 2019), Digital Payments Market Worth $132.5 Billion by 2025 | CAGR: 17.6% - Digital Payment Market worth $154.1 billion by 2025

MarketsandMarkets (Oct 2020), Digital Payment Market worth $154.1 billion by 2025 - Global Digital Payment Market Size, Share, Growth & Forecast (2025-2033)

Renub Research (2025), Global Digital Payment Market Size, Share, Growth & Forecast (2025-2033) - Digital Payment Market By Mode of Payment (Online Payment, Mobile Payment, Contactless Payment, and Peer-to-Peer (P2P) Payment), By Payment Method, By Technology, By Deployment Mode, By Application, By End User – Global Industry Outlook, Key Companies (PayPal, Visa, Mastercard and others), Trends and Forecast 2025-2034

Dimension Market Research (May 2025), Digital Payment Market By Mode of Payment (Online Payment, Mobile Payment, Contactless Payment, and Peer-to-Peer (P2P) Payment), By Payment Method, By Technology, By Deployment Mode, By Application, By End User – Global Industry Outlook, Key Companies (PayPal, Visa, Mastercard and others), Trends and Forecast 2025-2034 - Digital Payment Market Analysis APAC, North America, Europe, South America, Middle East and Africa – US, Canada, China, Japan, Germany, France, Brazil, UK, South Korea, India – Size and Forecast 2025-2029

Technavio (Mar 2025), Digital Payment Market Analysis APAC, North America, Europe, South America, Middle East and Africa – US, Canada, China, Japan, Germany, France, Brazil, UK, South Korea, India – Size and Forecast 2025-2029 - India: 2025 analysis of payments and ecommerce trends

Tonet Santana (May 2025), India: 2025 analysis of payments and ecommerce trends - 5 Consumer Payment Trends Shaping How We Pay in 2025

Discover Global Network (Feb 2025), 5 Consumer Payment Trends Shaping How We Pay in 2025 - 5 Key Trends Shaping the Future of Digital Payments in 2025

Tommaso Jacopo Ulissi (Feb 2025), 5 Key Trends Shaping the Future of Digital Payments in 2025 - World Payments Report 2025

Capgemini (2025), World Payments Report 2025 - Digital Payment Fraud Statistics 2025: Essential Data and Prevention Measures

Barry Elad, Kathleen Kinder (Jun 2025), Digital Payment Fraud Statistics 2025: Essential Data and Prevention Measures - Tracking the Evolution of Payment Fraud in 2025

Sift Trust and Safety Team (May 2025), Tracking the Evolution of Payment Fraud in 2025 - 2025 AFP Payments Fraud and Control Survey Report

Association for Financial Professionals (2025), 2025 AFP Payments Fraud and Control Survey Report - Payment Fraud Goes Mainstream: Sift's Q1 2025 Digital Trust Index Reveals 89% Surge in Consumer Exposure to Fraud Schemes

Sift (Mar 2025), Payment Fraud Goes Mainstream: Sift's Q1 2025 Digital Trust Index Reveals 89% Surge in Consumer Exposure to Fraud Schemes - Annual Payment Fraud Intelligence Report: 2024

Insikt Group (Jan 2025), Annual Payment Fraud Intelligence Report: 2024 - Online payment fraud losses to hit $206bn by 2025

FinTech Global (Jul 2021), Online payment fraud losses to hit $206bn by 2025 - Tietoevry Banking’s new insight-report reveals an increase in digital payment fraud in Europe

Per Nordin (Apr 2025), Tietoevry Banking’s new insight-report reveals an increase in digital payment fraud in Europe - 2025 fraud and payments forecast: Key trends and emerging threats in the global landscape

LSEG (Jan 2025), 2025 fraud and payments forecast: Key trends and emerging threats in the global landscape - How Consumers are Embracing Security Measures in the Era of Digital Payments

Visa (2025), How Consumers are Embracing Security Measures in the Era of Digital Payments