21+ Real Estate Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Have you ever wondered how the real estate industry has evolved over the years and what the future holds for it? The Real Estate Industry Trends reveal fascinating shifts driven by changing buyer preferences, economic forces, and technological innovation.

As housing prices rise and urbanization accelerates, understanding these evolving patterns is more important than ever for buyers, investors, and professionals. Let’s explore the data-backed trends shaping today’s market and the exciting future opportunities they bring.

Historical Real Estate Market Performance

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Decade-Long Housing Price Trends

- In the United States, the median sales price for existing homes reached $422,800 in May 2025, up from $414,300 in May 2024 and $272,800 in 2015. This represents a $150,000 increase over the past 10 years.

- In India, the average house price has increased by approximately 6% per year over the past 20 years, with the Housing Price Index rising from 100 in 2015 to 122 as of March 2025. The year-over-year change for 2024 was 3.1%, compared to 4.34% in 2023.

- In major Indian cities, residential units priced above INR 10 million accounted for 46% of total sales in 2025, a 29% increase from 2024.

Sales Volume and Transaction Data

- U.S. existing home sales stood at 4.03 million units (annualized) in May 2025, up from 4.00 million in April 2025, but significantly lower than the 5.34 million units sold in 2019.

- New single-family home sales in the U.S. were 623,000 units (annualized) in May 2025, down from 665,000 in May 2024 and 682,000 in May 2023.

- The inventory of new houses for sale in the U.S. reached 507,000 in May 2025, up from 469,000 in May 2024.

- The months’ supply of new homes increasedto 9.8 months in May 2025, compared to 8.5 months in May 2024.

Rental Market Evolution

- The median U.S. rent rose from $1,350 per month in 2015 to $2,100 in June 2025, a $750 increase over the decade.

- The Consumer Price Index (CPI) for rent of primary residence climbed from 281.572 in January 2015 to 433.698 in May 2025.

- Single-family rents increased by 2.8% in 2025, while multifamily rents rose by 1.6% compared to 2024.

- In 2021–2022, national rent prices surged by 17–18%, with some regions, such as Florida, experiencing spikes above 25%.

Mortgage and Financing Trends

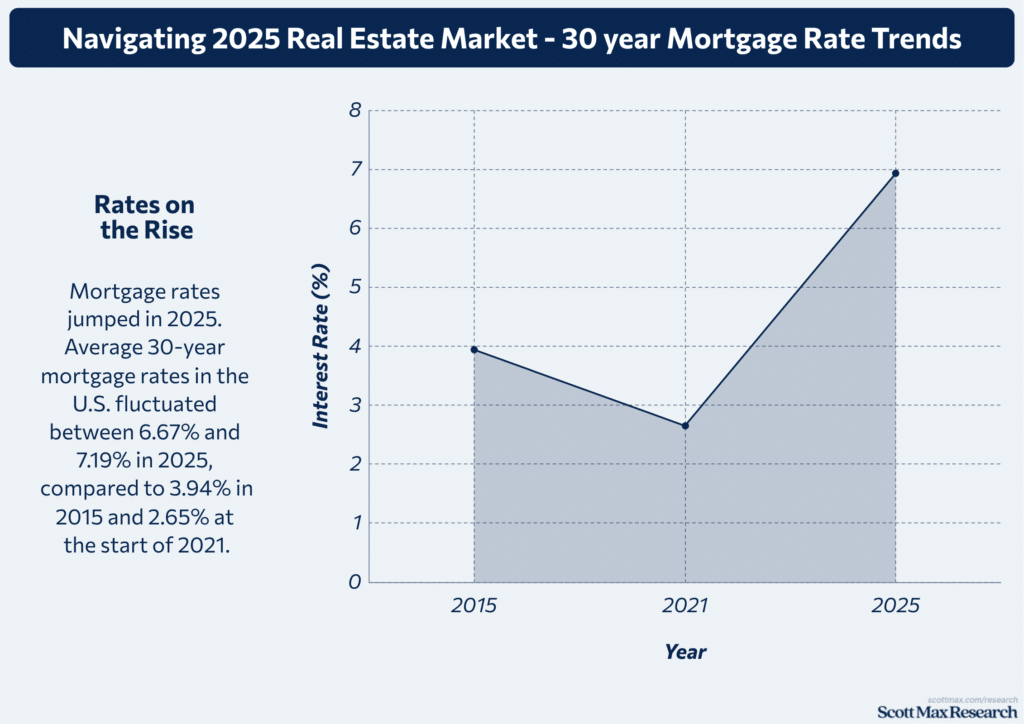

- Average 30-year mortgage rates in the U.S. fluctuated between 6.67% and 7.19% in 2025, compared to 3.94% in 2015 and 2.65% at the start of 2021.

- The Mortgage Bankers Association projects total mortgage origination volume at $2.1 trillion in 2025, up from $1.8 trillion in 2024.

- Purchase originations are forecasted to reach $1.4 trillion in 2025, an 8% increase from 2024.

- Total mortgage origination loan count is expected to rise to 5.7 million in 2025, up from 5.0 million in 2024.

Key Drivers of Real Estate Industry Trends: A Data-Driven Overview

Economic Factors Affecting Real Estate

- India’s real estate market is projected to grow from $332.85 billion in 2025 to $985.80 billion by 2030, a compound annual growth rate (CAGR) of 24.25%.

- Commercial leasing in India's top seven cities reached a record 62.98 million sq. ft. in 2023, representing a 26.4% increase from 2022.

- The U.S. economy is expected to grow moderately in 2025, supporting a 7-12% increase in home sales and a 2% rise in prices, despite a 10-year Treasury yield above 4%.

Demographic Shifts and Housing Demand

- Urban areas in India face a housing shortage of 10 million units, with an additional 25 million affordable homes required by 2030 to meet growing demand.

- The mid-income, premium, and luxury residential segments experienced a 29% increase in sales of units priced above INR 10 million in 2025 compared to 2024.

Technological Innovations in Real Estate

- The global real estate sector filed over 24,000 patents and secured more than 2,700 grants in 2024, with a yearly growth rate in patent filings of 14.37%.

- PropTech investments average $46.3 million per funding round, with support from over 19,000 investors worldwide.

Government Policies and Regulations

- India’s real estate sector is projected to increase its GDP contribution from 7.3% to 15.5% by 2047, supported by government incentives and initiatives aimed at promoting affordable housing.

- U.S. mortgage rates stabilized around 6% in 2025, influenced by Federal Reserve policies, supporting a moderate recovery in real estate investment activity.

Regional Real Estate Market Comparisons

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Major Metropolitan Real Estate Trends

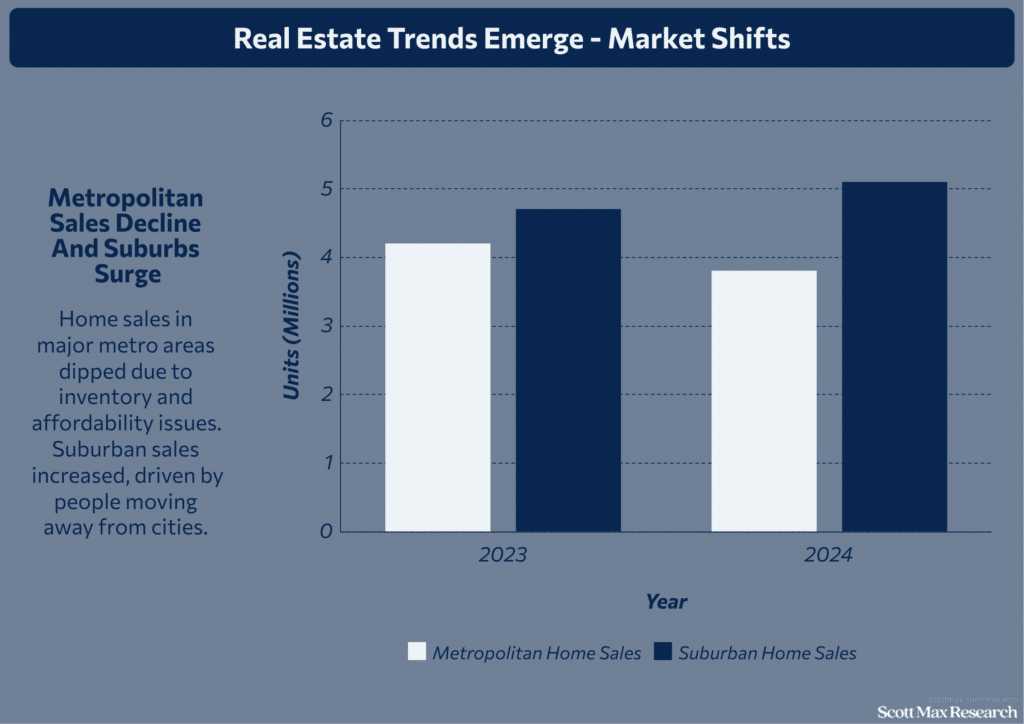

- In the U.S., home sales in major metropolitan areas, such as New York City and San Francisco, dropped to 3.8 million units in 2024, from 4.2 million in 2023, reflecting inventory constraints and affordability challenges.

- Despite this, median home prices in these metros rose to $720,000 in 2024 from $685,000 in 2023, continuing a steady upward trajectory over the past decade.

- Office space absorption in downtown cores increased by 12% in 2024, with vacancy rates tightening to 11.5% from 13.2% in 2023, signaling renewed demand post-pandemic.

- Retail real estate vacancy in metropolitan areas fell to 4.7% in 2024, the lowest since 2019, driven by urban redevelopment projects and increased consumer spending.

- Data center real estate demand surged by 18 million square feet in 2024, representing a 20% increase over 2023, with the majority of growth concentrated in tech hubs such as Seattle and Silicon Valley.

Suburban and Rural Market Dynamics

- Suburban home sales in the U.S. reached 5.1 million units in 2024, up from 4.7 million in 2023, fueled by migration trends away from urban centers.

- Median suburban home prices rose to $410,000 in 2024, a 7% increase from 2023, outpacing the growth in rural prices.

- Rural real estate markets showed modest gains, with sales rising by 3.5% to 1.2 million units in 2024, and median prices increasing from $225,000 in 2023 to $235,000 in 2024.

- Industrial space in rural regions expanded by 9 million square feet in 2024, a 10% increase over 2023, driven by the growth of logistics and distribution centers.

International Real Estate Trends

- Global real estate market size is projected to grow from $4.47 trillion in 2025 to $5.87 trillion by 2029, with a CAGR of 7.1%.

- European markets saw residential property prices increase by 5.4% in 2024, compared to 4.1% in 2023, with London and Berlin leading gains.

- Asia-Pacific commercial real estate investment reached $210 billion in 2024, up from $190 billion in 2023, driven by China and Japan.

- Middle Eastern real estate markets experienced a 12% increase in luxury property sales in 2024, with Dubai accounting for over 60% of transactions.

- Cross-border real estate investments increased by 8% globally in 2024, totaling $320 billion, indicating a growing trend of international capital flows.

Commercial vs. Residential Real Estate

- Residential real estate sales in the U.S. totaled 6.5 million units in 2024, down slightly from 6.7 million in 2023, while median prices increased by 4.5% to $395,000.

- Commercial real estate investment volume reached $450 billion in 2024, up from $420 billion in 2023, with the office and industrial sectors leading growth.

- Office vacancy rates declined to 12.3% in 2024 from 13.8% in 2023, reflecting a slow but steady recovery in workspace demand.

- Industrial real estate leasing was robust, with 450 million sq. ft. leased in 2024, a 5% increase over 2023, driven by e-commerce expansion.

- Retail sector vacancy rates reached a historic low of 5.1% in 2024, down from 6.3% in 2023, driven by the growth of suburban retail and the adoption of experiential retail concepts.

Real Estate Investment Insights

Popular Real Estate Investment Strategies

- Buy-and-hold strategies remain dominant, with U.S. residential rental properties generating an average annual return of 8.6% in 2024, up from 7.9% in 2023.

- House flipping saw a slowdown, with the number of flipped homes dropping to 54,000 in 2024, down from 68,000 in 2023, reflecting tighter lending and rising costs.

- Real Estate Investment Trusts attracted $300 billion in global capital in 2024, a 5% increase from 2023, driven by strong performance in industrial and data center sectors.

- Crowdfunding platforms facilitated $15 billion in real estate investments in 2024, up from $11 billion in 2023, reflecting an increase in participation from retail investors.

- Short-term rental investments accounted for 12% of residential property sales in key U.S. markets in 2024, down slightly from 14% in 2023 due to regulatory pressures.

Risk Factors and Market Volatility

- The U.S. housing market experienced a 3.5% price correction in select overheated metros in 2024, compared to steady growth of 4.1% nationally.

- Mortgage delinquency rates rose modestly to 1.8% in 2024, up from 1.5% in 2023, signaling increased borrower stress amid rising interest rates.

- Commercial real estate cap rates averaged 6.2% in 2024, slightly higher than 5.9% in 2023, reflecting cautious investor sentiment amid economic uncertainty.

- Supply chain disruptions led to a 7% increase in construction costs in 2024, resulting in a 4% decline in new project starts compared to 2023.

Return on Investment (ROI) Analysis

- The average ROI for U.S. multifamily properties was 9.4% in 2024, up from 8.7% in 2023, driven by strong rental demand and limited new supply.

- Retail properties showed a rebound with ROI increasing to 7.3% in 2024, compared to 6.5% in 2023, supported by declining vacancy rates.

- Single-family rental homes generated an average ROI of 8.2% in 2024, up from 7.6% in 2023, reflecting increased investor interest.

Emerging Real Estate Markets

- Secondary U.S. cities, such as Austin, Nashville, and Raleigh, saw transaction volumes rise to $45 billion in 2024, a 12% increase from 2023, driven by growth in the tech sector.

- Data center real estate demand increased by 20 million square feet in 2024, up from 16 million square feet in 2023, driven by the expansion of AI and cloud computing.

- Logistics hubs in the Sun Belt states experienced 18% growth in leasing in 2024, surpassing the 15% growth rate in 2023, which reflects increased investments in e-commerce supply chains.

- Affordable housing projects attracted $25 billion in investments in 2024, up from $20 billion in 2023, supported by government incentives.

- Internationally, real estate investment in European secondary cities increased by 8% in 2024, led by Berlin and Lisbon, compared to 5% growth in 2023.

Future Outlook: Real Estate Market Predictions

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Forecasting Home Price Trends

- The National Association of Realtors (NAR) forecasts home sales growth between 7% and 12% in 2025, with median prices expected to rise by 2%, reaching approximately $410,000 nationally, compared to $402,000 in 2024.

- Zillow reports a 3.5% price correction in overheated metro areas in 2024, while suburban and secondary markets saw price increases averaging 5.2%, up from 4.7% in 2023.

- The Federal Reserve’s stable mortgage rates near 6% in 2025 support moderate price growth, contrasting with the spike from 3.1% in 2021 to over 7% in 2023.

Technology and the Future of Real Estate

- Global real estate patent filings reached 24,000 in 2024, representing a 14.37% annual growth, with the U.S. and China leading the innovation.

- AI-powered platforms increased property transaction efficiency by 20% in 2024, reducing time on market from an average of 45 days in 2023 to 36 days in 2024.

- Smart building technologies adoption grew by 25% in 2024, with energy-efficient systems reducing operational costs by up to 18%.

- Virtual tours and immersive visualization tools contributed to a 30% increase in remote property viewings in 2024, compared to 2023.

Policy and Regulatory Changes on the Horizon

- The U.S. government’s affordable housing initiatives aim to add 1.5 million new units by 2030, with funding increasing by 12% annually since 2022.

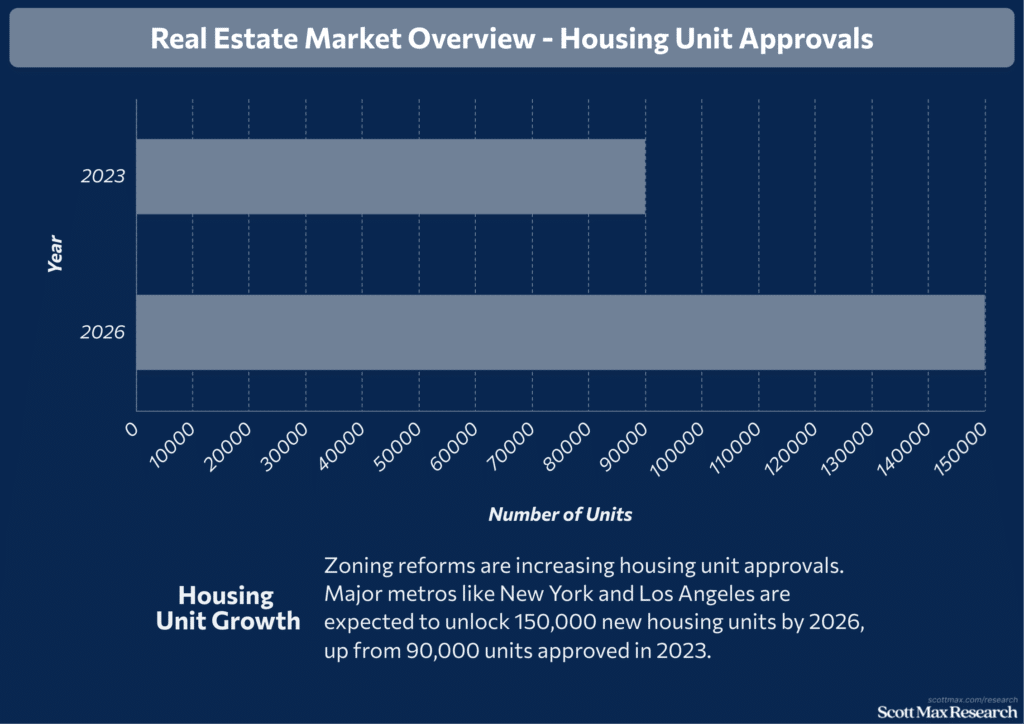

- Zoning reforms in major metros like New York and Los Angeles are expected to unlock 150,000 new housing units by 2026, up from 90,000 units approved in 2023.

- Rent control expansions affected 18 major cities in 2024, with vacancy rates stabilizing at 5.3%, compared to 4.9% in 2023.

- Mortgage lending standards tightened in 2024, with average credit score requirements rising to 720 from 700 in 2023, impacting first-time buyers.

Adapting to Changing Buyer Preferences

- Millennials and Gen Z buyers accounted for 55% of home purchases in 2024, up from 48% in 2023, with a preference for suburban and mixed-use developments.

- Customization and smart home integration requests grew by 27% in 2024, compared to 2023.

- Remote work trends sustained a 15% higher demand for homes with dedicated office spaces in 2024.

Conclusion

The real estate industry has continuously evolved, shaped by economic shifts, technological advances, and changing consumer needs. Over the years, data reveals how markets adapt—from rising demand in urban and suburban areas to the growing influence of smart technologies and sustainable building practices.

As we look ahead, these trends signal exciting opportunities for investors, buyers, and developers alike. Staying informed about these patterns helps navigate the market with confidence and foresight. Explore further to understand how these dynamic shifts will shape the future of real estate investment and living.

Insights On Real Estate Industry Trends and Statistics

How has the real estate industry grown over the last decade?

The real estate sector has seen exponential growth, with the global market size projected to reach $5.8 trillion by 2030. Residential sales in major markets hit record highs, and commercial leasing surged by over 26% in 2023, reflecting robust demand and investment opportunities.

What are the key drivers behind recent real estate trends?

Economic growth, urbanization, and evolving buyer preferences—such as demand for affordable and luxury housing—are shaping the industry. Technology adoption and government incentives have also fueled the expansion of both residential and commercial properties.

Which real estate segments are experiencing the most growth?

Residential real estate leads the market, especially in mid-income and luxury segments. Commercial spaces, including office and retail, have seen strong leasing activity, while data centers and co-working spaces are emerging as high-growth areas.

What challenges does the real estate industry face today?

Despite growth, the sector faces a housing shortage—urban areas need 10 million more units, and 25 million affordable homes will be required by 2030. High mortgage rates and rising property prices also pose affordability concerns.

What future trends should investors watch in real estate?

Expect continued digital transformation, a focus on sustainable and smart buildings, and rising demand for well-connected, amenity-rich properties. Market forecasts indicate strong long-term growth, especially in emerging cities and tech-driven segments.

References & Citations:

- United States Existing Home Sales

Trading Economics (2025), United States Existing Home Sales - Monthly New Residential Sales, May 2025

United States Census Bureau (Jun 2025), Monthly New Residential Sales, May 2025 - House Price Graph Last 20 Years India: Trends, Factors, and Future Predictions

Simon (Jan 2025), House Price Graph Last 20 Years India: Trends, Factors, and Future Predictions - India Residential Property Prices

Trading Economics (2025), India Residential Property Prices - House Price Index

The Mirrority (2025), House Price Index - India's Residential Property Market Analysis 2025

Tamila Nussupbekova (Mar 2025), India's Residential Property Market Analysis 2025 - Is Rent Outpacing Inflation? A Look at U.S. Median Rent Prices from 2015-2025

Innago (Jun 2025), Is Rent Outpacing Inflation? A Look at U.S. Median Rent Prices from 2015-2025 - Mortgage rate history: 1970s to 2025

Andrew Dehan, Suzanne De Vita, Jeffrey Beal (Jun 2025), Mortgage rate history: 1970s to 2025 - Mortgage banking insights: Key trends and challenges ahead

Kristin Golab (Feb 2025), Mortgage banking insights: Key trends and challenges ahead - India's Real Estate Sector Growth in 2025

Sell.Do (May 2025), India's Real Estate Sector Growth in 2025 - Real estate 2025: What are the top five trends to watch out for?

Neeraj Bansal (Jan 2025), Real estate 2025: What are the top five trends to watch out for? - Emerging Trends in Real Estate® 2025

PwC (2025), Emerging Trends in Real Estate® 2025 - India Real Estate Report FY 2025-26: Trends, Insights & Forecasts

Grant Thornton Bharat LLP (2025), India Real Estate Report FY 2025-26: Trends, Insights & Forecasts - Explore the Real Estate Market Outlook 2025

Iryna Bursuk (Nov 2024), Explore the Real Estate Market Outlook 2025 - U.S. Real Estate Market Outlook 2025

CBRE Research (Dec 2024), U.S. Real Estate Market Outlook 2025 - Navigating Real Estate in 2025: Trends That Matter Most

Rethinking The Future (2025), Navigating Real Estate in 2025: Trends That Matter Most - 2025 India Market Outlook

CBRE Research (Mar 2025), 2025 India Market Outlook - Biggest Real Estate Trends Shaping 2025

Pioneer Property Management Ltd (Jun 2025), Biggest Real Estate Trends Shaping 2025 - Emerging Trends Europe survey 2025

PwC, Urban Land Institute (Nov 2024), Emerging Trends Europe survey 2025 - Real Estate Trends in India 2025: What the Data Says About the Future

Altois (May 2025), Real Estate Trends in India 2025: What the Data Says About the Future - Commercial Real Estate Market Insights May 2025

National Association of REALTORS (May 2025), Commercial Real Estate Market Insights May 2025 - The global outlook for 2025 Emerging Trends in Real Estate

PwC (Mar 2025), The global outlook for 2025 Emerging Trends in Real Estate - Top Real Estate Trends to Watch This Year | Market Insights 2025

Team MoneyTree (May 2025), Top Real Estate Trends to Watch This Year | Market Insights 2025