17+ Semiconductor Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Have you ever wondered how tiny chips inside your devices power the massive shifts in technology around us? The semiconductor industry's trends reveal a fascinating story of relentless innovation and explosive growth over the years. From the rise of AI-driven chips to the expansion of data centers, this dynamic sector is projected to reach nearly $700 billion by 2025 and is set to surpass $1 trillion by 2030.

Understanding these trends is crucial, as they shape everything from smartphones to smart cities. Let’s explore the key forces driving this evolving industry.

Evolution of the Semiconductor Market: A Decade in Review

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Global Semiconductor Market Growth Trends

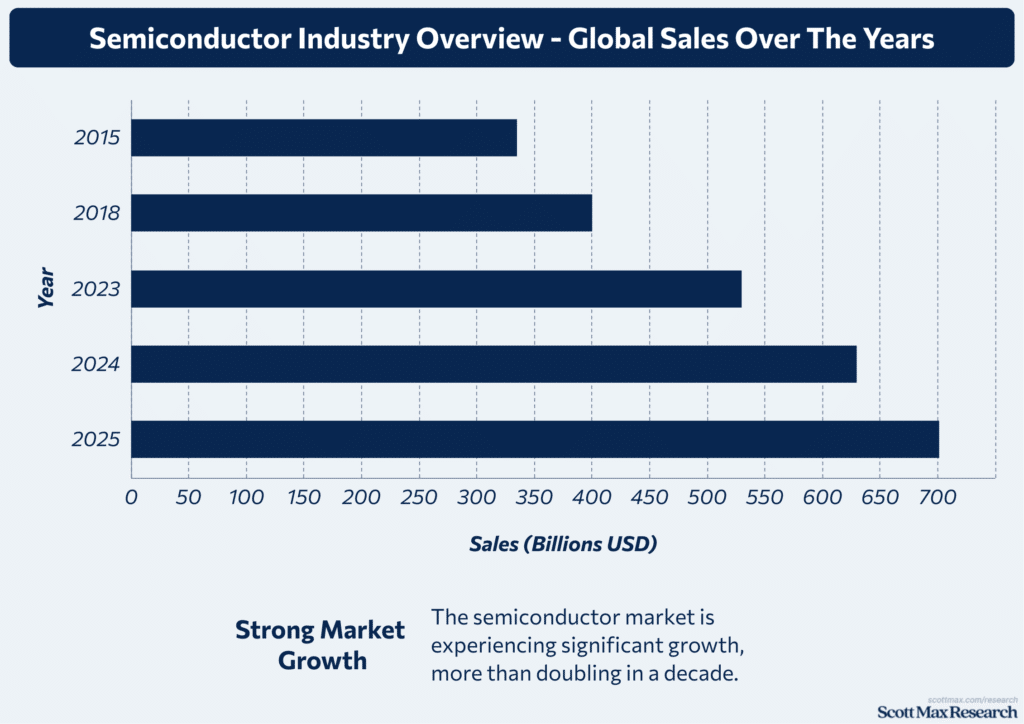

- Global semiconductor sales surged from $335 billion in 2015 to an estimated $701 billion in 2025, more than doubling in 10 years. Notably, after a pandemic-related dip in 2023 with revenue at $530 billion, the market rebounded sharply, posting 18.8% growth in 2024 to $630 billion.

- May 2025 alone saw global sales hit $59 billion, a 20% increase over May 2024’s $49.2 billion, reflecting steadily rising month-on-month growth averaging around 3-4%.

- Regional growth in 2025 is led by the Americas, with an 18% increase, followed by the Asia Pacific at 9.8%. Europe and Japan are expected to grow at lower single-digit percentages.

Market Size and Revenue Milestones

- The semiconductor market is projected to surpass $700 billion by 2025, a significant increase from $400 billion in 2018, with forecasts indicating a potential rise beyond $1 trillion by 2030.

- Capital expenditures by chip companies are expected to reach $185 billion in 2025, representing a 7% increase from 2024, highlighting the significant investments in fab capacity expansion and technology development.

Impact of COVID-19 on Semiconductor Supply Chains

- The pandemic caused a sharp contraction in 2020 and 2021, with industry revenues dropping to nearly $412 billion in 2020, but recovery began quickly, reaching $530 billion in 2023, followed by explosive growth of 18.8% in 2024.

- Supply shortages caused by factory shutdowns and logistic bottlenecks delayed product launches, but by mid-2025, semiconductor supply chains expanded capacity by 7%, aided by $185 billion in capital investments targeting new fab construction and modernization.

- The pandemic accelerated diversification strategies, with increased regional production capacities in the Americas and Asia aimed at minimizing dependency risks, which supported an 18% growth in the U.S. semiconductor market in 2025.

Key Drivers of Semiconductor Demand: Sector-Wise Insights

Consumer Electronics Market Trends

- Global semiconductor sales in consumer electronics reached approximately $160 billion in 2024, growing from around $135 billion in 2022 as smartphone, PC, and wearable device shipments increased.

- The semiconductor content per smartphone increased by 15% from 2022 to 2024, driven by 5G upgrades and the integration of AI functionalities into chips, such as AI accelerators and image processors.

- Shipments of 5G smartphones increased from 400 million units in 2021 to over 700 million units in 2024, accounting for approximately 55% of all smartphone sales globally. This contributed to the surge in mobile SoC (System-on-Chip) demand.

- Consumer electronics-related semiconductor revenue is forecast to reach $180 billion by 2025, representing an increase of over 12% compared to 2023, driven by rising demand for smart home appliances and AR/VR devices.

Automotive Semiconductor Growth

- Semiconductor revenue from the automotive sector reached $50 billion in 2024, up from $35 billion in 2020, reflecting a CAGR of nearly 11% over four years.

- The average semiconductor content per vehicle increased from approximately $350 in 2020 to $500 in 2024, primarily due to the adoption of advanced driver-assistance systems (ADAS) and electric vehicle (EV) powertrain components.

- EV shipments increased by over 45% year-over-year between 2023 and 2024, driving further demand for chips as EVs consume nearly three times the semiconductor content of traditional vehicles.

Data Centers and Cloud Computing Expansion

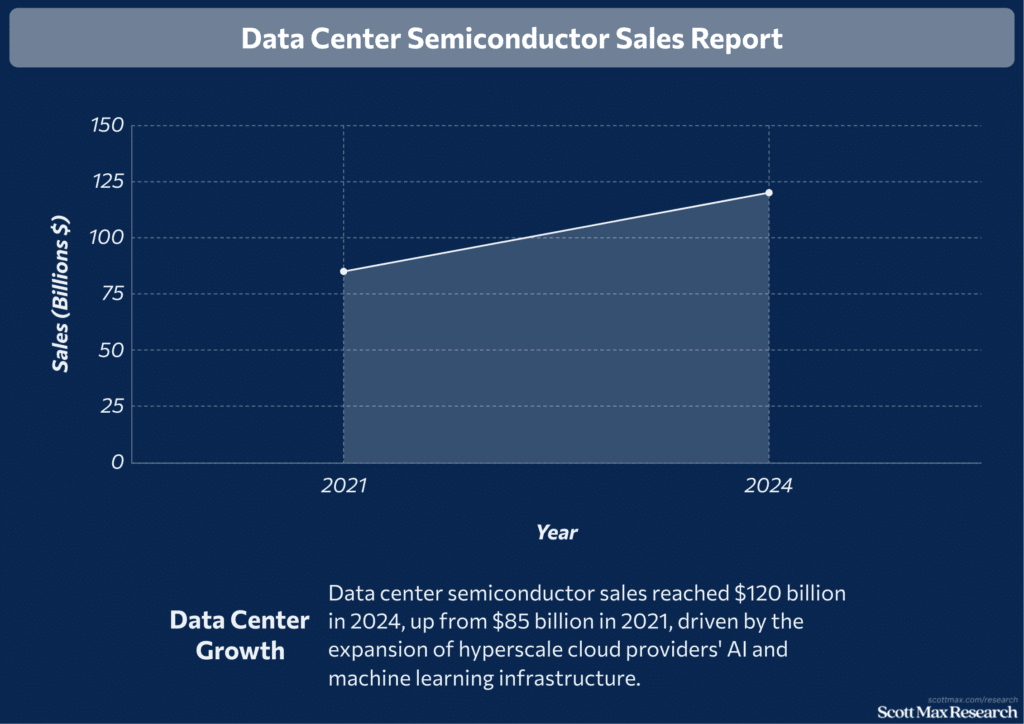

- Data center semiconductor sales reached a landmark of $120 billion in 2024, climbing from $85 billion in 2021—a 41% increase driven by cloud infrastructure, AI workloads, and high-performance computing demands.

- Memory chip revenue for data centers increased by 33% in 2024 compared to 2023, reaching over $45 billion, driven by the demand for AI model training and higher data throughput.

- Logic chip sales, critical for servers and GPUs, increased from $25 billion in 2020 to $50 billion in 2024, doubling in just four years due to the rapid growth of AI and cloud services.

- Capital investments supporting data center expansion reached $185 billion in 2025, forecasted to increase manufacturing capacity by 7%, necessary to meet ongoing chip demand.

Industrial & Healthcare Applications

- Semiconductor revenue in industrial automation and healthcare crossed $40 billion in 2024, up from $30 billion in 2020, marking steady growth as industries embrace IoT and smart manufacturing solutions.

- The integration of semiconductors in healthcare devices expanded with a 20% growth in medical wearables and biosensors sales from 2022 to 2024, reaching $8 billion in semiconductor content.

- Analog and sensor semiconductor shipments, crucial for industrial control and medical diagnostics, have grown at a 5% annual rate since 2021, reaching a market value of $22 billion by 2024.

Innovations Fueling Semiconductor Progress

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Transition to Advanced Process Nodes

- In 2024, leading-edge semiconductor capacityfor 5nm and below nodes increased by 13%, driven predominantly by AI applications in data centers. This growth outpaces the 8% rise reported in 2023, reflecting accelerating demand for smaller, more efficient chips.

- Production ramp-up for 3nm chips doubled year-over-year from 2023 to 2024, with significant volume shipments commencing in late 2024 and expected to continue expanding in 2025, thereby contributing to overall growth in leading-edge capacity.

- Chipmakers such as Intel, Samsung, and TSMC are preparing for 2nm Gate-All-Around (GAA) processors, slated for mass production in 2026-2027, which are expected to elevate total leading-edge capacity by 17% in 2025 compared to 2024.

- The global semiconductor fab count is increasing, with 18 new fabs scheduled to begin construction in 2025, primarily 300mm wafer fabs, aimed at addressing growing capacity needs for advanced nodes. This compares with 20 new fabs started in 2024, showing sustained investment momentum.

Packaging and Integration Technology Advancements

- Advanced packaging adoption, including 2.5D and 3D chiplet integration, has expanded rapidly, reaching approximately $8 billion in market value by 2024, a 25% increase over 2023, driven by the growing requirements for AI chips and the need for heterogeneous integration.

- System-in-Package (SiP) solutions, crucial for mobile and IoT devices, experienced a 30% increase in shipments in 2024, totaling over 15 million packages shipped globally, up from 11.5 million in 2023.

- The demand for high-bandwidth memory (HBM) stacks is growing, with chips integrating 8 to 12 dice per stack, resulting in an HBM capacity increase of 9% in 2024 and projected to be 9% more in 2025.

Materials and Equipment Evolution

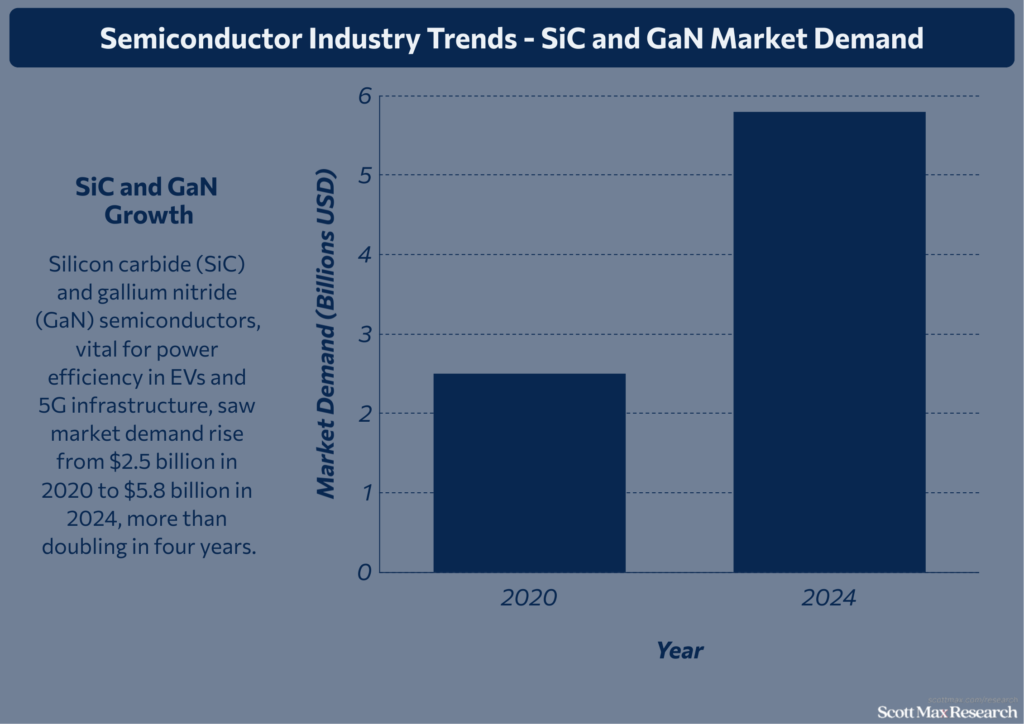

- Silicon carbide (SiC) and gallium nitride (GaN) semiconductors, vital for power efficiency in EVs and 5G infrastructure, saw market demand rise from $2.5 billion in 2020 to $5.8 billion in 2024, more than doubling in four years.

- DRAM capacity increased by 9% year-over-year in both 2024 and 2025, driven largely by AI workloads that require more memory bandwidth. In contrast, 3D NAND capacity grew marginally by 5% in 2025, following a flat 2024.

- Worldwide semiconductor manufacturing capacity reached a record 33.7 million 8-inch equivalent wafers per month in 2024, up 6% from 2023, with plans to expand another 7% in 2025 to meet surging chip demand.

- Semiconductor equipment spending reached $87 billion in 2024, up from $74 billion in 2022, as the industry adapted to new lithography and etching demands required for smaller process nodes.

R&D, Patents, and Technology Investments

- The semiconductor sector is projected to invest approximately $185 billion incapital expenditures in 2025, a 7% increase from 2024, primarily in expanding fab capacity and technology upgrades.

- TSMC plans to invest a total of $165 billion in U.S. operations by 2035, including the expansion of R&D centers and advanced manufacturing facilities to support AI and cutting-edge chip design.

- The combined market capitalization of the top 10 global chip companies nearly doubled between 2023 and 2024, rising from $3.4 trillion to $6.5 trillion, reflecting investor confidence in innovation-driven growth.

Regional Landscape: Global Semiconductor Leaders & Emerging Hubs

Asia-Pacific Dominance in Manufacturing

- The Asia-Pacific region maintained its stronghold as the global semiconductor manufacturing powerhouse, with an estimated 60% share of worldwide wafer fabrication capacity in 2024, up from 57% in 2022.

- Taiwan and South Korea led the pack, commanding over 80% of the global foundry market revenue, with TSMC’s 2024 revenue surpassing $75 billion, a 12% increase over 2023.

- China’s semiconductor import value surged to $155 billion in 2024, representing a 20.5% year-over-year increase, and sustaining its crucial role as the largest chip consumer despite ongoing supply chain and trade tensions.

- Investments in new fabrication facilities soared, with Asia-Pacific companies committing over $110 billion in capital spending for fabs between 2023 and 2025—a 25% rise compared to the previous two-year period.

U.S. and Europe: Policy and Ecosystem Shifts

- North America’s semiconductor market expanded by 18% in 2025 to approximately $145 billion, recovering from a dip in 2022 due to significant investments from companies such as Intel and TSMC.

- The U.S. CHIPS Act supported a record $65 billion investment pledged by TSMC for Arizona fabs through 2035, reflecting a policy-driven push to reshore and diversify supply chains.

- Europe’s semiconductor sales grew moderately to $50 billion in 2024, up from $48 billion in 2022, driven primarily by demand for automotive semiconductors and analog chip sales.

- The European Chips Act mobilized €15 billion (~$16 billion) in subsidies and incentives, contributing to plans for 12 new fabs by 2027 —a substantial increase from the five fabs in operation in 2020.

Emerging Markets and Future Hubs

- Taiwan’s expansion projects include capacity hikes targeting 40,000 wafers/month for advanced 5nm and 3nm nodes by 2026, a 30% increase over current volumes.

- New semiconductor hubs in South Korea and Singapore attracted over $8 billion in new investments in 2024, growing regional semiconductor production share by nearly 10% since 2020.

- The U.S. Southwest hosts multiple greenfield fabs announced since 2023, expected to increase domestic production capacity by over 1.5 million wafers per month by 2027.

Global Semiconductor Value Chain Analysis

- The global foundry market, valued at $120 billion in 2024, increased 14% from 2023, driven by contract manufacturers such as TSMC and Samsung, which expanded output to meet demand for AI and data center chips.

- Fabless design companies accounted for nearly 40% of total semiconductor revenue in 2025, up from 35% in 2022, indicating a consistent trend of outsourcing manufacturing.

- OSAT services reached a market size of $60 billion in 2024, growing 8% year-over-year as chip packaging complexity continues to rise.

Future Semiconductor Trends: Forecasts and Projections

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Market Size and Segment Growth Projections

- The global semiconductor market is forecast to reach approximately $697 billion in 2025, up from $630 billion in 2024, marking an increase of $67 billion within a year.

- Growth is driven by AI, 5G/6G communications, autonomous vehicles, and cloud computing, which are collectively pushing the market to potentially exceed $1 trillion by 2030, nearly doubling the 2025 projections.

- The Americas are expected to lead with a forecasted growth of 18% in 2025, followed by the Asia-Pacific region at 9.8%. Meanwhile, Europe and Japan are projected to grow modestly at around 4% annually.

- Capital expenditure on semiconductor fabrication and R&D is projected to surpass $185 billion in 2025, up from $173 billion in 2024, underscoring aggressive investment to meet capacity and technology demands.

Technology Disruption and Megatrends

- AI-optimized chips accounted for nearly 25% of new chip designs in 2024, up from about 12% in 2022, fueling demand for advanced nodes such as 5nm and 3nm.

- Data center semiconductor sales reached $120 billion in 2024, up from $85 billion in 2021, driven by the expansion of hyperscale cloud providers' AI and machine learning infrastructure.

- Autonomous vehicle semiconductor content increased to $500 per vehicle in 2024, up from $350 in 2020, as EV shipments grew 45% year-over-year, reflecting the rapid electrification of the market.

Talent, Workforce, and Education

- The global semiconductor workforce is expected to grow from 345,000 in 2024 to 460,000 by 2030, representing an increase of 115,000 workers; however, 67,000 positions are expected to remain unfilled due to skill shortages.

- In the U.S., workforce aging is a concern, with 55% of employees above the age of 45 and just under 25% under the age of 35, which poses a challenge to talent pipeline sustainability.

- Semiconductor engineering hires currently number about 1,500 per year in the U.S., whereas the demand forecast requires up to 88,000 engineers by 2029, revealing a critical shortfall.

Policy and Regulation’s Future Impact

- The U.S. CHIPS Act supports over $65 billion in semiconductor investments, expected to triple U.S. chipmaking capacity by 2032 and create more than 500,000 American jobs across facilities, construction, and supply chains.

- Europe’s Chips Act commits approximately €15 billion (~$16 billion) to boost local fabrication, aiming for 12 new fabs by 2027, compared to just 5 in 2020.

Conclusion

The semiconductor industry's journey over the years has showcased incredible innovation and adaptability, driving technologies that touch every aspect of our lives. With expanding markets in AI, automotive, and communication sectors, the future promises even more transformative breakthroughs.

Understanding these shifts helps businesses and enthusiasts stay ahead in a rapidly evolving landscape. Whether you’re a professional or simply curious, keeping an eye on these developments offers valuable insight into where technology is headed next. Dive deeper, share your thoughts, and stay connected to the pulse of this ever-changing industry.

Insights On Semiconductor Industry Trends and Statistics

How has the semiconductor industry grown in recent years?

The semiconductor industry reported a strong 19% sales increase in 2024 and is projected to grow 11% year-over-year in 2025, reaching approximately $697 billion globally, driven by demand for AI and data centers.

What are the key sectors driving semiconductor demand?

High-performance computing, AI technologies, data centers, automotive electronics, and IoT devices are leading growth segments fueling semiconductor sales and innovation.

How is technology advancing semiconductor production?

Innovations in advanced chip packaging, new materials such as silicon carbide, and AI-driven R&D are pushing Moore's Law forward, despite challenges in scaling smaller nodes.

Which regions lead semiconductor manufacturing and sales?

Asia Pacific and the Americas drive most growth, with Asia growing 9.8% and the Americas soaring 18% in 2025; Europe and Japan show moderate growth.

What future trends are shaping the semiconductor market?

The market is expected to reach $1 trillion by 2030, driven by the integration of AI, increased capital expenditure (approximately $185 billion in 2025), efforts to enhance supply chain resilience, and AI-enabled efficiency gains.

References & Citations:

- Semiconductor Industry Outlook 2025

Venkat Srinivasan, Peter van Herrewegen, Vanishree Mahesh (Apr 2025), Semiconductor Industry Outlook 2025 - WSTS Semiconductor Market Forecast Spring 2025

WSTS (Spring 2025), WSTS Semiconductor Market Forecast Spring 2025 - Global Semiconductor Sales Increase 19.8% Year-to-Year in May

Semiconductor Industry Association (Jul 2025), Global Semiconductor Sales Increase 19.8% Year-to-Year in May - Gartner Forecasts Worldwide Semiconductor Revenue to Grow 14% in 2025

Gartner (Oct 2024), Gartner Forecasts Worldwide Semiconductor Revenue to Grow 14% in 2025 - Global Semiconductor Market Size Worth USD 1.2 Trillion by 2034| Sales $57 Billion Recorded in April 2025

Precedence Research (Jul 2025), Global Semiconductor Market Size Worth USD 1.2 Trillion by 2034| Sales $57 Billion Recorded in April 2025 - Planning for the future: 2025 semiconductor market outlook

Sourceability Team (May 2025), Planning for the future: 2025 semiconductor market outlook - Semiconductor Revenues to Top $700 Billion Next Year

Moz Farooque (Jun 2025), Semiconductor Revenues to Top $700 Billion Next Year - Semiconductor leaders anticipate a strong 2025 powered by AI

Chris Gentle, Anna Scally, Mark Gibson, Simon Dubois (2025), Semiconductor leaders anticipate a strong 2025 powered by AI - 2025 global semiconductor industry outlook

Jeroen Kusters, Deb Bhattacharjee, Jordan Bish, Jan Thomas Nicholas, Duncan Stewart, Karthik Ramachandran (Feb 2025), 2025 global semiconductor industry outlook - TSMC Intends to Expand Its Investment in the United States to US$165 Billion to Power the Future of AI

TSMC (Mar 2025), TSMC Intends to Expand Its Investment in the United States to US$165 Billion to Power the Future of AI - State Of The U.S. Semiconductor Industry

Semiconductor Industry Association (2025), State Of The U.S. Semiconductor Industry - Global IC fab capacity to grow 6% in 2024 and 7% in 2025, says SEMI

Jessie Shen, DIGITIMES Asia (Jun 2024), Global IC fab capacity to grow 6% in 2024 and 7% in 2025, says SEMI - 18 New Semiconductor Fabs to Start Construction in 2025

SEMI (Jan 2025), 18 New Semiconductor Fabs to Start Construction in 2025 - SEMI Reports Typical Q1 2025 Semiconductor Seasonality with Potential for Atypical Shifts Due to Tariff Uncertainty

SEMI (May 2025), SEMI Reports Typical Q1 2025 Semiconductor Seasonality with Potential for Atypical Shifts Due to Tariff Uncertainty - Semiconductors have a big opportunity—but barriers to scale remain

Bill Wiseman, Henry Marcil, Marc de Jong, Raphaela Wagner, Taylor Roundtree, Teddy Stopford (Apr 2025), Semiconductors have a big opportunity—but barriers to scale remain - Global Semiconductor Industry Outlook worth $707 billion by 2025

MarketsandMarkets (Feb 2025), Global Semiconductor Industry Outlook worth $707 billion by 2025 - Semiconductor Industry Outlook 2025

Infosys Knowledge Institute (2025), Semiconductor Industry Outlook 2025 - Global Semiconductor Sales Increase 2.5% Month-to-Month in April

Semiconductor Industry Association (Jun 2025), Global Semiconductor Sales Increase 2.5% Month-to-Month in April - Global Semiconductor Market to Grow by 15% in 2025, Driven by AI

International Data Corporation (Dec 2024), Global Semiconductor Market to Grow by 15% in 2025, Driven by AI - 2025 State of the Industry Report: Investment and Innovation Amidst Global Challenges and Opportunities

Greg LaRocca (Jul 2025), 2025 State of the Industry Report: Investment and Innovation Amidst Global Challenges and Opportunities - Semiconductor Workforce 2025: Trends Every Company Should Prepare For

Ashley Yabut (Jun 2025), Semiconductor Workforce 2025: Trends Every Company Should Prepare For - Reimagining labor to close the expanding US semiconductor talent gap

Bill Wiseman, Brendan Jay, Nicholas Liao, Taylor Roundtree, Wade Toller (Aug 2024), Reimagining labor to close the expanding US semiconductor talent gap - Semiconductor Industry Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)

Mordor Intelligence (2025), Semiconductor Industry Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030) - UK Semiconductor Workforce Study Research Report

Perspective Economics (Apr 2025), UK Semiconductor Workforce Study Research Report