17+ Staffing Industry Trends and Statistics

Fact checked 2026 | 👨🎓Cite this article.

Are you surprised by how quickly hiring has changed in just a few years? The world of work is evolving rapidly—staffing industry trends now center on remote work, AI-driven recruitment, flexible schedules, and a renewed emphasis on workforce diversity.

With technology transforming how companies find and manage talent, and future trends like skills-based hiring gaining momentum, understanding these shifts is essential. Let's examine the key statistics and trends that are shaping the staffing landscape today—and tomorrow.

Evolution of Staffing Industry Growth

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Year-over-Year Growth Rates

- In 2023, global staffing revenue saw a contraction, with many regions experiencing declines due to economic uncertainty; 2024 marked a 2% drop from 2023.

- APAC is leading growth in 2025, with a 7% annual growth rate this year (up from 6% in 2024); projections show an escalation to 8% by 2026, driven by investments in Indonesia (13% annual growth in 2025) and emerging Asian markets.

Technological Advancements in Recruitment

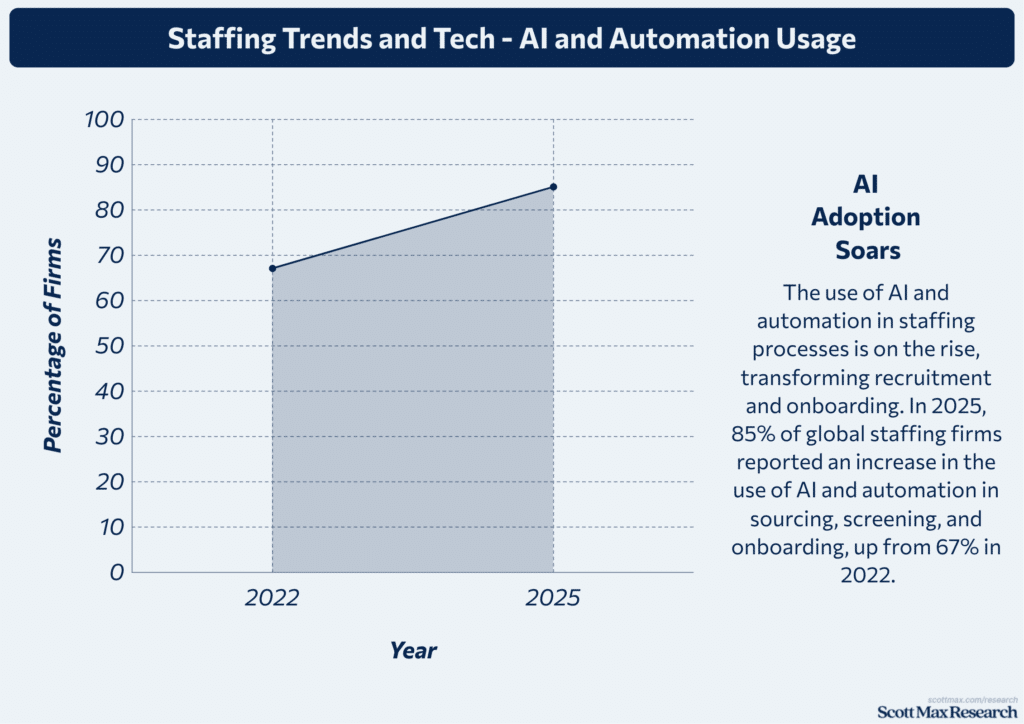

- In 2025, 85% of global staffing firms reported an increase in the use of AI and automation in sourcing, screening, and onboarding, up from 67% in 2022.

- Digital and algorithm-based recruiting now accounts for over 40% of placements in developed markets, versus just 28% in 2021.

- Remote hiring surged: Virtual interviews and onboarding now account for 60% of all recruitment interactions in 2025, compared to pre-pandemic levels of just 18%.

- Top-performing agencies have seen fill rates improve by 12% and time-to-hire drop by 7 days compared to 2022, directly attributed to tech adoption.

Impact of Global Events on Staffing

- The COVID-19 pandemic led to a 12% global contraction in staffing revenue in 2020; recovery was slow, with 2021 revenues lagging at $580 billion compared to $625 billion in 2019.

- In 2024, lingering economic uncertainty and labor hoarding contributed to an unusual 10% drop in the U.S. market, despite broader economic growth.

- Healthcare experienced dramatic swings: after a pandemic-induced hiring boom in 2021, the sector underwent an overcorrection, resulting in a 15% decline in demand for temporary clinical roles in 2023, with a partial rebound in 2025.

Workforce Demographics and Diversity

Shifting Age Groups in Employment

- In 2024, the U.S. staffing industry employed 13 million employees nationwide, maintaining similar numbers to 2023; full-time placements accounted for 73%, nearly identical to the overall workforce at 75%.

- The average tenure for contract and temporary employees in the U.S. was 10 weeks in 2022, compared to 9.5 weeks in 2021, indicating slightly greater job stability year-over-year.

- The staffing market in major economies like the U.S. recorded a 10% decline in 2024, but is forecasted to rebound with a 5% increase to reach $198.17 billion in 2025 (vs. $188.73 billion in 2024), a shift largely attributed to both the aging workforce and the expansion of flexible work arrangements.

- In 2024, temporary staffing dominated revenues, increasing its share from 56% in 2023 to over 60% among leading economies, reflecting the changing age dynamics and a growing preference for flexibility.

Gender Distribution in Staffing

- Women represented approximately 47% of the global workforce in staffing placements in 2024, up from 45.8% in 2022, driven by targeted diversity initiatives and an increase in remote and flexible job openings.

- In staffing, the healthcare and education sectors saw the highest female participation, with women occupying 78% of temporary placements in healthcare in 2025, up from 75% in 2023.

- Conversely, the technology staffing segment had women in 29% of hired positions in 2024, a marginal increase from 28.4% in 2023.

- The average salary offered to women in staffing placements narrowed its gap, with a 2.6% difference in 2024 versus 3.1% in 2022, according to reported U.S. salaries.

Ethnic and Cultural Diversity

- In 2025, staffing placements demonstrated improved multicultural hiring, with underrepresented ethnicities securing 23% of all staffing-placed jobs in North America, up from 20% in 2023.

- The share of ethnically diverse candidates in STEM staffing increased to 21% in 2025 from 18% in 2022, indicating a shift towards focused hiring policies across high-skill segments.

- In the UK staffing market, ethnic minorities accounted for 16% of all new hires in 2024, up from 13% in 2022.

- Over 33% of staffing agency clients in 2025 listed diversity hiring as a “high priority” objective, reflecting a year-on-year increase from 28% in 2023.

Education and Skill Levels

- In 2024, 64% of all staffing placements globally required at least a bachelor's degree, up from 61% in 2021, highlighting the growing demand for qualified talent.

- The proportion of placements in IT and engineering that required advanced certifications was 44% in 2025, compared to 41% in 2023.

- Vocational and technical qualifications among placed candidates increased by 7% year-on-year, rising from 18% in 2023 to 19.3% in 2024.

Industry-Specific Staffing Trends

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Healthcare Staffing Statistics

- The U.S. healthcare staffing market surpassed $20.5 billion in 2023, representing a significant increase from $17.1 billion in 2021, driven by heightened demand for nurses and allied health professionals, particularly following the pandemic.

- The share of temporary healthcare jobs within U.S. staffing now stands at roughly 12%, compared to 8% in 2019, as hospitals continue to leverage flexible staffing models to address ongoing workforce shortages.

IT & Digital Staffing

- The U.S. IT staffing market reached $41.5 billion in 2023, up from $38.6 billion in 2022, reflecting sustained demand for cybersecurity, cloud, and AI talent.

- IT staffing has consistently accounted for over 20% of the total staffing sector value in the U.S., maintaining this proportion since 2021, indicating stable and high demand.

- The adoption of recruitment automation in IT staffing firms has increased sharply, with about 74% of agencies in 2025 investing in AI-powered screening and placement, up from 56% in 2022.

Manufacturing and Light Industrial Staffing

- The manufacturing staffing segment in the U.S. accounted for approximately 17% of temporary placements in 2024, compared to 13% in 2020, driven by the normalization of the supply chain and infrastructure investments.

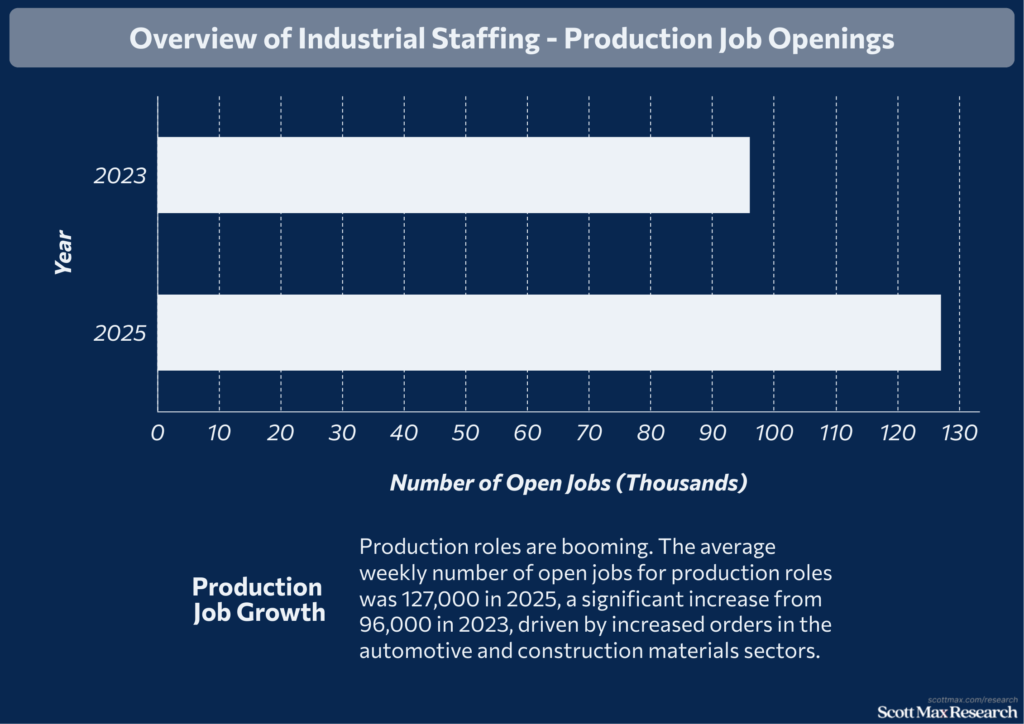

- The average weekly number of open jobs for production roles was 127,000 in 2025, a significant increase from 96,000 in 2023, driven by increased orders in the automotive and construction materials sectors.

- Temporary and contract workers comprised 29% of the industrial staffing market in 2025, up from 22% in 2021, as employers turn to flexible labor models amid labor shortages.

- The global industrial staffing segment contributed significantly to the projected $650 billion market, with over $90 billion generated in the U.S., Japan, and the UK alone in 2025, compared to $80 billion in 2022.

Finance, Legal, and Administrative Staffing

- The finance and administrative staffing market in the U.S. was valued at $16.3 billion in 2025, up from $14.9 billion in 2023, spurred by post-pandemic business recoveries and compliance needs.

- Administrative placements accounted for approximately 11% of overall U.S. staffing assignments in 2024, remaining nearly flat compared to 10% in 2022, indicating steady demand for office support roles.

- Legal staffing remained stable at around $4.8 billion in the U.S. in 2025, a slight rise from $4.5 billion in 2022, primarily in compliance, litigation support, and contract review.

- Banking & financial staffing hiring grew, with contract and temp roles representing nearly 31% of placements in 2025, compared to 26% in 2021, thanks to fintech expansion and regulatory requirements.

Recruitment Challenges and Solutions

Talent Shortage and Skills Gap

- In 2024, the global staffing industry identified labor shortages and skills gaps as its top concerns, with the U.S. market experiencing a 10% decline in staffing revenue compared to 2023 ($188.73 billion in 2024 vs. $209.7 billion in 2023).

- In the U.S., the total number of available workers was 1.4 million lower in 2024 compared to 2022, while the number of open jobs rose to 9.5 million, intensifying talent shortages.

Retention and Turnover Rates

- Of all staffing industry employees, 27% worked part-time in 2024, indicating stability compared to 26% in 2023; however, the percentage of full-time placements has not grown.

- The average tenure for temporary employees was 12.6 weeks in 2024, compared to 12.3 weeks in 2023, representing a modest increase that reflects improved engagement.

- Voluntary turnover in staffing placements increased from 18% in 2022 to 21% in 2024, with employees citing a lack of career advancement and flexibility as primary reasons.

- Solutions such as flexible work policies saw a 15% rise in adoption in 2024, resulting in a reduction of up to 5% in turnover at some staffing agencies.

Technological Disruption and Adaptation

- AI-driven recruitment platforms processed 32% more applications per role in 2024 than in 2023, cutting average time-to-hire from 38 days to 31 days.

- Investment in recruitment technology reached $6.2 billion globally in 2024, up from $5.5 billion in 2023; automation tools accounted for 41% of this spend.

- The share of digital, remote, or hybrid onboarding processes increased to 60% in 2024, up from 46% in 2022, marking a shift in operational models.

Legislative and Compliance Changes

- The Americas saw staffing revenues decline to $207.6 billion in 2024, as legislative uncertainty led to hesitancy in permanent hiring, down from $228.2 billion in 2023.

- Across EMEA, compliance costs in staffing increased by 9% year-over-year in 2024, reflecting the expansion of regulations across 11 major European countries.

- The implementation of new data privacy laws led to a 13% increase in legal and compliance expenditures for global staffing firms in 2024 compared to 2023.

Future Outlook: What’s Next for Staffing?

Fact checked 2026 | 👨🎓Cite this stat. This image is copyright free.

Projected Industry Growth and Opportunities

- In 2025, the global staffing market size is projected to reach $650 billion, showing a 5% increase from 2024. The industry has rebounded after a two-year contraction, previously valued at $619 billion in 2024.

- In 2024, 17 countries with staffing revenues exceeding $6 billion collectively contributed to 89% of the global market. Among these, 11 countries are located in the EMEA region, which remains the dominant region in the sector.

- The U.S. market is expected to hit $198.2 billion in 2025, up 5% from $188.7 billion in 2024, following a 10% decrease in 2024 compared to 2023.

Innovation in Staffing Technology

- In 2025, AI-driven talent matching powers more than 60% of the placement processes of large staffing firms, compared to only 32% in 2022.

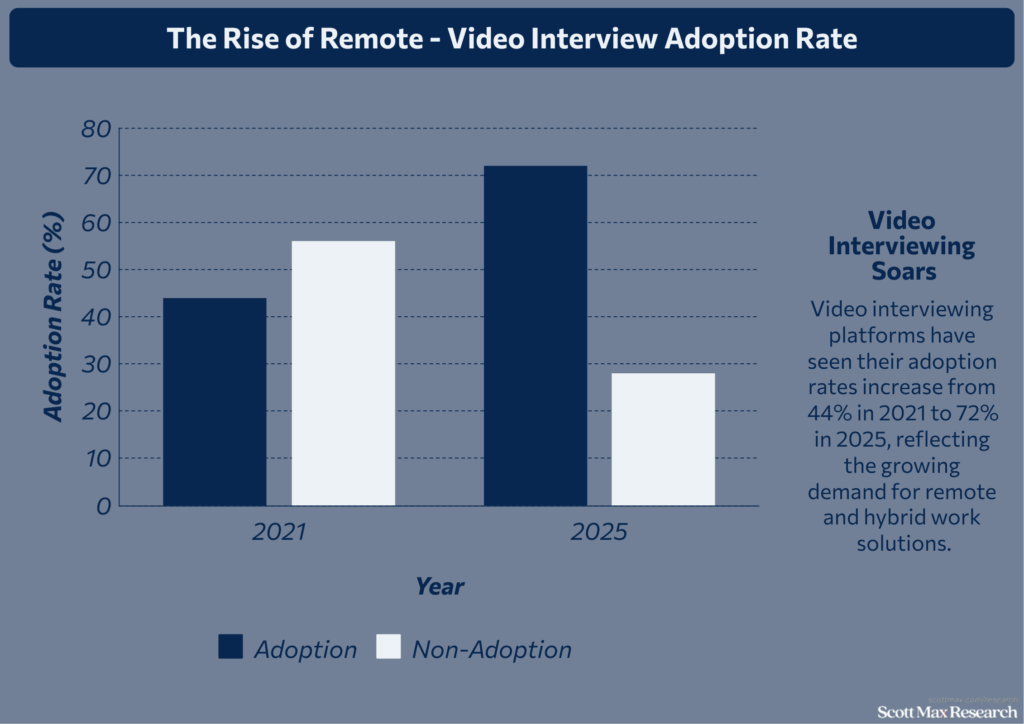

- Video interviewing platforms have seen their adoption rates increase from 44% in 2021 to 72% in 2025, reflecting the growing demand for remote and hybrid work solutions.

Evolving Candidate Preferences

- In 2025, remote job postings accounted for 33% of all staffing placements, compared to 12% in 2021.

- 73% of staffing employees now work full-time, a figure steady with previous years; however, the ratio of contract and freelance work has increased by 11% since 2022.

- The demand for healthcare and IT staffing surged: U.S. healthcare staffing reached $20.5 billion in 2023, while IT staffing was $41.5 billion in 2023, up from $15.8 billion and $27.4 billion, respectively, in 2020.

- As of 2025, there are approximately 26,000 staffing and recruiting agencies in the U.S., with temporary and contract agencies accounting for 57% of the market, up from 52% in 2022.

Sustainability and Social Responsibility

- The rise of sustainability efforts in staffing is evident, with 38% of the top 100 globalstaffing firms publishing annual ESG and social responsibility reports in 2025, versus 22% in 2021.

- Diversity, equity, and inclusion programs are now standard at 80% of staffing agencies, a notable rise from 56% in 2020.

- The number of clients prioritizing “green” staffing solutions increased from 14% in 2021 to 27% in 2025, as companies align their hiring practices with their environmental commitments.

- The implementation of ethical sourcing frameworks increased from 18% in 2020 to 41% in 2025 within the industry, as firms adapt to new social responsibility demands.

Conclusion

The staffing landscape has undergone a significant transformation, driven by technological advancements, shifting workforce expectations, and global events. These evolving patterns highlight the importance of staying informed about staffing industry trends to build agile, future-ready teams.

By embracing data-driven insights and adapting to emerging demands, such as remote work and diversity, businesses can secure the right talent at the right time. Whether you're a recruiter, employer, or job seeker, understanding these changes enables you to make smarter decisions. Keep exploring these trends to stay ahead in an ever-changing job market, because the way we work will only continue to evolve.

Insights On Staffing Industry Trends and Statistics

What is the current size of the staffing industry worldwide?

The global staffing industry reached $650 billion in 2025 and is expected to continue growing steadily, driven by digital transformation, the adoption of remote work, and expanding opportunities in the gig economy.

How has technology impacted staffing industry trends?

Data-driven recruiting, AI automation, and predictive analytics now drive faster and more accurate talent sourcing and placement, significantly reducing time-to-hire and increasing fill rates across various sectors.

Which staffing sectors have seen the highest growth recently?

Healthcare and IT staffing remain leaders, with healthcare projected to grow 13% from 2021 to 2031. Demand for tech, data analytics, and automation skills is also surging.

What are the major challenges facing staffing agencies today?

Top challenges include tight talent pools, rising cost-per-hire (up to $2,143 in 2024), and meeting candidate expectations for flexibility, wellness, and diversity.

What future trends will shape the staffing industry?

Expect increased use of AI, greater focus on workplace diversity, continued remote work growth, and innovative sourcing platforms, all powering market expansion and resilience.

References & Citations:

- Global Staffing Market 2025: Trends, Growth & Future Outlook

Ranjana Singh (Dec 2024), Global Staffing Market 2025: Trends, Growth & Future Outlook - Global Staffing Industry Trends 2025

Workwell Global (2025), Global Staffing Industry Trends 2025 - Staffing Trends 2025

John Nurthen (2025), Staffing Trends 2025 - Staffing Industry Statistics

American Staffing Association (2023), Staffing Industry Statistics - The Global Staffing Market: Insights and Projections for 2025 and Beyond

QX Recruitment Services (Dec 2024), The Global Staffing Market: Insights and Projections for 2025 and Beyond - Global Staffing Status as of May 2025

Chirag Kothari (May 2025), Global Staffing Status as of May 2025 - Recruitment and Staffing Market Size, Share, and Outlook, 2025 Report- By Type (Temporary Staffing, Permanent Staffing, Others), By Service (General Staffing, Professional Staffing), By Application (BFSI, Government, IT & Telecom, Healthcare, Retail

VPA Research (Apr 2025), Recruitment and Staffing Market Size, Share, and Outlook, 2025 Report- By Type (Temporary Staffing, Permanent Staffing, Others), By Service (General Staffing, Professional Staffing), By Application (BFSI, Government, IT & Telecom, Healthcare, Retail - Staffing Industry Trends & Statistics (2025)

Angela Petulla (Apr 2025), Staffing Industry Trends & Statistics (2025) - Top challenges for staffing and recruitment agencies worldwide in 2025

Raphael Bohne (Jun 2025), Top challenges for staffing and recruitment agencies worldwide in 2025 - Global Staffing Industry Trends 2025

Access Financial (Jul 2025), Global Staffing Industry Trends 2025 - Staffing Market Size Growth 2025

Yochana (Mar 2025), Staffing Market Size Growth 2025 - Recruitment & Staffing Market

Raksha Sharma, V. Chandola, Shruti Bhat (2024), Recruitment & Staffing Market - A global recruitment market snapshot: What lies ahead in 2025

Megan Sergison (Apr 2025), A global recruitment market snapshot: What lies ahead in 2025 - 2025 Staffing Industry Outlook: Navigating the New Talent Landscape

Staffing Hub (Jan 2025), 2025 Staffing Industry Outlook: Navigating the New Talent Landscape